Taking Stock of Duolingo (DUOL)’s Valuation After Insider Buying and AI-Driven Growth Initiatives

Duolingo (DUOL) just saw its top brass step in as buyers, with Chairman Luis von Ahn and other executives adding tens of thousands of shares, even as the stock lags and AI fears weigh on sentiment.

See our latest analysis for Duolingo.

That insider buying comes after a difficult stretch, with Duolingo’s 1-year total shareholder return down sharply, even though the 3-year total shareholder return remains very strong. At the same time, recent 7-day share price momentum has turned positive again.

If Duolingo’s rebound has your attention, this may be a useful moment to see what else is moving in high growth tech and AI by exploring high growth tech and AI stocks.

So with insiders doubling down while the share price still trades well below both intrinsic value estimates and analyst targets, is Duolingo quietly on sale here, or is the market already accounting for years of potential growth?

Most Popular Narrative: 23.3% Undervalued

Compared to Duolingo’s last close around $208, the most followed narrative points to a materially higher fair value estimate near $271, framing today’s price as a potential discount worth examining more closely.

Strategic investments in AI driven personalized learning and model optimization are yielding reduced unit costs, improved gross margins, and enhanced scalability; as compute costs decline further, expanded access to higher tier Max features in international markets is expected to support margin expansion.

Curious how a long term push for user growth, richer subscriptions, and expanding margins can still back up a higher valuation than today’s market price? The most popular narrative stitches together aggressive top line expansion, rising profitability, and a premium future earnings multiple to justify that gap. Want to see exactly which growth and margin assumptions turn today’s selloff into a potential opportunity? Read the complete breakdown behind this fair value call.

Result: Fair Value of $271.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained DAU slowdown in mature markets and intensifying AI driven competition could quickly challenge the growth assumptions behind this undervaluation story.

Find out about the key risks to this Duolingo narrative.

Another View: Market Multiple Sends a Different Signal

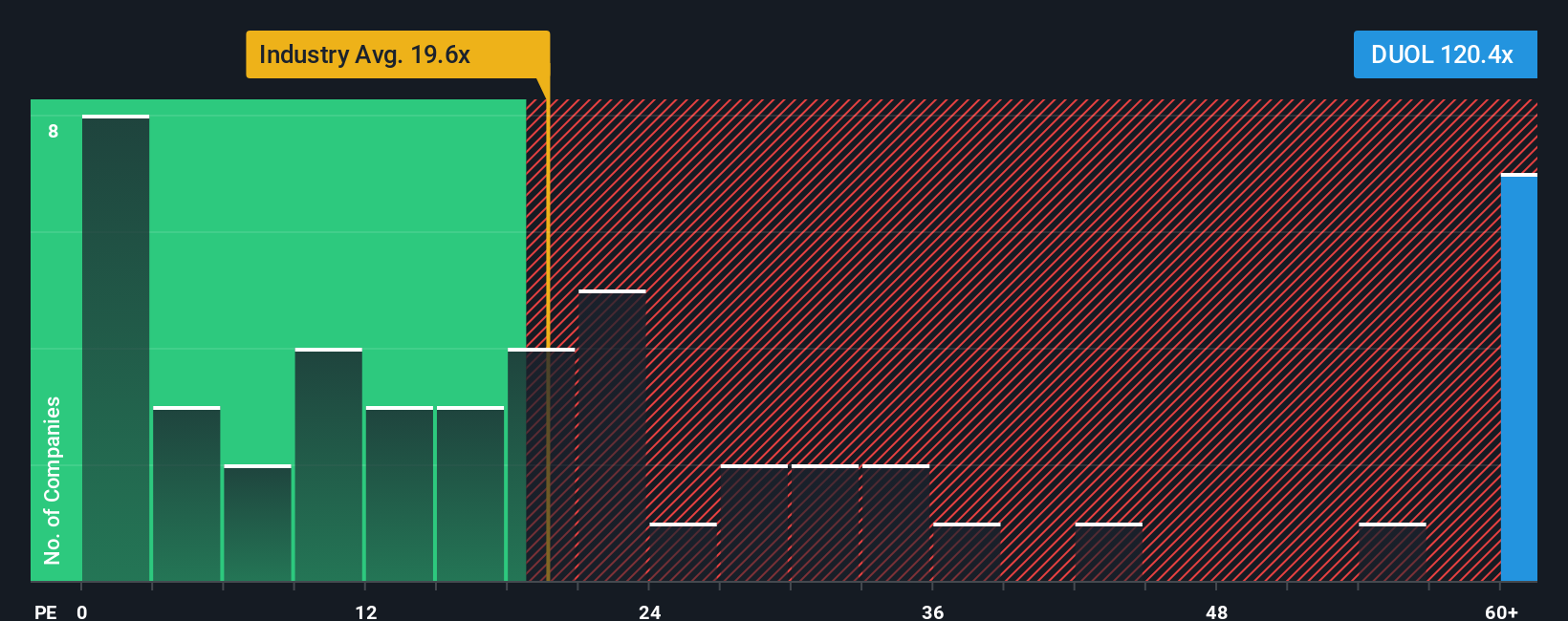

While narrative models point to Duolingo being 23.3% undervalued, its 24.9x price to earnings ratio looks steep versus the 16.2x Consumer Services average and an estimated 11.2x fair ratio. If sentiment sours further, the market could push DUOL closer to those lower benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Duolingo Narrative

If you see Duolingo differently or want to stress test your own assumptions, you can assemble a personalized narrative in just minutes: Do it your way.

A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you might consider using the Simply Wall St Screener to uncover fresh stocks that match your strategy and help keep you ahead.

- Capitalize on fast-moving innovation by checking out these 27 AI penny stocks that could benefit as artificial intelligence adoption develops worldwide.

- Explore potential long-term income streams by targeting these 15 dividend stocks with yields > 3% offering payouts that may help support returns even when markets become volatile.

- Position yourself in emerging trends by evaluating these 81 cryptocurrency and blockchain stocks that are connected to blockchain, digital assets, and next generation payment infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報