Does DigitalOcean (DOCN) Have a Coherent AI Infrastructure Strategy After Leadership Turnover and Paperspace Bet?

- DigitalOcean Holdings recently presented at the UBS Global Technology and AI Conference 2025 in Scottsdale, shortly after announcing the departure of Chief Product and Technology Officer Bratin Saha in November.

- Alongside this leadership change, DigitalOcean’s Paperspace acquisition and added data center capacity highlight an intensified push into AI-focused cloud infrastructure for developers and small businesses.

- We’ll now explore how DigitalOcean’s accelerated AI infrastructure push, highlighted by the Paperspace acquisition, may influence the company’s existing investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

DigitalOcean Holdings Investment Narrative Recap

To own DigitalOcean, you generally need to believe it can carve out a durable niche as the go-to cloud and AI platform for smaller businesses and developers, despite competition from hyperscalers. The recent UBS conference appearance and leadership change around the Chief Product and Technology Officer do not materially alter the near term focus on scaling AI infrastructure, or the key risk that heavy AI investments could outpace profitable customer adoption.

The Paperspace acquisition is the announcement that most clearly ties into this AI push, as it directly expanded DigitalOcean’s AI infrastructure and tools for developers. Combined with roughly 30 megawatts of added data center capacity, it reinforces the near term catalyst of growing AI and ML usage on the platform, while also magnifying the execution risk around capital intensity and potential pricing pressure in GPU driven workloads.

Yet even as AI momentum builds, investors should be aware that...

Read the full narrative on DigitalOcean Holdings (it's free!)

DigitalOcean Holdings' narrative projects $1.3 billion revenue and $182.0 million earnings by 2028. This requires 14.6% yearly revenue growth and about a $55.6 million earnings increase from $126.4 million today.

Uncover how DigitalOcean Holdings' forecasts yield a $53.33 fair value, a 10% upside to its current price.

Exploring Other Perspectives

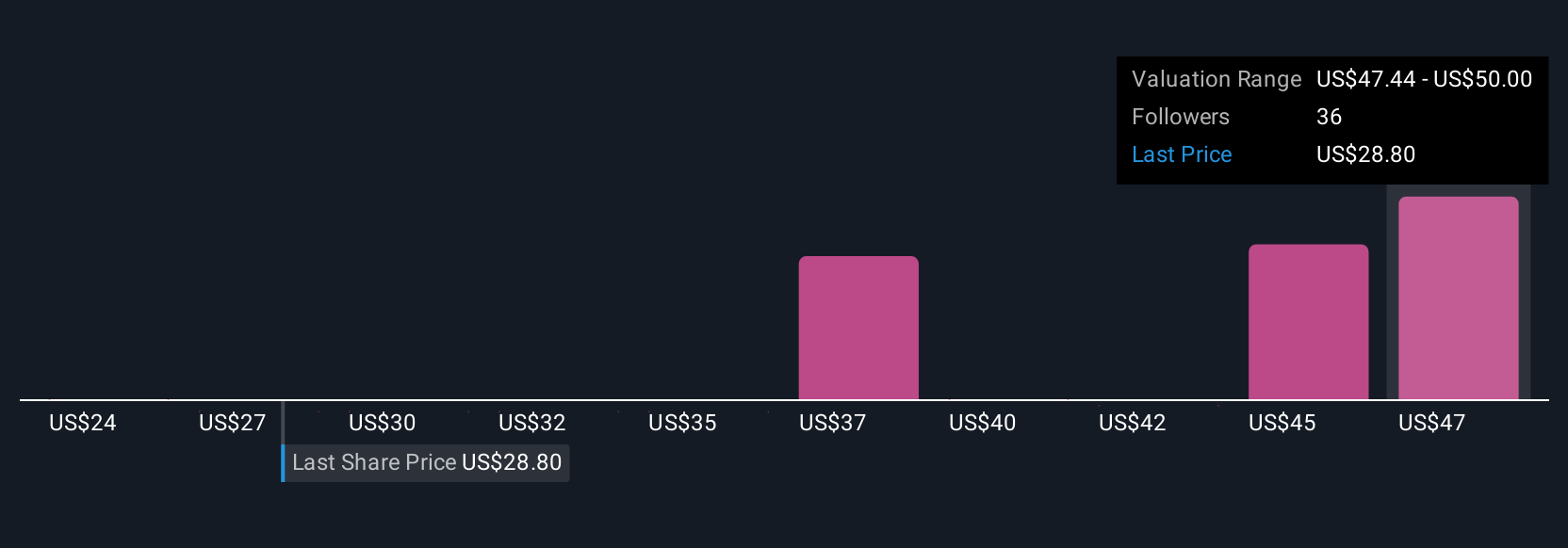

Thirteen members of the Simply Wall St Community currently see fair value for DigitalOcean anywhere between US$24.42 and US$55.17, with clusters across the mid US$30s to low US$50s. Against that backdrop, the company’s intensified AI infrastructure buildout after the Paperspace deal raises important questions about whether future returns on these investments will keep pace with rising capital demands, so it is worth comparing several viewpoints before deciding where you stand.

Explore 13 other fair value estimates on DigitalOcean Holdings - why the stock might be worth 49% less than the current price!

Build Your Own DigitalOcean Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalOcean Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free DigitalOcean Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalOcean Holdings' overall financial health at a glance.

No Opportunity In DigitalOcean Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報