Earnings Not Telling The Story For Citizen Watch Co., Ltd. (TSE:7762) After Shares Rise 26%

Despite an already strong run, Citizen Watch Co., Ltd. (TSE:7762) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 49%.

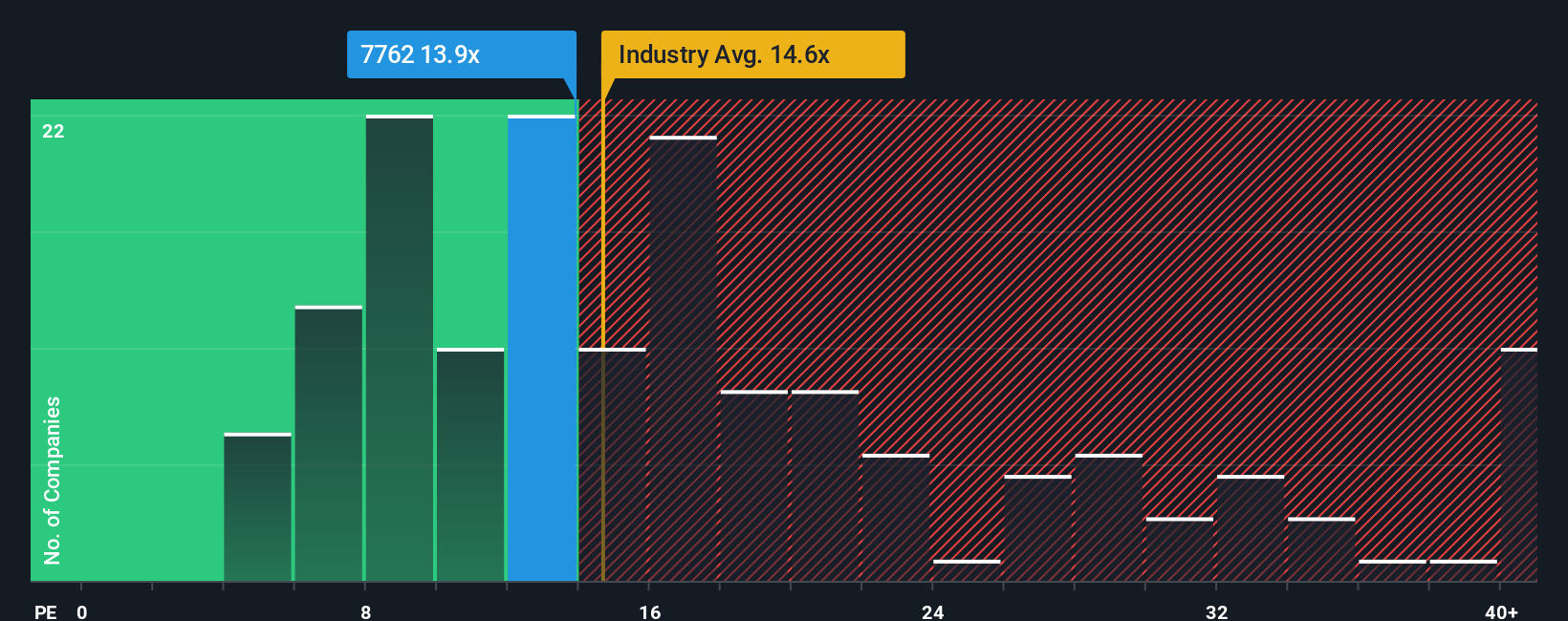

Although its price has surged higher, it's still not a stretch to say that Citizen Watch's price-to-earnings (or "P/E") ratio of 13.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Citizen Watch as its earnings have been rising slower than most other companies. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Citizen Watch

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Citizen Watch's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.4% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 16% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 1.5% each year over the next three years. Meanwhile, the broader market is forecast to expand by 9.2% each year, which paints a poor picture.

With this information, we find it concerning that Citizen Watch is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

Citizen Watch appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Citizen Watch currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Citizen Watch (1 doesn't sit too well with us!) that we have uncovered.

If you're unsure about the strength of Citizen Watch's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報