Prosperity Bancshares (PB) Valuation Check After Strong Q3 Beat and Upgraded Analyst Outlook

Prosperity Bancshares (PB) just beat third quarter expectations, with earnings per share up 8% year over year, and management used the call to double down on its long term growth playbook.

See our latest analysis for Prosperity Bancshares.

The upbeat Q3 numbers seem to be nudging sentiment back in Prosperity Bancshares’ favor, with a 30 day share price return of 4.59% helping to offset year to date weakness, while a 5 year total shareholder return of 25.10% underlines its longer term compounding potential.

If this earnings driven move has you rethinking your financials exposure, it could be a good moment to explore other bank led opportunities through solid balance sheet and fundamentals stocks screener (None results).

Yet with the stock still down year to date but now trading only modestly below analyst targets, investors face a sharper dilemma: Is Prosperity Bancshares a value opportunity, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 10% Undervalued

With Prosperity Bancshares closing at $70.63 versus a narrative fair value of about $78.47, the story leans toward upside built on improving profitability and growth.

Repricing of a sizable bond portfolio and rollover of existing loans at higher yields, combined with a disciplined deposit pricing strategy and low cost core deposit base, are set to meaningfully increase net interest margin and net interest income through 2026.

Curious how steady double digit growth, fatter margins, and a richer future earnings multiple all combine to support that higher value? The full narrative unpacks the specific revenue runway, profit uplift, and valuation bridge that justify this target, step by step.

Result: Fair Value of $78.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising nonperforming assets and ongoing loan and deposit declines could pressure earnings and undermine the growth and valuation case.

Find out about the key risks to this Prosperity Bancshares narrative.

Another Angle on Valuation

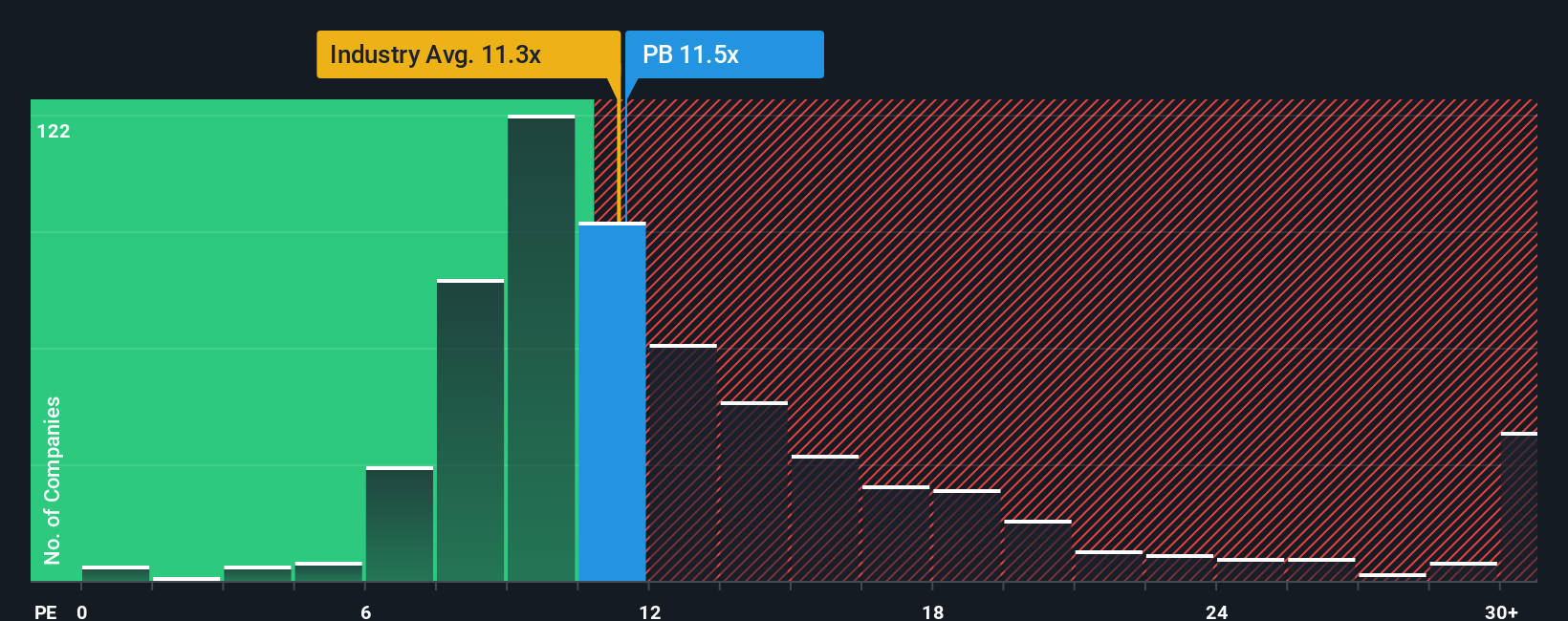

On earnings, Prosperity Bancshares looks a little pricey, trading on 12.6 times profit versus 11.6 times for the US Banks industry and 12 times for peers, yet still below a fair ratio of 13.1 times. That gap hints at upside, but also at less room for error if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosperity Bancshares Narrative

If you see the story differently or want to test your own thesis against the numbers, you can build a custom narrative in minutes with Do it your way.

A great starting point for your Prosperity Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before the market moves on without you, lock in your next opportunities using the Simply Wall St screener and keep your capital working intelligently.

- Target income first and let growth follow by reviewing these 15 dividend stocks with yields > 3% that combine reliable payouts with sustainable business models.

- Position yourself early in transformative technology by assessing these 27 AI penny stocks shaping everything from automation to data driven decision making.

- Strengthen your margin of safety by focusing on these 898 undervalued stocks based on cash flows where prices still trail underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報