Can Johnson Rice’s Upgrade Sharpen the APA (APA) Story Around Cash Generation and Merger Optionality?

- Recently, Johnson Rice shifted its view on APA Corporation from “Hold” to “Accumulate,” citing a more favorable outlook on the company’s performance and prospects.

- This ratings change, alongside APA’s continued production stability and steady reduction of net debt toward a US$3.00 billion target, has sharpened investor focus on its cash generation profile.

- We’ll now assess how Johnson Rice’s more constructive stance on APA fits with the existing investment narrative around cost discipline and merger optionality.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

APA Investment Narrative Recap

To own APA today, you generally need to believe that its low earnings multiples, improving balance sheet and steady production can translate into resilient cash generation despite commodity and geopolitical risks. Johnson Rice’s upgrade to “Accumulate” and higher price target sharpen attention on these themes but does not materially change the near term catalyst, which remains execution on cost efficiency and debt reduction, or the largest risk, APA’s exposure to policy and demand changes tied to the energy transition.

The most relevant recent datapoint alongside the rating change is APA’s continued net debt reduction, from US$8.5 billion in Q4 2020 to US$4.0 billion in Q3 2025, against a US$3.0 billion target. Together with a low EV/EBITDA of 2.61x and P/CF of 1.55x, this bolsters the story that balance sheet progress and cash generation could support the merger optionality some investors are watching, even as production and regional risks remain in focus.

Yet for all the progress on costs and debt, APA’s concentration in higher risk regions is something investors should be aware of...

Read the full narrative on APA (it's free!)

APA’s narrative projects $8.1 billion revenue and $1.6 billion earnings by 2028.

Uncover how APA's forecasts yield a $25.89 fair value, a 4% downside to its current price.

Exploring Other Perspectives

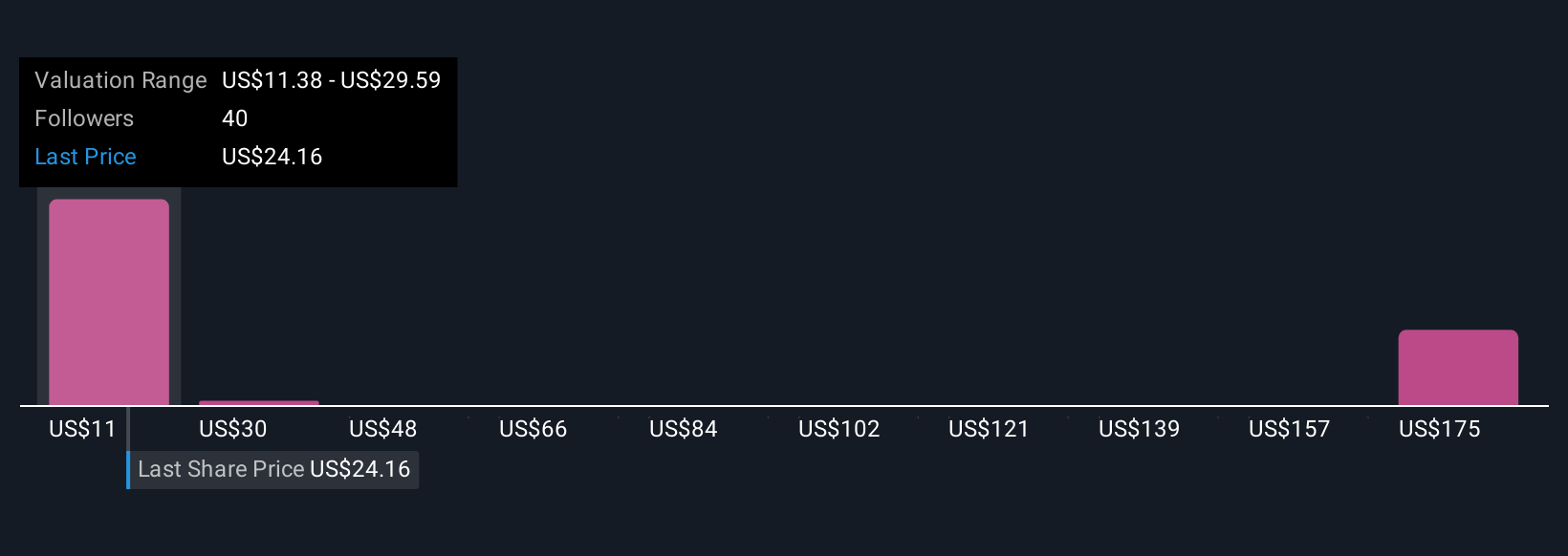

Eleven Simply Wall St Community fair value estimates for APA span roughly US$11 to US$176 per share, highlighting how far apart individual views can be. You can weigh those opinions against APA’s heavy exposure to long term oil and gas demand trends, and decide how that balance of transition risk and cash generation potential might affect the company’s future performance.

Explore 11 other fair value estimates on APA - why the stock might be worth less than half the current price!

Build Your Own APA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your APA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free APA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate APA's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報