Jones Lang LaSalle (JLL): Reassessing Valuation After Earnings Beat and Higher Full-Year EBITDA Guidance

Jones Lang LaSalle (JLL) just delivered stronger than expected third quarter earnings and raised its full year Adjusted EBITDA outlook, a combination that usually makes investors sit up and revisit the stock’s valuation.

See our latest analysis for Jones Lang LaSalle.

The market has taken notice, with a roughly 9 percent 1 month share price return and a 31 percent year to date share price return helping lift sentiment as JLL secures wins like JFK’s New Terminal One contract and deepens client partnerships. That momentum sits on top of an impressive 3 year total shareholder return of about 101 percent, suggesting the latest earnings beat is reinforcing a longer term rerating story rather than a short lived bounce.

If JLL’s renewed momentum has you rethinking where the next big compounders might come from, now could be a smart time to explore fast growing stocks with high insider ownership.

Still, with JLL now trading near record highs, a double digit intrinsic discount, and only a modest gap to analyst targets, investors must ask: Is there real upside left here, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative: 5% Undervalued

With the narrative fair value sitting modestly above JLL’s last close, the valuation case leans on improving margins and compounding earnings power over time.

Analysts expect earnings to reach $1.0 billion (and earnings per share of $22.67) by about September 2028, up from $563.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $859.0 million.

Curious how relatively steady revenue growth, rising margins, and a leaner share count combine into this upside case? The full narrative unpacks the math and the stretch assumptions driving that target.

Result: Fair Value of $345 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower capital markets activity and ongoing office leasing softness could easily derail those assumptions and force analysts to rethink today’s fair value.

Find out about the key risks to this Jones Lang LaSalle narrative.

Another Lens on Valuation

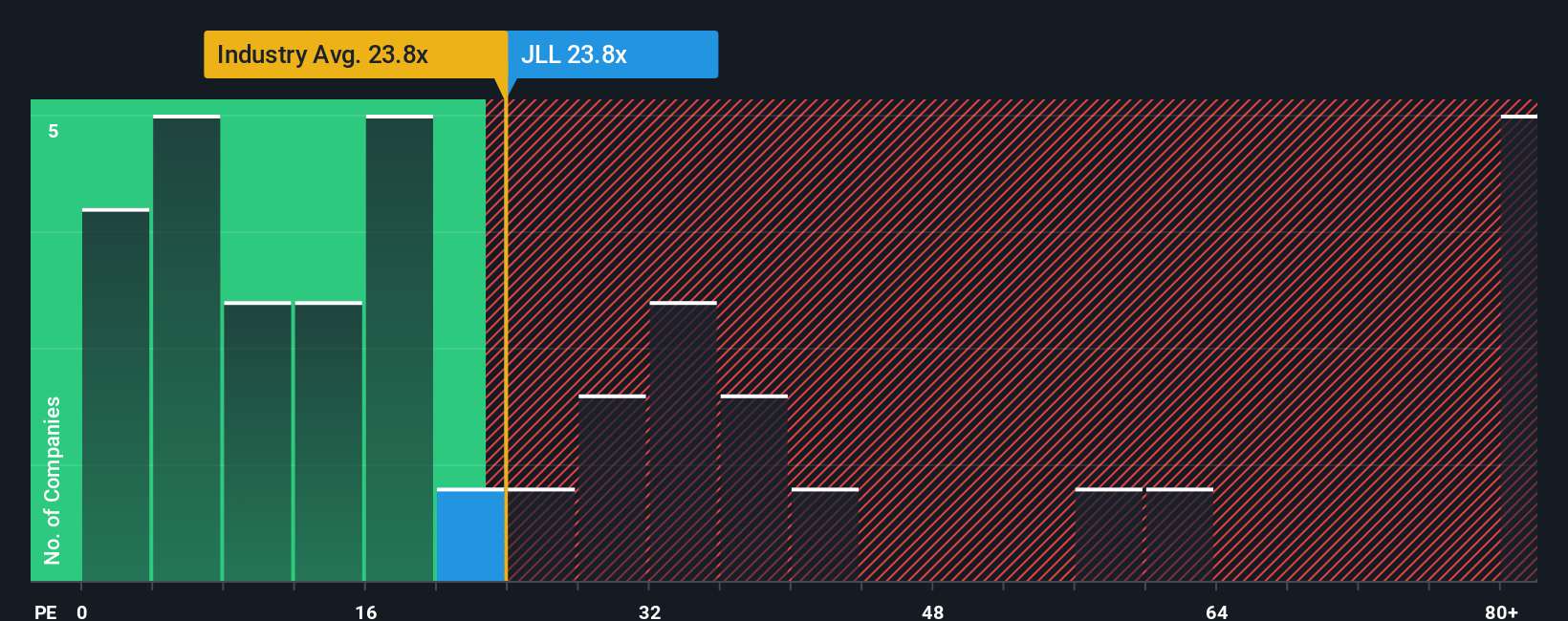

Step away from narrative fair value and the earnings multiple tells a more mixed story. JLL trades at 24.5 times earnings versus a 23.2 times fair ratio, which hints at some valuation stretch, yet it still looks cheaper than peers on roughly 31 times. Is that discount enough compensation if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jones Lang LaSalle Narrative

If you are not fully aligned with this view or would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jones Lang LaSalle.

Looking for more investment ideas?

Do not stop at one opportunity when the market offers many. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy today.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 904 undervalued stocks based on cash flows.

- Position yourself early in transformative innovation by focusing on next generation opportunities with these 27 AI penny stocks.

- Strengthen your portfolio’s income engine by finding reliable payers using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報