Is Surging In‑Game Spending And GTA VI Hype Altering The Investment Case For Take‑Two (TTWO)?

- In recent months, Take-Two Interactive has reported much faster growth than the broader gaming industry, with bookings rising sharply and recurrent consumer spending on in-game items and virtual currency becoming a major revenue driver.

- This momentum, combined with investor focus on the previously announced Grand Theft Auto VI launch planned for November 2026, is reshaping expectations for how durable Take-Two’s growth and earnings power could be over the next several years.

- We’ll now examine how this surge in recurrent in-game spending influences Take-Two’s existing investment narrative and outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Take-Two Interactive Software Investment Narrative Recap

To own Take-Two, you need to believe its biggest franchises can keep players spending inside games while carrying the long wait to Grand Theft Auto VI in November 2026. The latest jump in bookings and recurrent in-game spending supports that thesis and appears to strengthen the main near term catalyst, but it does not eliminate key risks around franchise concentration and rising development costs.

The company’s November 2025 earnings update, which showed strong year over year revenue growth and raised full year revenue guidance to US$6,380 million to US$6,480 million despite ongoing losses, is especially relevant here. It underlines how quickly recurrent consumer spending is scaling inside existing titles, even as profitability remains pressured by higher expenses and the long build up to GTA VI.

But while recurrent in-game spending is growing fast and expectations are rising, investors should still be aware of the risk that...

Read the full narrative on Take-Two Interactive Software (it's free!)

Take-Two Interactive Software's narrative projects $8.8 billion revenue and $1.1 billion earnings by 2028. This requires 14.8% yearly revenue growth and about a $5.3 billion earnings increase from $-4.2 billion today.

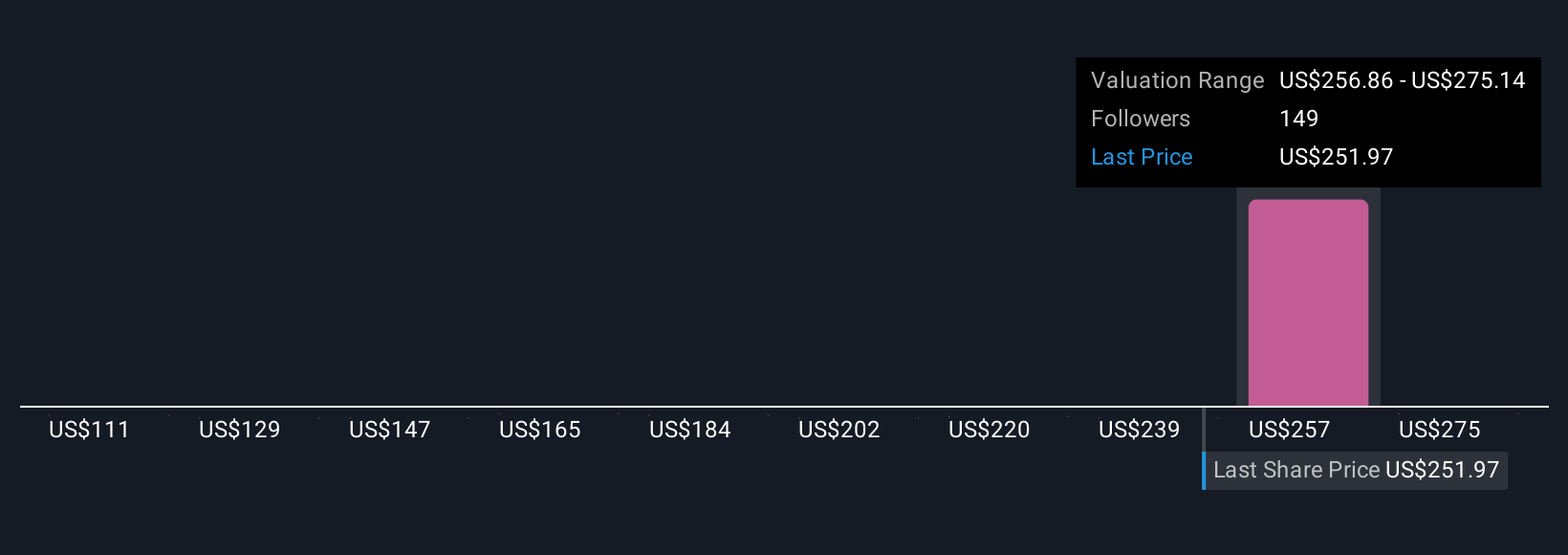

Uncover how Take-Two Interactive Software's forecasts yield a $276.59 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community currently see Take-Two’s fair value anywhere between US$110.67 and US$305.93, with estimates spread across the entire range. Against that backdrop, the recent acceleration in recurrent in-game spending as a key catalyst may look encouraging, but it also heightens the importance of understanding how dependent the business remains on a few blockbuster franchises over time.

Explore 12 other fair value estimates on Take-Two Interactive Software - why the stock might be worth less than half the current price!

Build Your Own Take-Two Interactive Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Take-Two Interactive Software research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Take-Two Interactive Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Take-Two Interactive Software's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報