The Bull Case For OPENLANE (KAR) Could Change Following Its Surprise Revenue Beat And EBITDA Strength

- In its latest quarterly update, OPENLANE reported past revenues of US$498.4 million, an 8.4% year-on-year increase that exceeded analyst expectations by 5.9% and delivered US$87.0 million in Adjusted EBITDA.

- Management credited this outperformance to ongoing organic growth and prior investments in the business, suggesting its digital marketplace model is gaining further operational traction.

- We’ll now examine how this earnings beat and solid Adjusted EBITDA performance may influence OPENLANE’s existing investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

OPENLANE Investment Narrative Recap

To own OPENLANE, you need to believe its digital wholesale marketplace can keep converting traditional auction volumes into profitable online transactions. The latest revenue beat and US$87.0 million in Adjusted EBITDA reinforce that this shift is translating into solid execution, but they do not materially change the near term focus on scaling digital volumes as the key catalyst, nor do they remove the ongoing competitive and integration risks that could pressure margins if growth stumbles.

In my view, the recent decision to take on US$550 million in incremental term loans to help fund common and preferred share buybacks sits in the background of this earnings print: together, they highlight a company leaning into its current profitability while also increasing balance sheet leverage, which could amplify the impact of any future slowdown or operational hiccups in the marketplace business.

Yet behind the strong quarter, investors should still be aware of how rising competition in digital wholesale auctions could...

Read the full narrative on OPENLANE (it's free!)

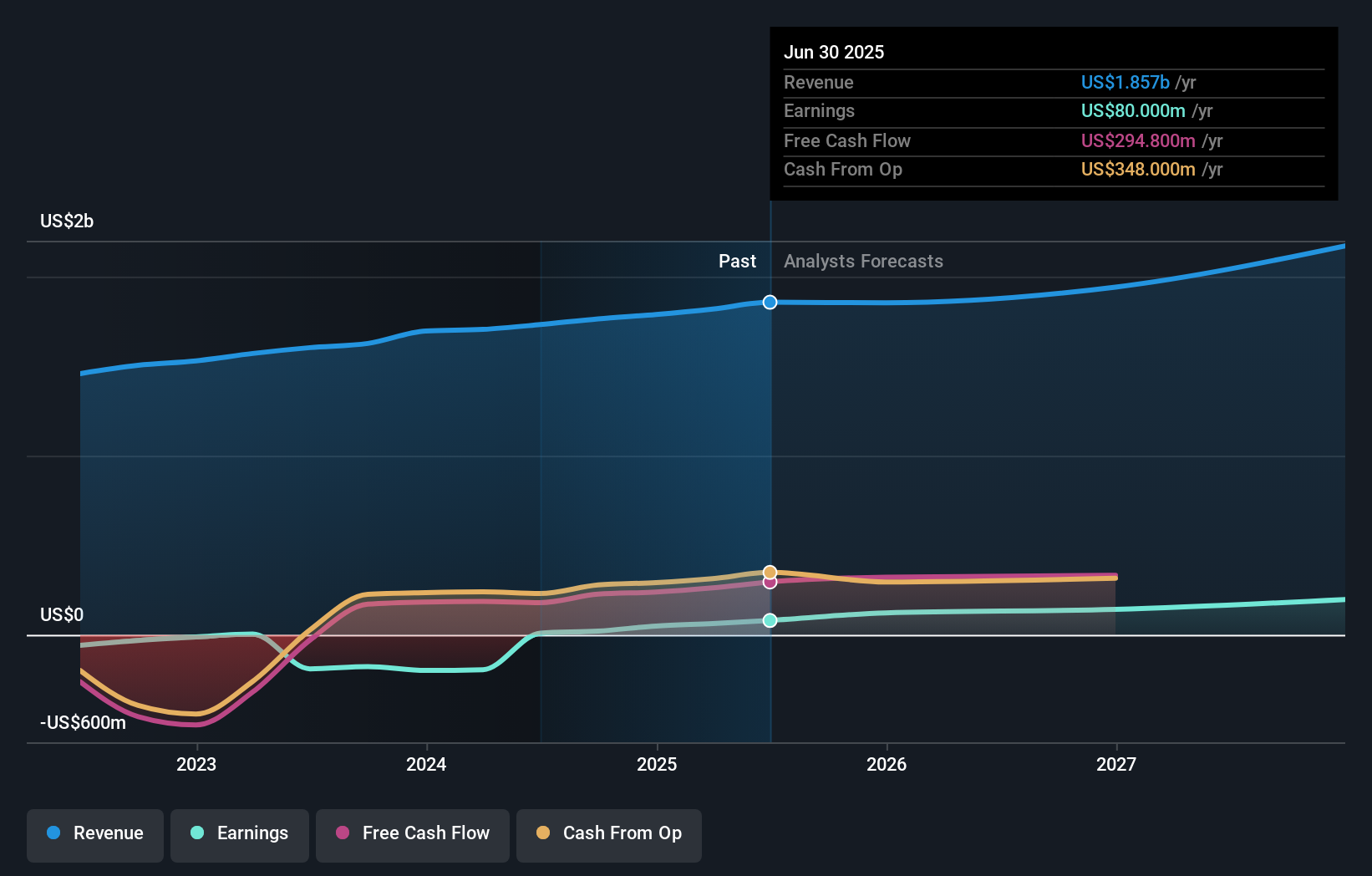

OPENLANE's narrative projects $2.2 billion revenue and $230.6 million earnings by 2028. This requires 5.0% yearly revenue growth and about a $150.6 million earnings increase from $80.0 million today.

Uncover how OPENLANE's forecasts yield a $31.81 fair value, a 22% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member currently pegs OPENLANE’s fair value at US$22.96, underscoring how differently individual investors can frame upside and risk. You should weigh that against the recent earnings beat and the ongoing threat of more aggressive digital offerings from traditional auction rivals when thinking about the company’s future performance.

Explore another fair value estimate on OPENLANE - why the stock might be worth as much as $22.96!

Build Your Own OPENLANE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OPENLANE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPENLANE's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報