BTIG’s Focus on Canaan’s U.S. Mining Rigs Might Change The Case For Investing In Canaan (CAN)

- In recent days, BTIG initiated coverage on Canaan Inc., emphasizing its vertically integrated Bitcoin mining model and expansion into U.S.-based rig manufacturing during 2025.

- This fresh analyst attention highlights how Canaan’s combination of global miner sales and its own data center fleet could reshape its role across the Bitcoin mining value chain.

- We’ll now examine how BTIG’s focus on Canaan’s new California production facility may influence the company’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Canaan Investment Narrative Recap

To own Canaan, you need to believe that a vertically integrated Bitcoin miner and hardware supplier can convert volatile, cycle driven demand into more predictable growth. BTIG’s new coverage raises Canaan’s profile but does not materially change the near term focus on improving profitability and managing the sizeable risk from Bitcoin price swings and hardware demand cyclicality.

Among recent updates, Canaan’s Q3 2025 results and Q4 revenue guidance of US$175 million to US$205 million stand out, because they frame expectations just as the California rig facility comes online. Together, the guidance and new production footprint give investors a clearer, near term lens on how the company is balancing capital intensive expansion with its ongoing losses.

Yet behind this expansion, investors still need to weigh the risk that shifting power toward AI and HPC could quietly reduce long term demand for Bitcoin mining rigs...

Read the full narrative on Canaan (it's free!)

Canaan's narrative projects $1.2 billion revenue and $83.1 million earnings by 2028.

Uncover how Canaan's forecasts yield a $2.89 fair value, a 210% upside to its current price.

Exploring Other Perspectives

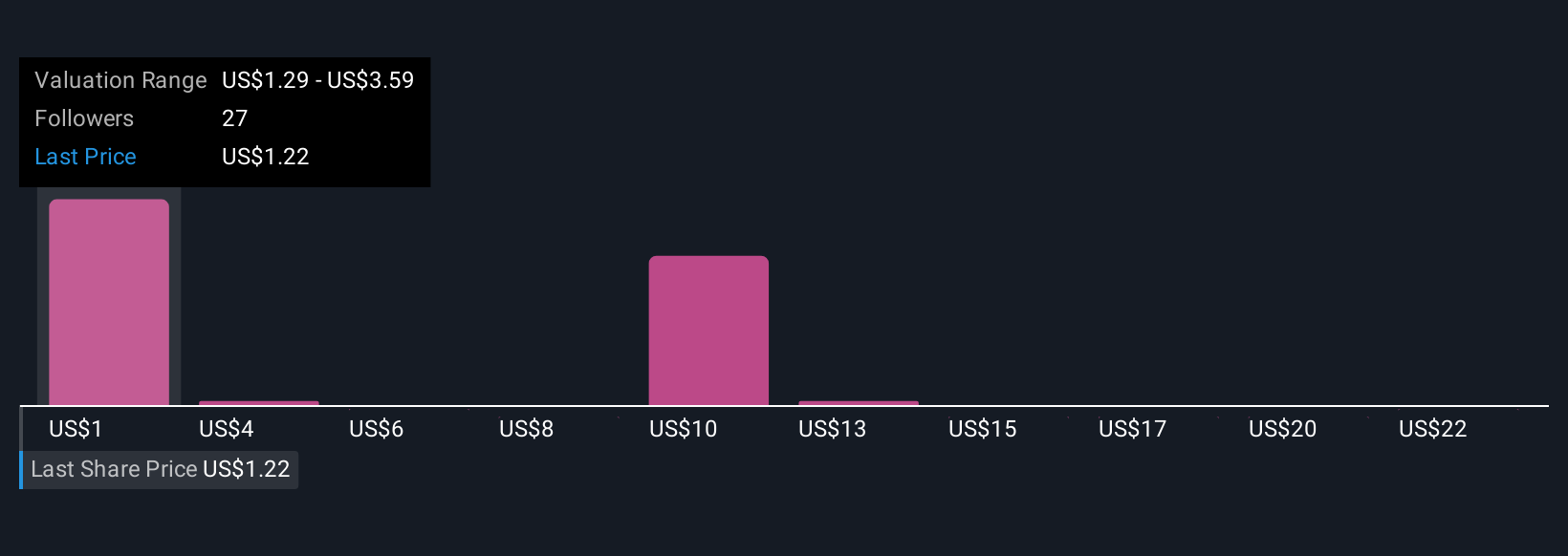

Thirteen fair value estimates from the Simply Wall St Community span a wide range, from US$1.29 to US$24.26 per share, highlighting how differently individual investors view Canaan’s potential. Against this backdrop, the key question many of them are wrestling with is whether Canaan’s vertically integrated mining model and new US manufacturing can offset the continued earnings volatility tied to Bitcoin price cycles.

Explore 13 other fair value estimates on Canaan - why the stock might be a potential multi-bagger!

Build Your Own Canaan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canaan research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Canaan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canaan's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報