How Activist Pressure and Tripadvisor Rewards Rollout Will Impact Tripadvisor (TRIP) Investors

- In recent months, Tripadvisor attracted activist investors 13D Activist Fund and Starboard after completing a buyback of Liberty Media’s controlling stake and collapsing its dual-class share structure, while its Viator and TheFork businesses continued to grow as the core Tripadvisor segment softened.

- Around the same time, the company also rolled out Tripadvisor Rewards, a new loyalty program offering Trip Cash and members-only perks, signaling a push to deepen app engagement and monetization across its travel guidance, tours, and restaurant platforms.

- We’ll now examine how activist investor involvement, along with the Tripadvisor Rewards rollout, may reshape the company’s broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Tripadvisor Investment Narrative Recap

To own Tripadvisor, you need to believe its shift toward higher-growth experiences and restaurants can offset a slower, more competitive core travel guidance business. Activist involvement from 13D and Starboard, alongside governance changes after Liberty Media’s exit, may increase scrutiny on profitability and capital allocation, but does not materially change the immediate risk that Brand Tripadvisor continues to lose organic traffic and becomes more dependent on paid marketing.

Among recent developments, Tripadvisor Rewards looks most relevant here, because it directly targets user engagement and repeat app usage across stays and experiences. If Rewards can nurture more frequent, higher-value bookings for Viator and TheFork, it could support the key catalyst of better monetization and lower reliance on costly acquisition, even if headline revenue growth for the core segment remains under pressure in the near term.

Yet even if rewards and activism help, investors should still be aware of how ongoing traffic pressure at Brand Tripadvisor could...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor's narrative projects $2.3 billion revenue and $144.6 million earnings by 2028.

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 19% upside to its current price.

Exploring Other Perspectives

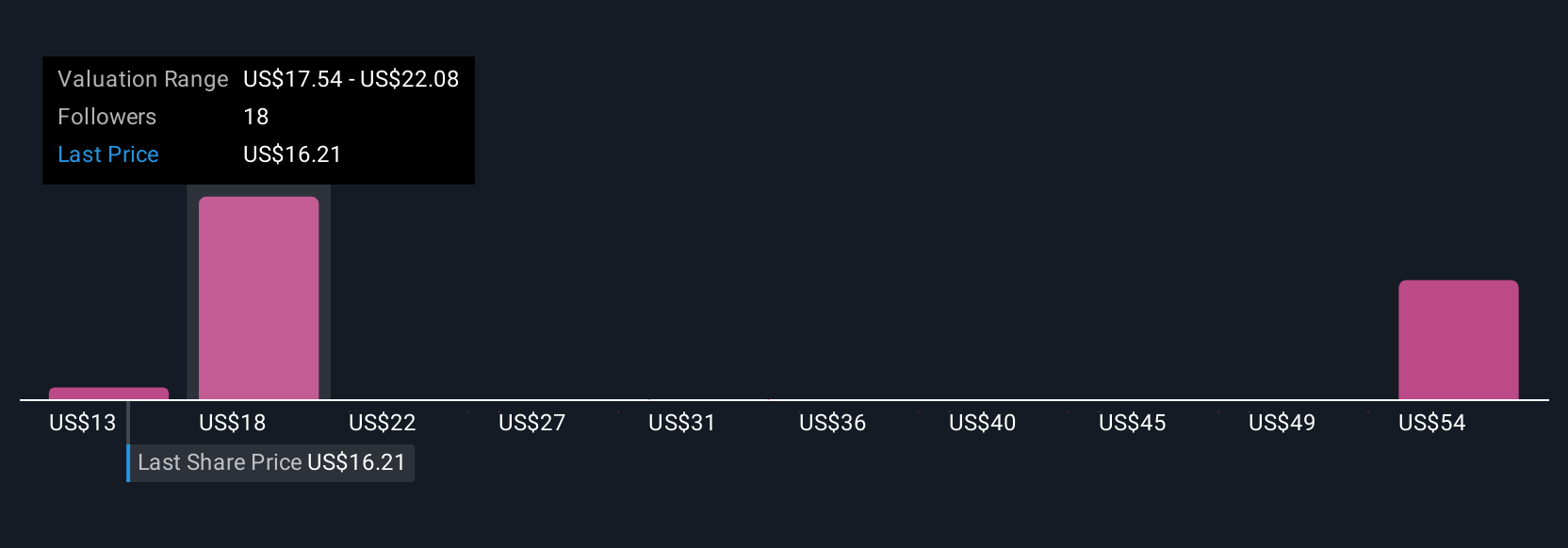

Seven Simply Wall St Community fair value estimates for Tripadvisor span roughly US$13.50 to US$33.47, showing how far apart individual views can be. As you weigh those opinions, remember that the central risk many see is sustained weakness in Tripadvisor’s core organic traffic, which could keep revenue growth muted and make any recovery in profitability harder to sustain over time, so it is worth exploring several contrasting scenarios before forming a view.

Explore 7 other fair value estimates on Tripadvisor - why the stock might be worth 12% less than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報