The Bull Case For Global Net Lease (GNL) Could Change Following £250M McLaren Campus Sale To Cut Debt

- Global Net Lease, Inc. recently completed an agreement to sell the McLaren Campus in Woking, Surrey, England for £250 million, following rent increases of 14.5% since acquiring the asset in April 2021.

- The company plans to direct a large share of the proceeds toward reducing its multi-billion-dollar debt load, aiming to strengthen the balance sheet and potentially free up capacity for future share repurchases and acquisitions.

- Next, we’ll explore how using the McLaren Campus sale proceeds to cut debt could reshape Global Net Lease’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Global Net Lease Investment Narrative Recap

To own Global Net Lease, you need to believe in its shift toward a focused net lease portfolio while steadily working down a heavy debt load. The McLaren Campus sale fits that story by recycling capital into debt reduction, which directly affects the key near term catalyst of deleveraging and helps address the biggest current risk of elevated leverage and interest costs.

In this context, the ongoing share repurchase program, which has already retired over 12 million shares in 2025, matters because it competes with debt reduction for capital and can magnify the impact of any income loss from asset sales like McLaren. How Global Net Lease balances these two uses of cash will influence whether disposition driven deleveraging supports or strains future AFFO and dividend capacity.

Yet investors should also be aware that high leverage and a US$3.1 billion gross debt load could still...

Read the full narrative on Global Net Lease (it's free!)

Global Net Lease's narrative projects $493.0 million revenue and $97.6 million earnings by 2028. This requires a 13.8% yearly revenue decline and an earnings increase of about $372 million from -$274.4 million today.

Uncover how Global Net Lease's forecasts yield a $9.36 fair value, a 15% upside to its current price.

Exploring Other Perspectives

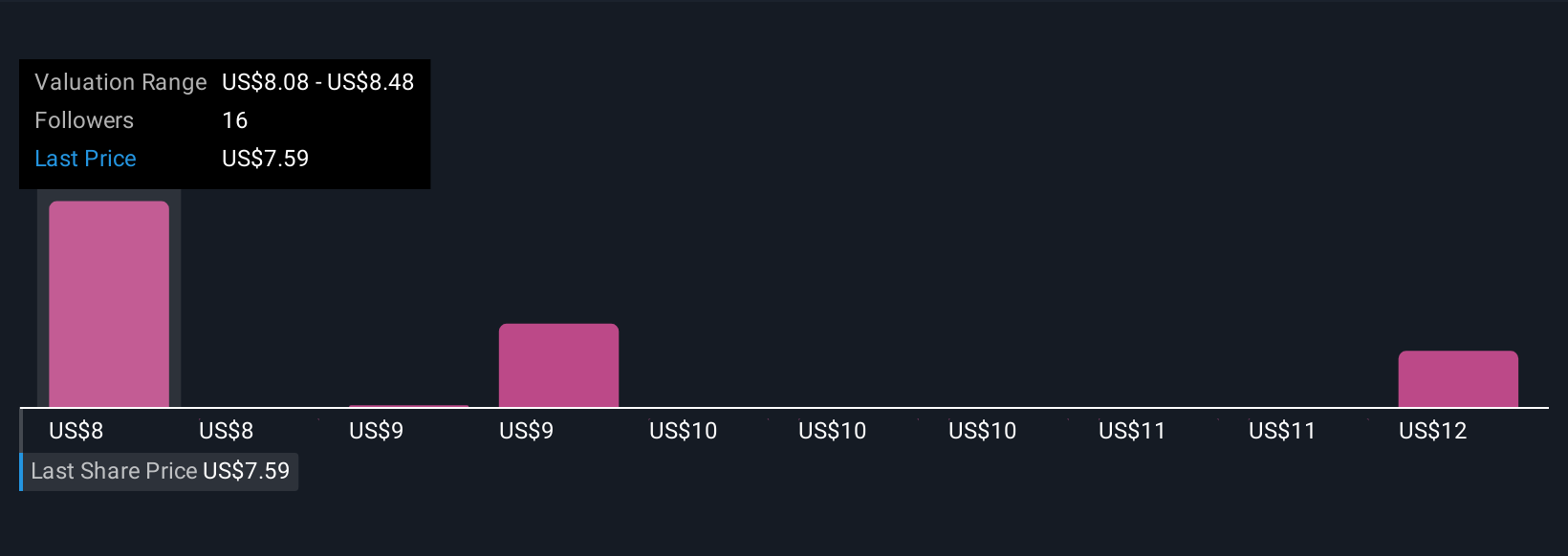

Four Simply Wall St Community fair value estimates for Global Net Lease currently span roughly US$8.08 to US$13.72 per share, reflecting very different expectations about risk and reward. Against that backdrop, the focus on using large asset sales to cut a US$3.1 billion debt load gives you a concrete issue to weigh as you compare these varied viewpoints.

Explore 4 other fair value estimates on Global Net Lease - why the stock might be worth as much as 69% more than the current price!

Build Your Own Global Net Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Net Lease research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Net Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Net Lease's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報