Virginia Adult-Use Cannabis Proposal Might Change The Case For Investing In Green Thumb Industries (CNSX:GTII)

- In early December 2025, a Virginia state panel released a detailed proposal outlining how an adult-use marijuana retail market could operate, with Green Thumb Industries highlighted as a relevant operator given its experience in other legal cannabis states.

- This move signals that Virginia may become a meaningful future market for established multi-state operators, potentially reshaping how companies like Green Thumb assess long-term expansion opportunities and regulatory risk.

- We’ll now examine how Virginia’s progress toward an adult-use retail framework could influence Green Thumb Industries’ investment narrative and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Green Thumb Industries Investment Narrative Recap

To own Green Thumb Industries, you need to believe that regulated U.S. cannabis can support durable, profitable operators despite pricing pressure, regulatory uncertainty and capital intensity. Virginia’s proposal for an adult-use framework is directionally positive for long-term optionality, but it does not materially change the near term focus on stabilizing margins and managing regulatory risk across existing core markets.

The most relevant recent announcement here is Green Thumb’s Q3 2025 results, which showed modest year-on-year sales growth and improved quarterly net income to US$23.29 million. Against that backdrop, Virginia’s progress looks like an incremental, longer term potential catalyst layered on top of a still-challenging backdrop of price compression and uneven profitability across the footprint.

Yet while new markets like Virginia may expand Green Thumb’s opportunity set, investors should be aware of how ongoing regulatory and political uncertainty could...

Read the full narrative on Green Thumb Industries (it's free!)

Green Thumb Industries' narrative projects $1.3 billion revenue and $141.9 million earnings by 2028. This requires 4.2% yearly revenue growth and about a $112.9 million earnings increase from $29.0 million today.

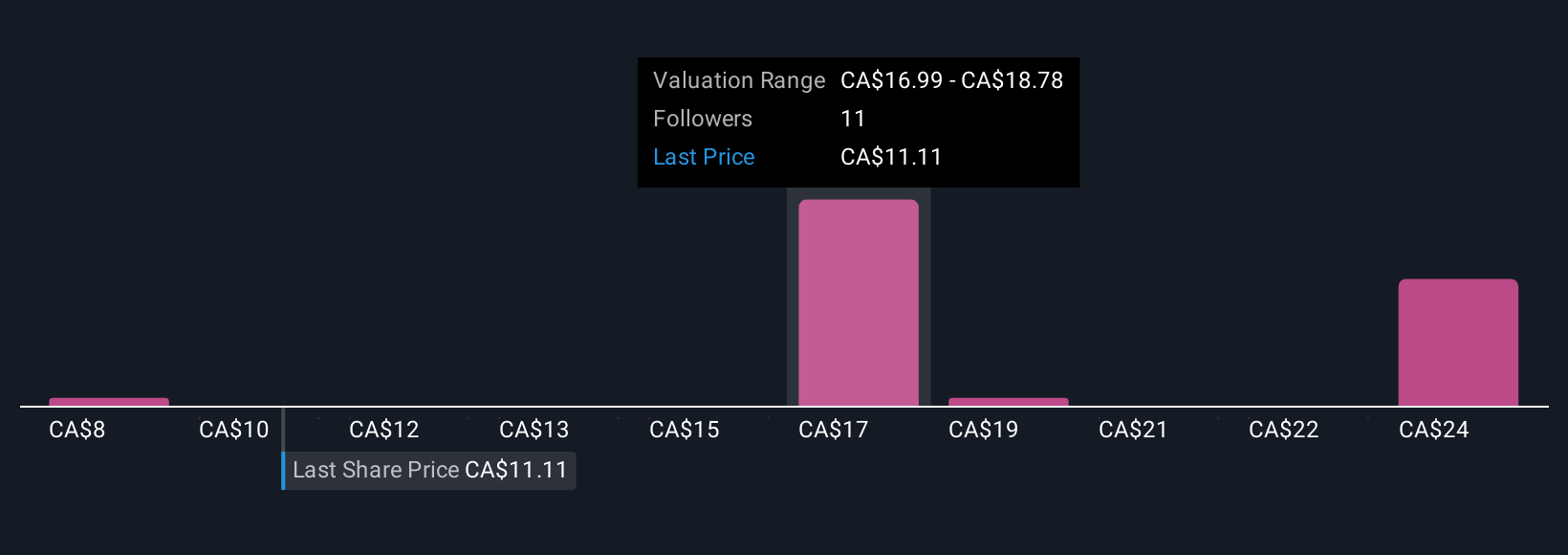

Uncover how Green Thumb Industries' forecasts yield a CA$17.00 fair value, a 85% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Green Thumb’s fair value between US$8.05 and US$21.13, reflecting very different expectations. When you set those views against the continuing regulatory and political uncertainty facing U.S. cannabis operators, it becomes even more important to compare multiple scenarios for Green Thumb’s long term profitability and capital needs.

Explore 5 other fair value estimates on Green Thumb Industries - why the stock might be worth over 2x more than the current price!

Build Your Own Green Thumb Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Thumb Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Green Thumb Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Thumb Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報