3 TSX Dividend Stocks For Your Canadian Portfolio

As we approach the end of 2025, Canadian markets have shown robust performance, with the TSX delivering impressive double-digit gains amid a landscape shaped by central bank meetings and labor market dynamics. In this context of economic shifts and potential rate changes, dividend stocks stand out as a compelling choice for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.11% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.54% | ★★★★★☆ |

| Rogers Sugar (TSX:RSI) | 6.09% | ★★★★☆☆ |

| Pulse Seismic (TSX:PSD) | 14.46% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.47% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.07% | ★★★★☆☆ |

| Olympia Financial Group (TSX:OLY) | 6.34% | ★★★★★☆ |

| Great-West Lifeco (TSX:GWO) | 3.85% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.39% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.66% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

Toronto-Dominion Bank (TSX:TD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services across Canada, the United States, and internationally, with a market cap of CA$206.46 billion.

Operations: Toronto-Dominion Bank's revenue is primarily derived from Canadian Personal and Commercial Banking (CA$18.54 billion), Wealth Management and Insurance (CA$14.56 billion), U.S. Retail (CA$10.79 billion), Wholesale Banking (CA$8.10 billion), and Corporate services (CA$11.27 billion).

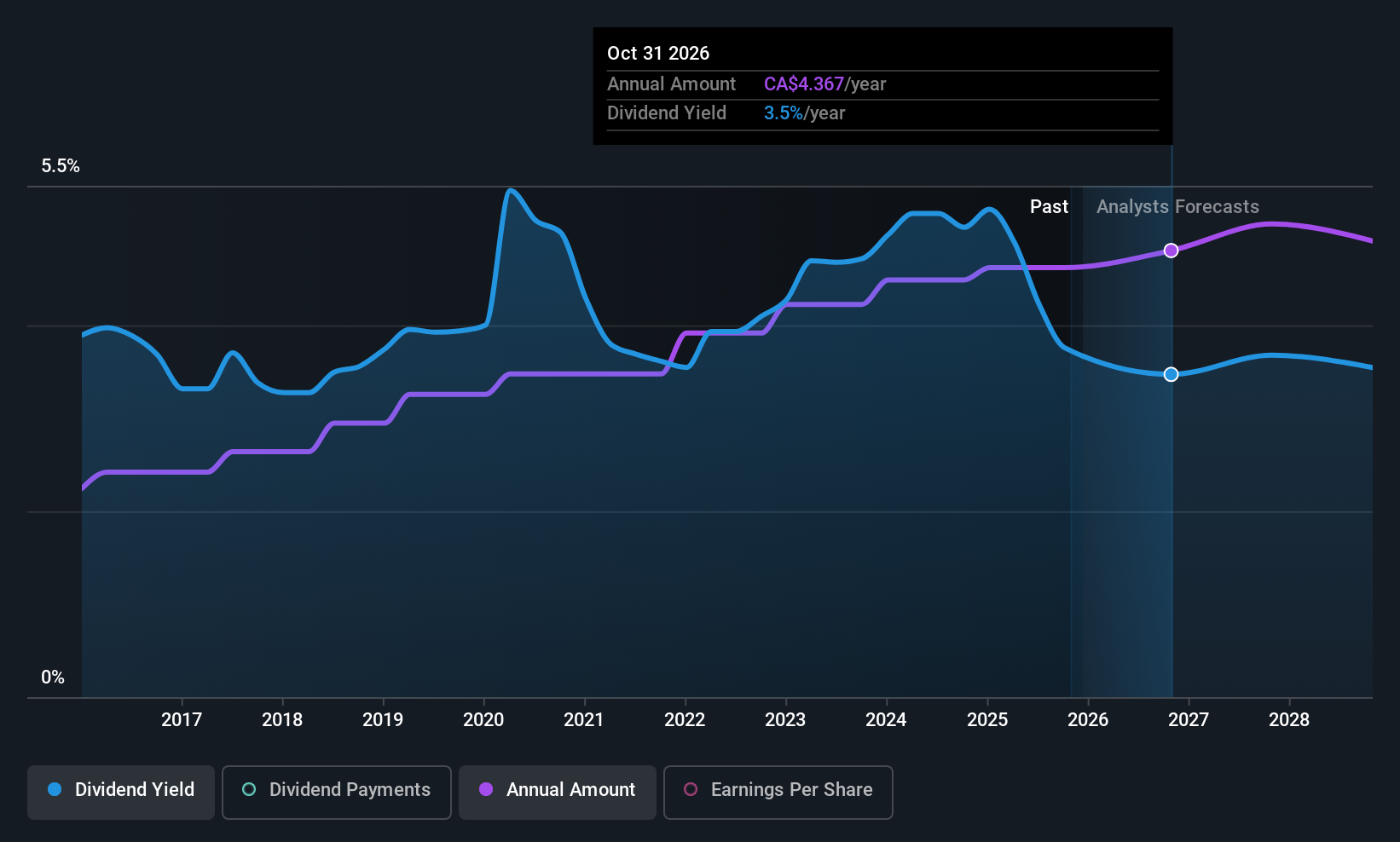

Dividend Yield: 3.5%

Toronto-Dominion Bank has transitioned to a semi-annual dividend review, recently declaring a CAD 1.08 per share dividend for Q1 2026. Despite a lower-than-market-average yield of 3.54%, TD's dividends have been stable and growing over the past decade, with a payout ratio of 36.3% indicating sustainability. The bank reported significant earnings growth last year but faces an expected earnings decline over the next three years, which could impact future dividend increases.

- Click here to discover the nuances of Toronto-Dominion Bank with our detailed analytical dividend report.

- Our expertly prepared valuation report Toronto-Dominion Bank implies its share price may be lower than expected.

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitecap Resources Inc. is involved in the acquisition, development, and production of petroleum and natural gas properties in Western Canada, with a market cap of CA$14.37 billion.

Operations: Whitecap Resources Inc.'s revenue primarily comes from its Oil & Gas - Exploration & Production segment, which generated CA$4.52 billion.

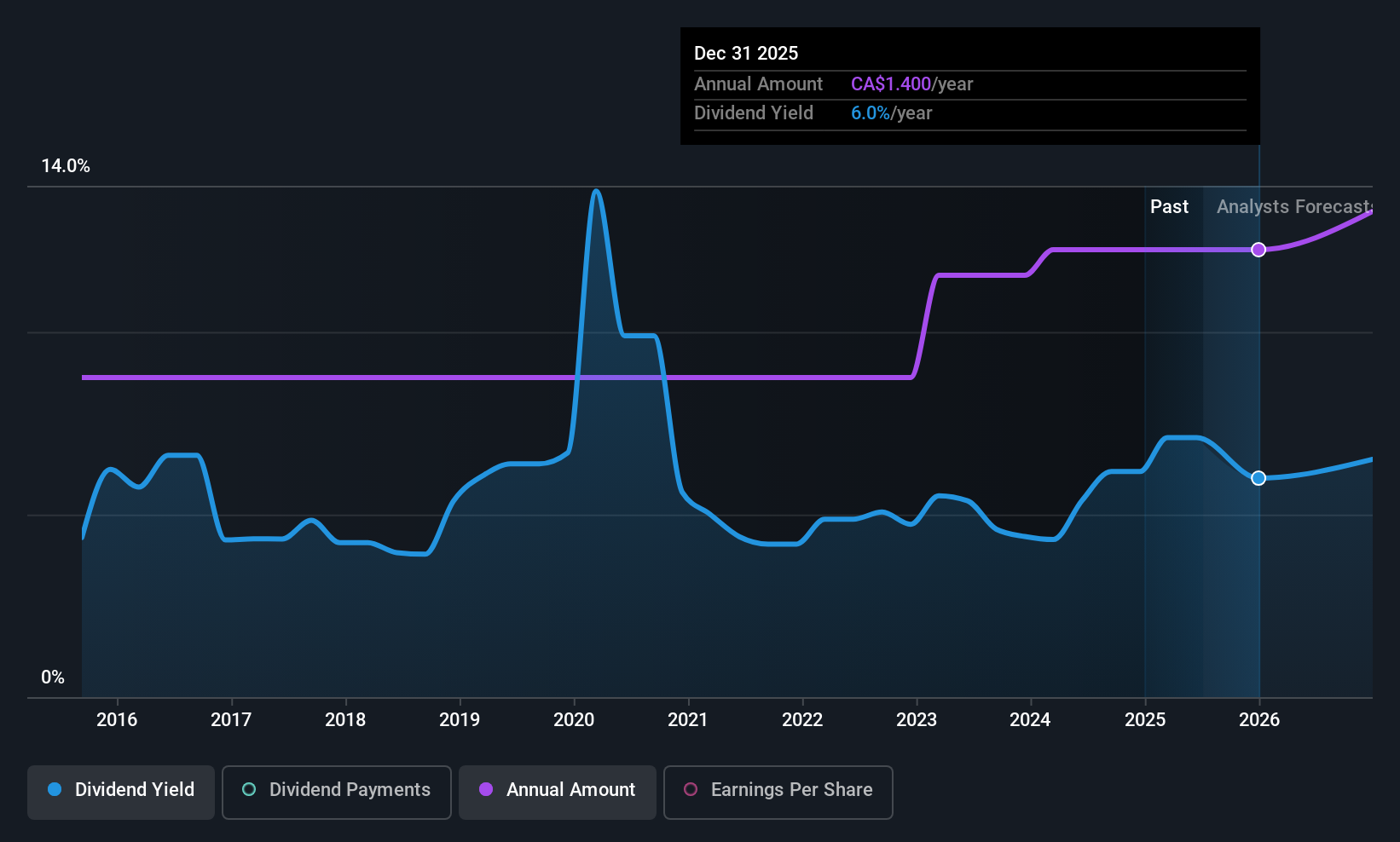

Dividend Yield: 6.2%

Whitecap Resources confirmed a CAD 0.0608 dividend per share for November, maintaining this payout since September. Despite a high cash payout ratio of 133.4%, dividends remain covered by earnings with a reasonable payout ratio of 66.9%. However, the dividend's sustainability is questionable due to insufficient free cash flow coverage and past volatility in payments. Recent earnings growth and increased production provide some positive outlook, but shareholder dilution remains a concern.

- Delve into the full analysis dividend report here for a deeper understanding of Whitecap Resources.

- In light of our recent valuation report, it seems possible that Whitecap Resources is trading behind its estimated value.

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wajax Corporation operates in Canada, offering industrial products and services, with a market capitalization of CA$596.70 million.

Operations: Wajax Corporation generates revenue primarily through its Wholesale - Machinery & Industrial Equipment segment, which accounts for CA$2.15 billion.

Dividend Yield: 5.1%

Wajax's dividend stability is underscored by a low cash payout ratio of 16.9%, ensuring coverage by cash flows, while a reasonable earnings payout ratio of 65.7% supports sustainability. The company has consistently increased dividends over the past decade, though its yield of 5.11% lags behind top-tier Canadian payers. Recent financial results show improved earnings and revenue growth, but significant insider selling and high debt levels could pose risks to dividend reliability moving forward.

- Navigate through the intricacies of Wajax with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Wajax is trading beyond its estimated value.

Make It Happen

- Discover the full array of 17 Top TSX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報