Freshworks And Two More Stocks Estimated To Be Trading Below Fair Value

As U.S. stocks rise on hopes of a Federal Reserve rate cut, the market's attention is keenly focused on inflation data and major corporate deals like Netflix's acquisition of Warner Bros. Discovery. In such an environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities, as these stocks may offer significant value relative to their current market prices amidst shifting economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Super Group (SGHC) (SGHC) | $11.23 | $21.55 | 47.9% |

| Perfect (PERF) | $1.79 | $3.41 | 47.6% |

| Pattern Group (PTRN) | $13.31 | $25.44 | 47.7% |

| Palomar Holdings (PLMR) | $116.42 | $224.09 | 48% |

| MoneyHero (MNY) | $1.26 | $2.40 | 47.5% |

| Investar Holding (ISTR) | $26.03 | $51.21 | 49.2% |

| DexCom (DXCM) | $65.49 | $127.10 | 48.5% |

| Chagee Holdings (CHA) | $14.58 | $28.55 | 48.9% |

| BioLife Solutions (BLFS) | $25.46 | $49.97 | 49.1% |

| Beacon Financial (BBT) | $25.16 | $48.39 | 48% |

Let's take a closer look at a couple of our picks from the screened companies.

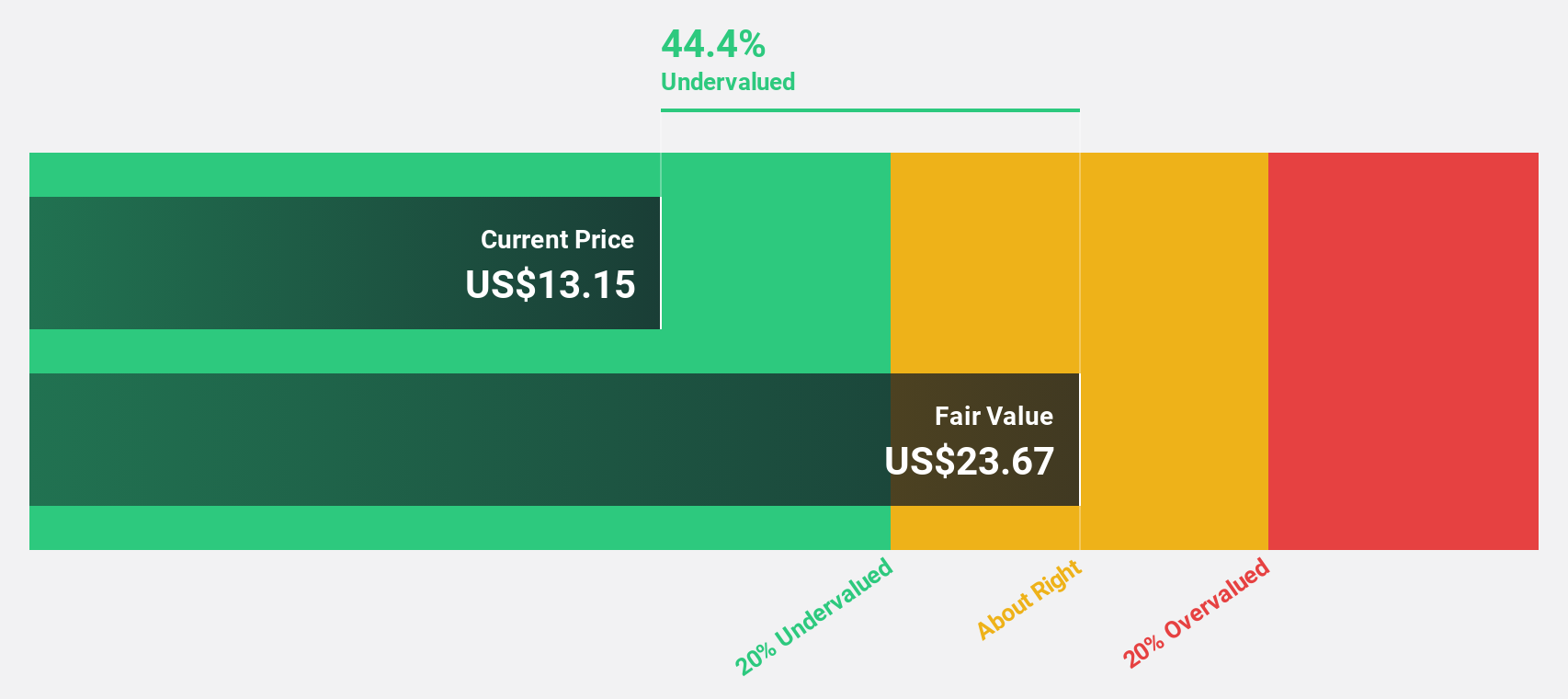

Freshworks (FRSH)

Overview: Freshworks Inc. is a software development company that offers software-as-a-service products globally, with a market cap of $3.62 billion.

Operations: The company's revenue is primarily derived from its software and programming segment, which generated $810.64 million.

Estimated Discount To Fair Value: 45.7%

Freshworks is trading at 45.7% below its estimated fair value of US$23.63, indicating significant undervaluation based on discounted cash flows. Recent earnings showed a narrowing net loss and increased sales, with third-quarter revenue reaching US$215.12 million, up from US$186.58 million year-over-year. The company raised its full-year revenue guidance to US$833-836 million, reflecting strong execution and market conditions while unveiling AI enhancements to improve IT service efficiency and employee experience.

- Upon reviewing our latest growth report, Freshworks' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Freshworks stock in this financial health report.

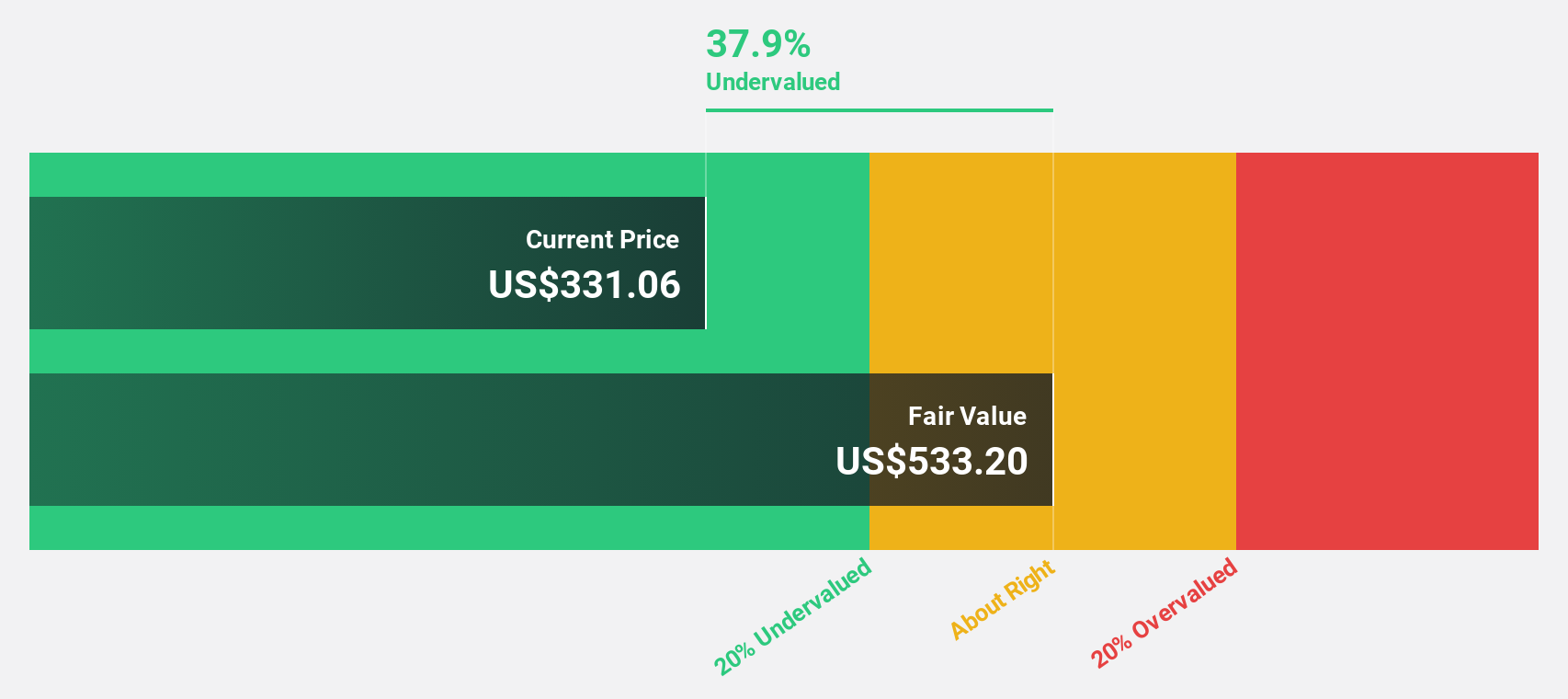

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers in the United States, Brazil, the United Kingdom, and internationally; it has a market cap of $21.73 billion.

Operations: Corpay's revenue is primarily derived from vehicle payments at $2.06 billion, corporate payments at $1.50 billion, and lodging payments at $477.92 million.

Estimated Discount To Fair Value: 40.2%

Corpay is trading at US$310.64, significantly undervalued compared to its estimated fair value of US$519.63, based on discounted cash flows. Despite slower revenue growth forecasts of 13.2% annually, earnings are expected to grow 20.56% per year over the next three years. Recent initiatives like the USCIS Navigator and strategic partnerships enhance operational efficiency and market reach, although debt coverage by operating cash flow remains a concern amidst aggressive share repurchases and expansion activities.

- Our expertly prepared growth report on Corpay implies its future financial outlook may be stronger than recent results.

- Take a closer look at Corpay's balance sheet health here in our report.

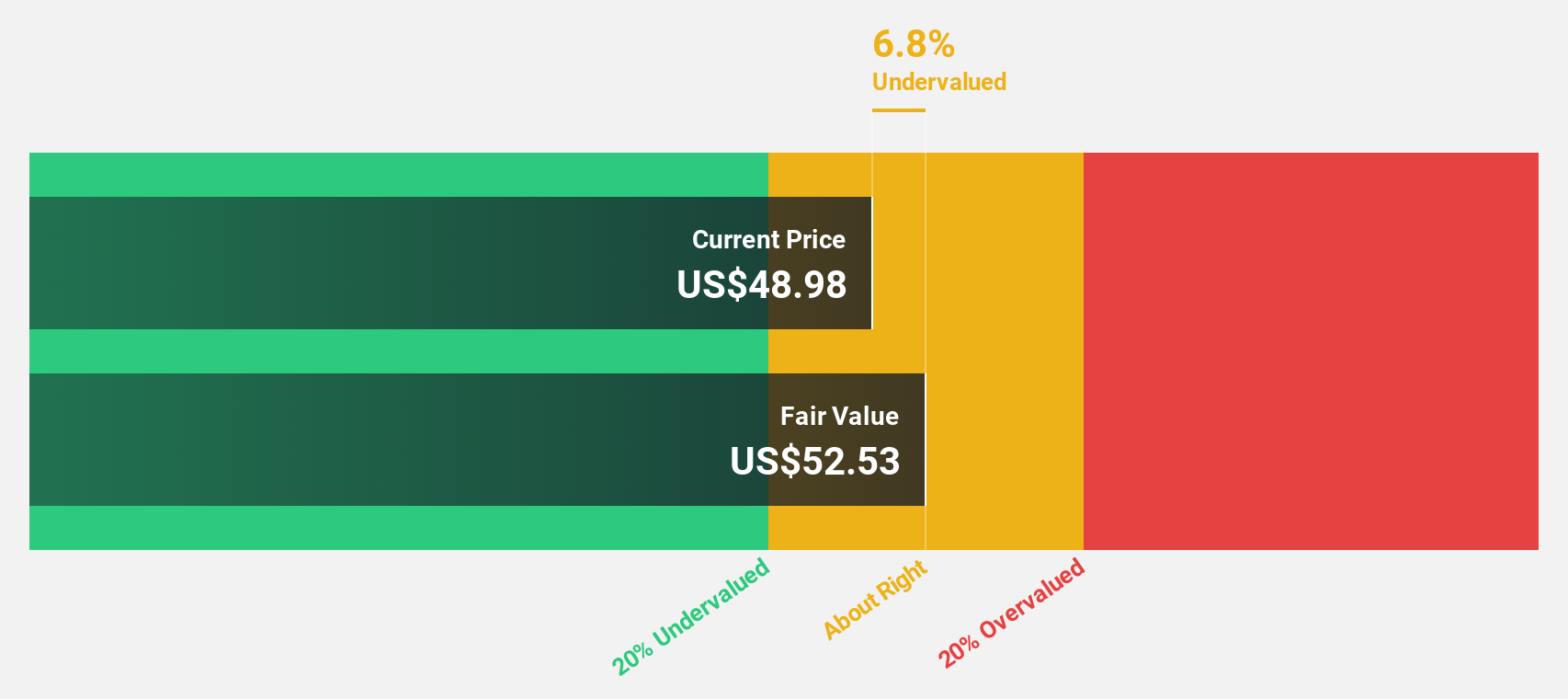

Unity Software (U)

Overview: Unity Software Inc. provides a platform for creating and expanding games and interactive experiences across various devices globally, with a market cap of approximately $19.59 billion.

Operations: Unity Software Inc.'s revenue from Software Solutions amounts to $1.80 billion, supporting its platform for developing and enhancing games and interactive experiences across multiple devices worldwide.

Estimated Discount To Fair Value: 12.6%

Unity Software, trading at US$45.78, is undervalued relative to its estimated fair value of US$52.36 based on discounted cash flows. The company anticipates becoming profitable within three years with annual revenue growth forecasted at 11.7%, surpassing the U.S. market average of 10.6%. Strategic alliances with Epic Games and product enhancements like Android XR support bolster Unity's market position, though recent insider selling may warrant caution for potential investors assessing long-term prospects.

- According our earnings growth report, there's an indication that Unity Software might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Unity Software.

Make It Happen

- Discover the full array of 205 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報