3 Promising Penny Stocks With Market Caps Below $800M

As U.S. stocks rise on hopes of an interest rate cut following tame inflation data, the market is buzzing with anticipation. Amidst this backdrop, penny stocks—though an old term—continue to capture investor interest by offering potential growth at accessible price points. These smaller or newer companies can present valuable opportunities when they boast strong financials and clear growth prospects, making them worth a closer look in today's evolving market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.16 | $462.9M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8739 | $149.45M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.25 | $546.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.29 | $1.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.99 | $56.58M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.61 | $598.45M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.97 | $1.05B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8799 | $6.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.40 | $99.69M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

HF Foods Group (HFFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HF Foods Group Inc. operates as a marketer and distributor of specialty food products, including seafood, fresh produce, frozen and dry food, and non-food items to Asian restaurants and other foodservice customers in the United States, with a market cap of approximately $138.44 million.

Operations: The company generates revenue primarily from the sales of food and non-food items, amounting to $1.23 billion.

Market Cap: $138.44M

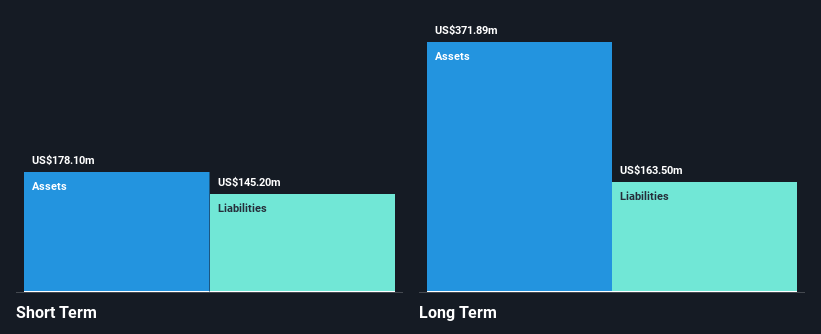

HF Foods Group, with a market cap of approximately US$138.44 million, is navigating challenges typical of penny stocks. Despite being unprofitable, the company has reduced its losses significantly over the past five years and maintains a sufficient cash runway for more than three years due to positive free cash flow. However, it faces high debt levels with a net debt to equity ratio at 68%. Recent strategic moves include seeking mergers and acquisitions to expand its geographic footprint in high-potential markets while leveraging operational synergies. Leadership changes have brought experienced financial executives onboard, potentially strengthening governance and strategic execution.

- Take a closer look at HF Foods Group's potential here in our financial health report.

- Assess HF Foods Group's future earnings estimates with our detailed growth reports.

Lineage Cell Therapeutics (LCTX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lineage Cell Therapeutics, Inc. is a clinical-stage biotechnology company focused on developing novel cell therapies for neurological and ophthalmic conditions, with a market cap of $416.80 million.

Operations: The company generates revenue from its research and development of therapeutic products, amounting to $10.82 million.

Market Cap: $416.8M

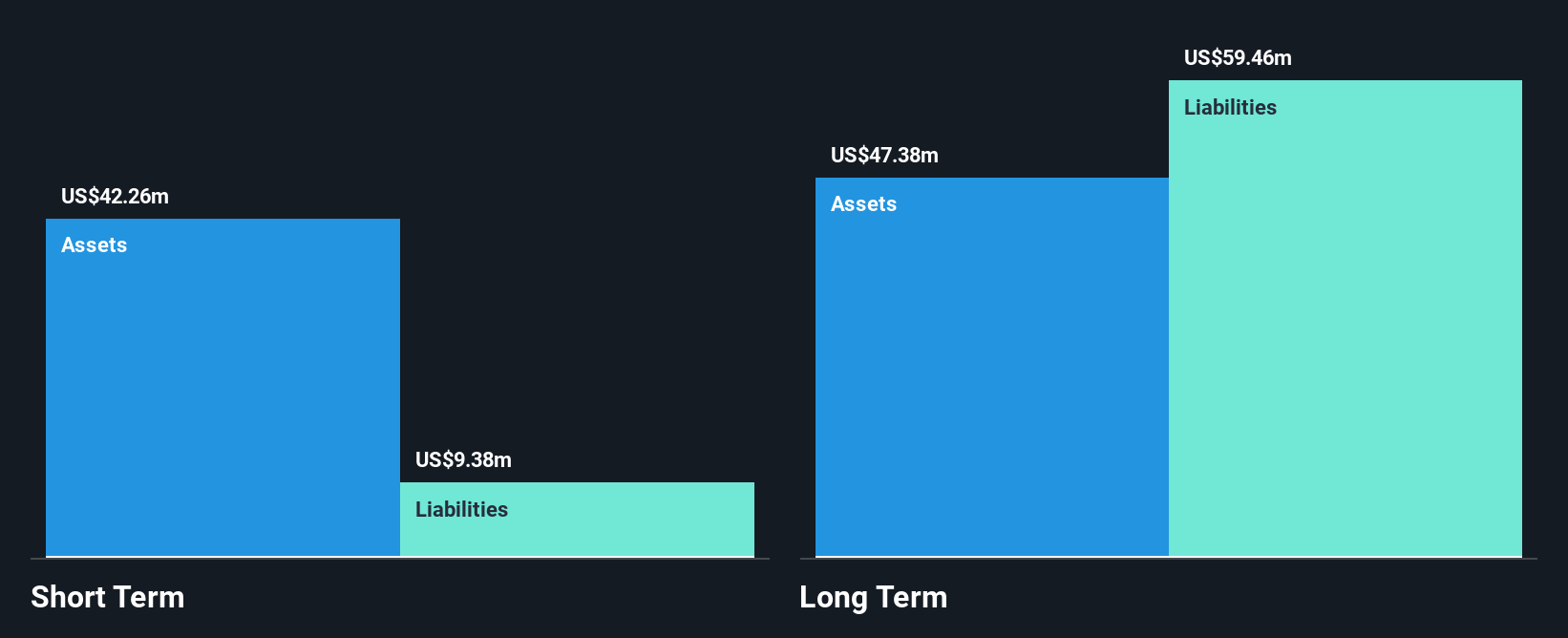

Lineage Cell Therapeutics, with a market cap of US$416.80 million, is navigating the complexities of the biotech sector as it develops novel cell therapies. The company remains unprofitable and reported a significant increase in net losses for Q3 2025 compared to the previous year, despite generating US$7.95 million in revenue over nine months. Its short-term assets exceed short-term liabilities, yet long-term liabilities remain uncovered. Lineage's experienced management and board offer stability as it progresses initiatives like its new islet cell transplant program for Type 1 Diabetes, aiming to overcome production challenges critical for commercialization success.

- Unlock comprehensive insights into our analysis of Lineage Cell Therapeutics stock in this financial health report.

- Gain insights into Lineage Cell Therapeutics' future direction by reviewing our growth report.

SES AI (SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation develops and produces AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and robotics, with a market cap of $792.21 million.

Operations: SES AI Corporation has not reported any distinct revenue segments.

Market Cap: $792.21M

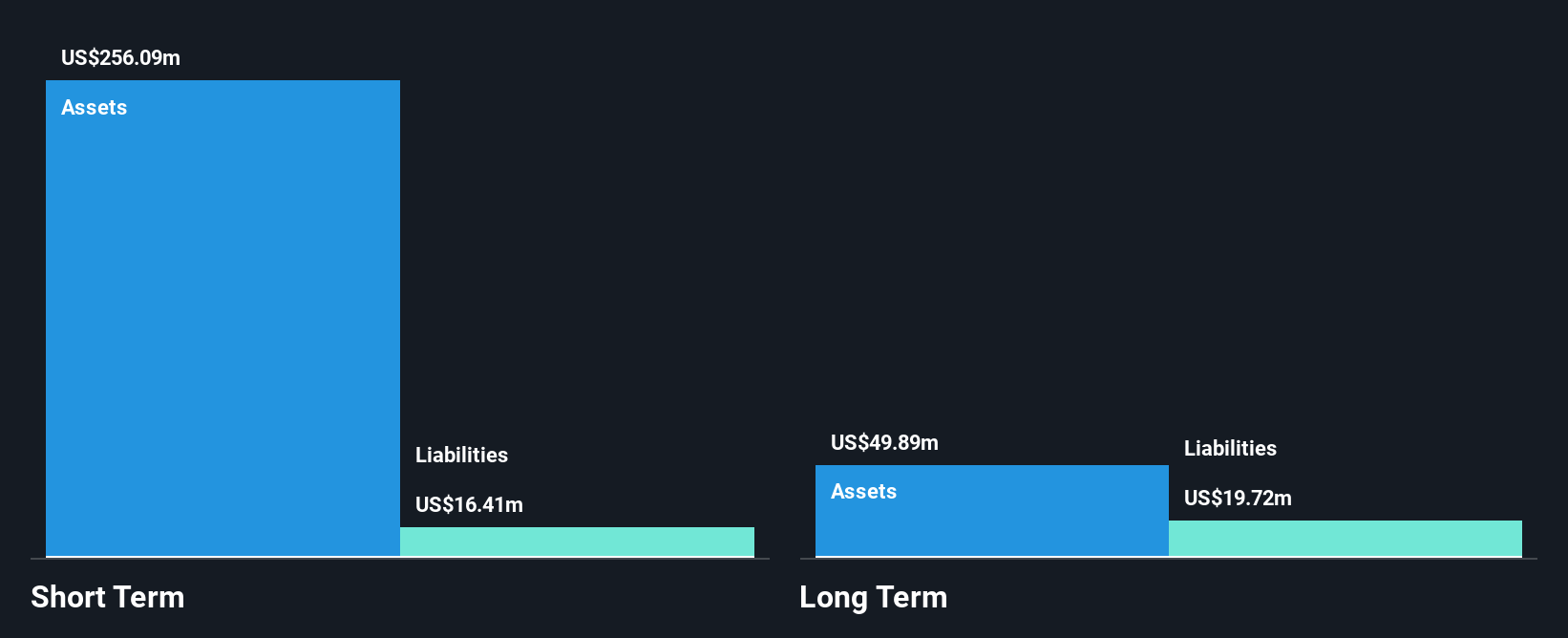

SES AI Corporation, with a market cap of US$792.21 million, is advancing its position in the battery technology sector despite being unprofitable. The company reported Q3 2025 revenues of US$7.12 million and reduced net losses compared to the previous year. SES AI's short-term assets significantly exceed both its short- and long-term liabilities, providing financial stability. Recent strategic moves include raising revenue guidance to US$20-25 million for 2025 and forming a joint venture with Hisun New Energy Materials Ltd., aimed at commercializing new electrolyte materials discovered through its Molecular Universe platform—a potential new revenue stream for the company.

- Click here and access our complete financial health analysis report to understand the dynamics of SES AI.

- Explore SES AI's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Discover the full array of 344 US Penny Stocks right here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報