Could Emera’s Renewed Equity Program Reframe Its Capital Structure Story For Investors (TSX:EMA)?

- Emera Incorporated recently renewed its at-the-market equity program, allowing it to issue up to C$600,000,000 of common shares from treasury to the public at its discretion.

- This renewed program gives Emera additional flexibility to raise equity capital when conditions suit, which can affect both its funding mix and future earnings per share.

- Next, we will examine how this renewed at-the-market equity capacity may influence Emera’s investment narrative, particularly around financing flexibility.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Emera Investment Narrative Recap

To own Emera, you generally need to be comfortable with a regulated utility focused on steady earnings, a meaningful dividend, and ongoing capital needs. The renewed C$600,000,000 at the market program modestly shifts the short term focus toward how Emera balances equity issuance with its biggest risk today: refinancing sizable 2026 debt in a high interest rate setting. Near term, the catalyst remains whether management can fund its capital plan without unduly pressuring earnings per share.

The most relevant recent development here is Emera’s decision to increase its quarterly common dividend to C$0.7325 per share in late 2025, reinforcing its income focused profile just as it adds fresh equity capacity. Together, a higher dividend and an at the market program highlight the tension between rewarding shareholders today and potentially issuing shares that could dilute per share metrics if used heavily around refinancing and capital spending needs.

Yet behind the renewed equity flexibility, investors should also be aware of how upcoming 2026 debt maturities could...

Read the full narrative on Emera (it's free!)

Emera's narrative projects CA$8.7 billion revenue and CA$1.1 billion earnings by 2028. This requires 1.8% yearly revenue growth and about a CA$224 million earnings increase from CA$875.6 million today.

Uncover how Emera's forecasts yield a CA$68.39 fair value, a 4% upside to its current price.

Exploring Other Perspectives

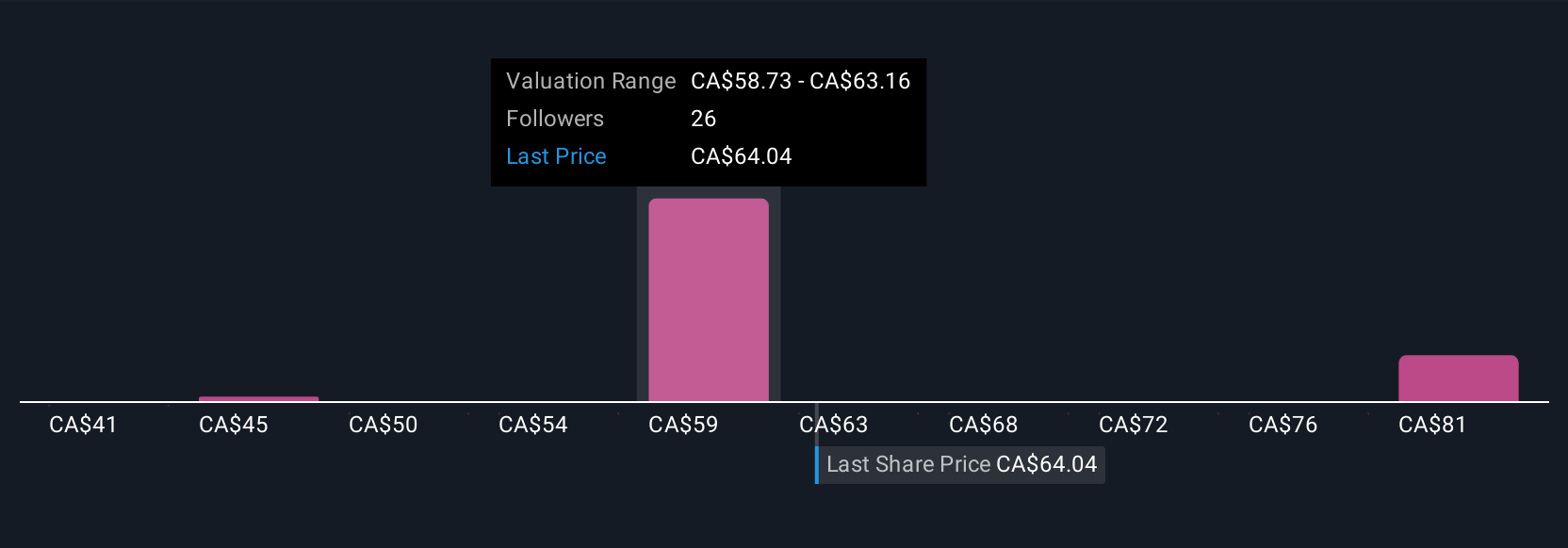

Five members of the Simply Wall St Community estimate Emera’s fair value between C$45.79 and C$87.84, showing wide dispersion in expectations. You can weigh these views against the renewed C$600,000,000 at the market equity program and its implications for refinancing risk and future earnings power.

Explore 5 other fair value estimates on Emera - why the stock might be worth 30% less than the current price!

Build Your Own Emera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emera research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Emera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emera's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報