Earnings Forecast | After Oracle (ORCL.US) shares retreated 35%, the market keeps an eye on debt and cash flow inflection points

The Zhitong Finance App learned that Oracle (ORCL.US) will announce financial results for the second quarter of the 2026 fiscal year after closing on December 10 (Wednesday) EST. According to the London Stock Exchange Group (LSEG), analysts on average expect second-quarter revenue of $16.22 billion, up 15.4% year over year, and non-GAAP earnings per share of $1.64, up 11.6% year over year.

Figure 1

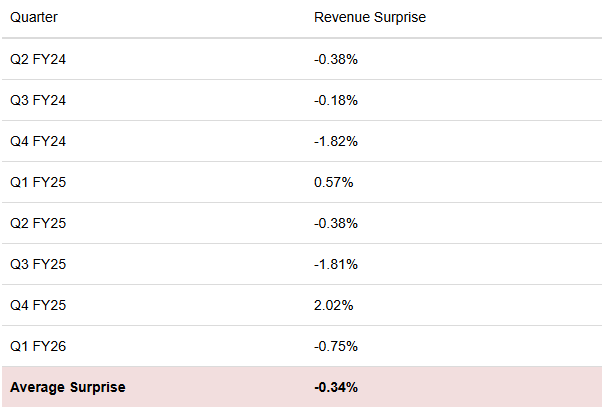

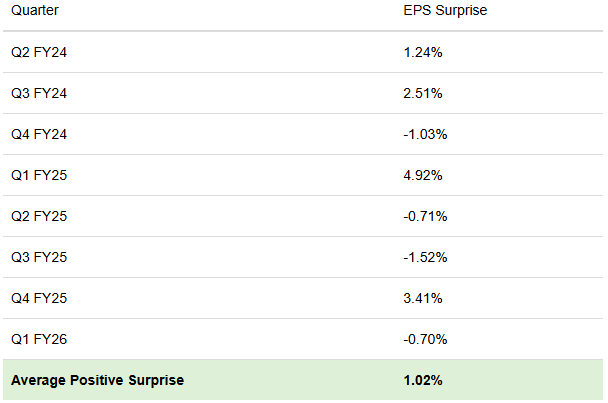

However, judging from historical records, Oracle's revenue exceeded expectations only twice in the past eight quarters, on average 0.34% lower than market expectations; the performance in terms of earnings per share was slightly better, with a win rate of about half, but the overall average still achieved a positive surprise of 1.02% because the margin that exceeded expectations was significantly greater than the extent that it did not meet expectations.

Figure 2

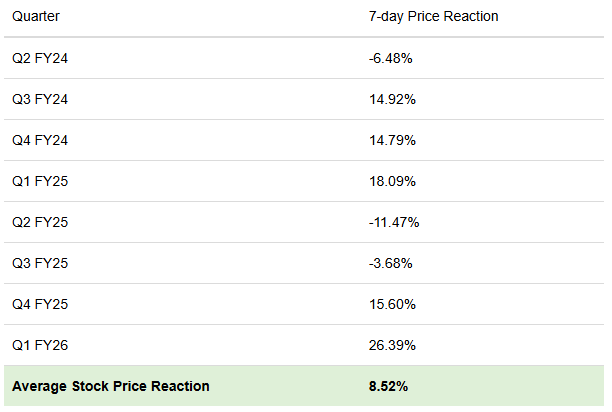

Given that analysts' expectations for revenue growth are higher than the upper limit of the company's guidelines, and data center construction is still constrained by supply chain bottlenecks, the market is cautious about whether the company can achieve a significant revenue jump, even though the remaining performance obligation (RPO) set a record last quarter. However, the current market seems to place more importance on the performance of its cloud infrastructure business and RPO growth. Both indicators have been quite impressive in the past few quarters; as a result, the stock price rose by an average of 8.52% in the seven days after the earnings report was released.

Figure 3

It is worth mentioning that Oracle's stock price has been weak recently, taking back the increase after issuing optimistic guidance about three months ago. The stock price has fallen by more than 35% since reaching a record high in September. The main reason is that investors' concerns about its solvency and funding gap quickly heated up after earnings reports revealed “sky-high orders.” This article will systematically sort out several core variables that investors should focus on in the process of interpreting this quarterly report. Among them, there are three key points that cannot be ignored, namely the debt situation, cash flow situation, and developments related to OpenAI.

The top three areas investors focused on in the second quarter: debt, cash flow, and OpenAI related developments

Oracle had a good start to the new fiscal year, but both revenue and profit fell short of expectations. Specifically, the company's first-quarter revenue reached $14.93 billion, up 12.2% year over year, but was still below market expectations of $1.17 billion; non-GAAP earnings per share were $1.47, up 5.75% year over year, yet $0.01 below consensus. Despite this, its cloud infrastructure business (OCI) revenue jumped 54% year over year, making it a major highlight; the non-GAAP operating margin recorded 42%, down about 1 percentage point year over year, and about 2 percentage points month over month. In terms of capital expenditure, the company surged to $2.74 billion last quarter, far higher than the previous quarter's $2.12 billion. For the second quarter, according to company management guidance, revenue is expected to increase 12% to 14% year over year at a constant exchange rate, and non-GAAP earnings per share are expected to be between $1.61 and $1.65, corresponding increase of about 10% to 12%.

However, since the release of the first quarter earnings report in September of this year, the company's stock price has experienced sharp fluctuations. After the financial report was announced, thanks to a 359% year-on-year surge in remaining performance obligations and a 1,529% year-on-year increase in multi-cloud database revenue, the stock price once soared and hit a record high of $345.72; at the same time, Oracle also reached a computing power supply agreement of about 300 billion US dollars with OpenAI, and plans to provide computing power over the next five years. However, investors then began to question whether the company had enough capital to fulfill these orders, and the stock price fell sharply as a result.

The company also issued $18 billion in investment-grade bonds in September due to a surge in capital expenditure that led to negative free cash flow, and there are reports that it may be forced to borrow up to $100 billion to finance data center construction. Last month, market concerns about the company's solvency were also reflected in the credit default swap (CDS) market. The five-year CDS spread associated with Oracle once rose to 105 basis points, far higher than Google's parent company Alphabet and Amazon's approximately 38 basis points, and Microsoft's approximately 34 basis points.

Combining these factors, the most important thing investors need to pay attention to in the second quarter earnings report is the clarity of the company's capital plan, especially the final scale of the loan plan to build artificial intelligence infrastructure, and when it is expected to regain positive free cash flow. These two factors are critical in evaluating whether a company has sufficient financial strength to meet surging demand; if management only gives an abstract schedule or estimate that lacks clear evidence, this is not a positive sign for stock prices.

Additionally, investors should pay attention to the company's guidance on future profit margins. On Analyst Day in October, Oracle proposed ambitious targets for gross margin of 30% to 40%, earnings per share of $21, and revenue of $225 billion by FY2030. Although these targets are far higher than market expectations, investors still need to examine whether the company's current profit margins are showing signs of slowing down. Finally, management updates on any progress on the $300 billion deal with OpenAI will also be critical; given that OpenAI itself requires significant funding and is signing agreements with various AI giants, this deal accounts for a significant portion of Oracle's remaining performance obligations, and any related developments are worth watching closely.

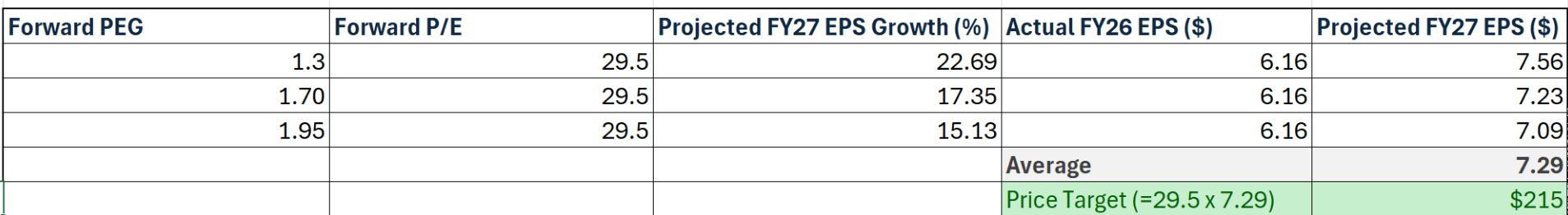

In terms of valuation, according to data, Oracle's current forward-looking price-earnings ratio is about 29.5 times, which is significantly lower than the previous 35.5 times, but it is still 21.3 times higher than the average of the past five years. Using an autoregressive integrated moving average (ARIMA) model after the first quarter earnings report, the company's earnings per share for the 2026 fiscal year were $6.16; currently, the stock's forward-looking price-earnings ratio (PEG) is 1.3, which is lower than the industry median of 1.70 and the company's five-year average of 1.95. Based on different PEG scenarios, the average earnings per share for fiscal year 2027 is $7.29, and the target price is around $215 at a 29.5 times price-earnings ratio, which means there is limited room for upward movement from current levels.

Figure 4

Overall, Oracle's record is mixed in terms of whether it has exceeded analysts' expectations, but the market recently placed more emphasis on its remaining performance obligations and growth in cloud infrastructure revenue. As long as the company continues to hand over strong data on these two indicators, it is expected that the stock price will still rise. In particular, the current stock price is already relatively low.

For the upcoming second-quarter earnings report, the market will focus on three key factors: management comments on plans to borrow money to build AI infrastructure, a timeline for when the company expects to return to positive cash flow, and the latest developments in the deal with OpenAI. From a valuation perspective, given the limited upside; although investors can still trade in the short term based on historical momentum before and after financial reports, they must balance the risk of the overall weakening of the AI sector and the company facing stricter cash flow and debt reviews.

Nasdaq

Nasdaq 華爾街日報

華爾街日報