How Huron’s New NL Digital Health Role Could Reshape Its Competitive Edge for HURN Investors

- In November 2025, Keyin College announced a collaboration with Huron Consulting Group, Vantiq, and Newfoundland and Labrador Health Services, after the group was pre-qualified as an Innovation Partner under NLHS’s 2025–2026 Innovation Strategy to support digital health training and technology initiatives across the province.

- This partnership highlights Huron’s role in large-scale electronic health record implementation and AI-enabled healthcare modernization, reinforcing its position in complex digital transformation projects for health systems.

- We’ll now explore how this new role in NLHS’s digital health and Epic implementation efforts may influence Huron’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Huron Consulting Group Investment Narrative Recap

To own Huron, you generally need to believe that its deep healthcare and education focus, especially in complex digital transformations, can offset policy and funding swings in those sectors. The NLHS collaboration broadens Huron’s role in electronic health records and AI-enabled care, but it does not fundamentally change the near term risk that delayed client technology spending or budget pressure could slow higher margin growth.

Among recent announcements, Huron’s expanded US$1.1 billion senior secured credit facility in July 2025 stands out here because it underpins the company’s ability to fund digital and AI consulting capabilities that support projects like NLHS’s Epic implementation. That additional financial flexibility, combined with ongoing share repurchases, sits alongside healthcare demand trends as a key driver that many investors focus on when weighing Huron’s catalysts against its concentration and cost risks.

But while these growth projects look promising, investors should be aware that Huron’s heavy reliance on healthcare and education clients leaves it exposed to shifting policy and funding...

Read the full narrative on Huron Consulting Group (it's free!)

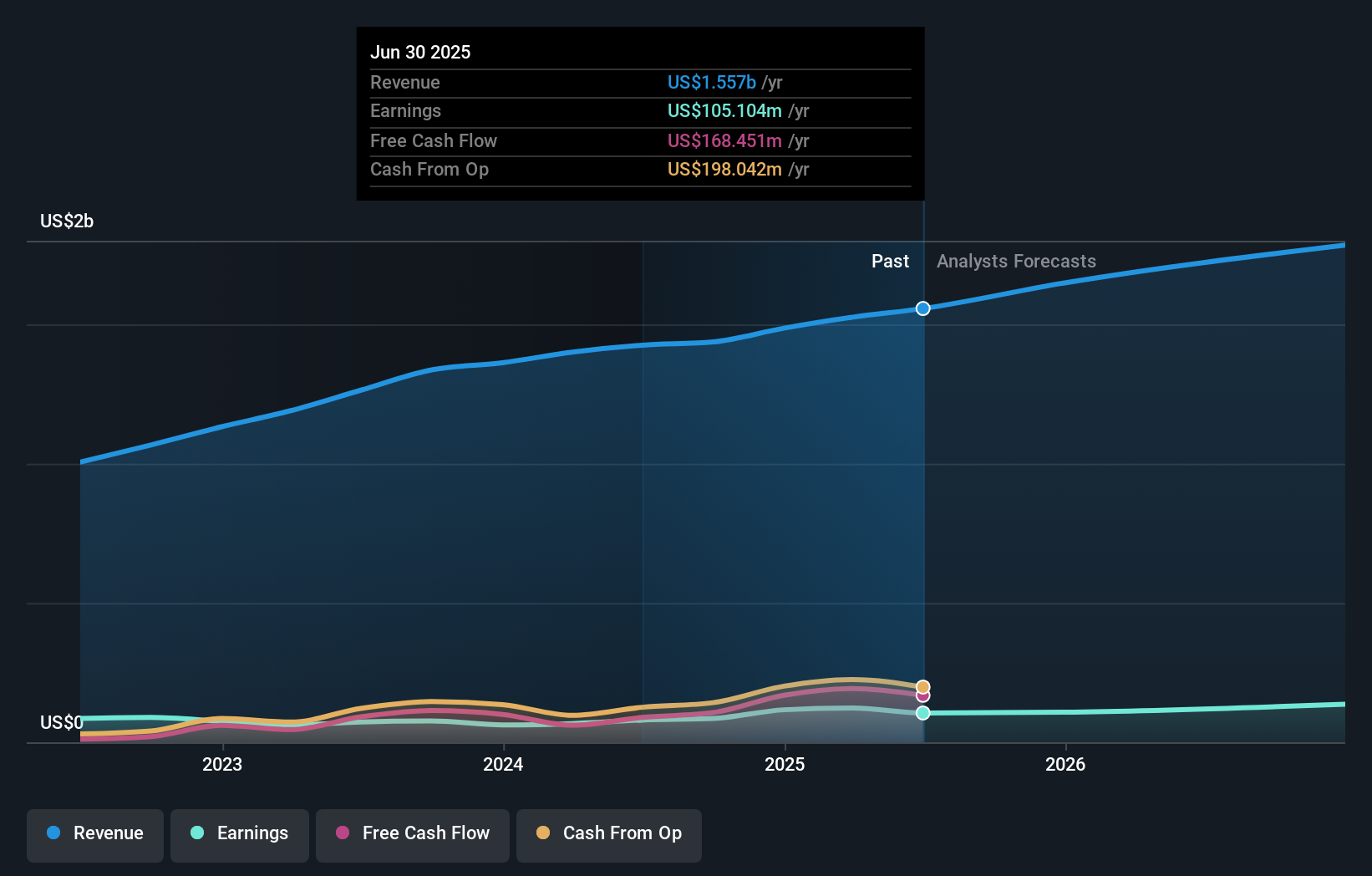

Huron Consulting Group's narrative projects $2.0 billion revenue and $172.9 million earnings by 2028. This requires 9.4% yearly revenue growth and about a $67.8 million earnings increase from $105.1 million today.

Uncover how Huron Consulting Group's forecasts yield a $178.33 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$178 to US$358 per share, showing how far apart individual views can be. When you set that against Huron’s reliance on healthcare and education budgets, it underlines why many readers may want to compare several risk and valuation viewpoints before forming a view on the stock.

Explore 2 other fair value estimates on Huron Consulting Group - why the stock might be worth over 2x more than the current price!

Build Your Own Huron Consulting Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huron Consulting Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huron Consulting Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huron Consulting Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報