Is Procore’s AI Push With AWS And New CEO Altering The Investment Case For Procore Technologies (PCOR)?

- In recent months, Procore Technologies announced three major developments: an AWS Marketplace and Amazon Bedrock AI integration, a CEO transition to Dr. Ajei Gopal, and the rollout of its Groundbreak AI suite for construction workflows.

- Together, these moves highlight Procore’s push to embed AI deeper into construction management, potentially broadening its platform’s role across the global building ecosystem.

- Next, we’ll examine how the new AWS partnership could reshape Procore’s existing investment narrative around AI-led growth and margins.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Procore Technologies Investment Narrative Recap

To own Procore, you need to believe construction will keep digitizing and that Procore can be the central operating system for that shift, eventually turning today’s losses into sustainable profits. The short term story still pivots on whether AI-led products can convert into higher attach rates and better margins; the key risk is that softer construction activity or slower software adoption, especially outside North America, could offset these product gains. The recent news does not materially change that balance of catalyst and risk.

Among the recent announcements, the AWS Marketplace and Amazon Bedrock integration looks most relevant, because it puts Procore’s Groundbreak AI capabilities directly in front of new global customers and simplifies adoption for existing AWS users. This could reinforce the existing catalyst around AI-powered workflow automation and higher customer stickiness, while also testing whether Procore can expand beyond its North American base fast enough to reduce its regional concentration risk.

Yet while AI partnerships sound promising, investors should still be aware of how exposed Procore remains to...

Read the full narrative on Procore Technologies (it's free!)

Procore Technologies’ narrative projects $1.8 billion revenue and $240.6 million earnings by 2028. This requires 14.3% yearly revenue growth and a $383.4 million earnings increase from -$142.8 million today.

Uncover how Procore Technologies' forecasts yield a $86.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

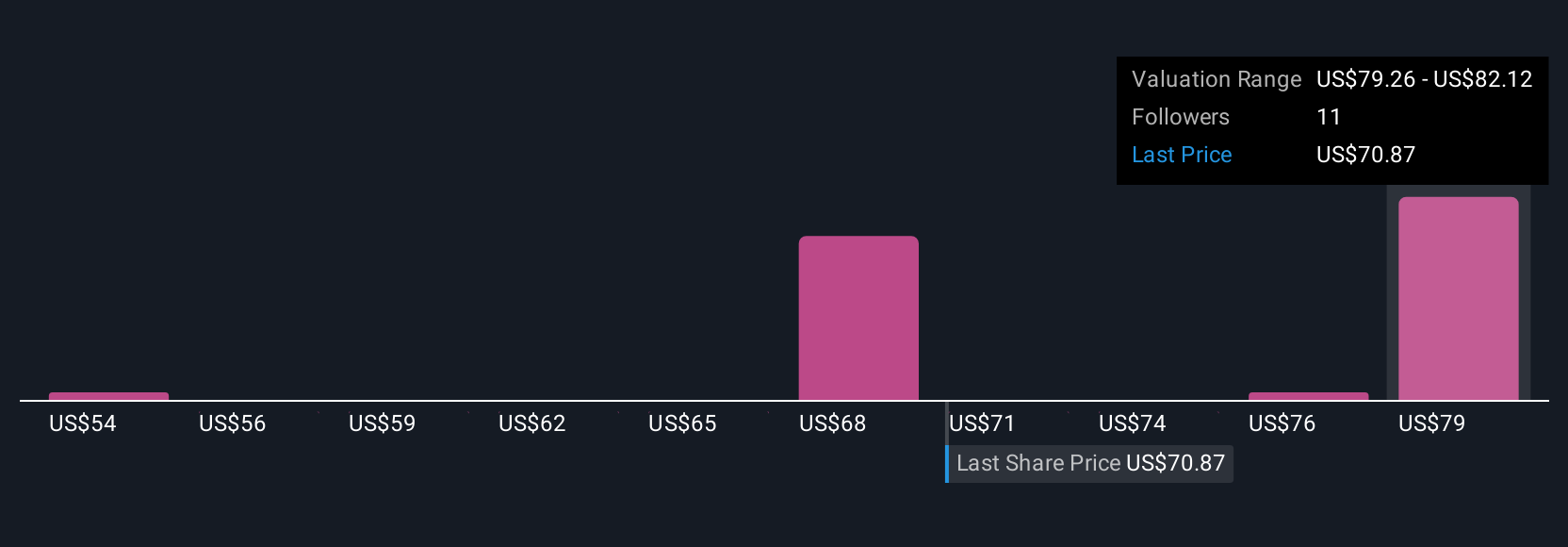

Four fair value estimates from the Simply Wall St Community span roughly US$53.58 to US$86.44, underlining how differently individual investors view Procore’s earnings potential. Against that spread, the key catalyst around AI driven workflow automation and margin improvement takes on added weight for anyone assessing how the business might perform if construction spending remains uneven.

Explore 4 other fair value estimates on Procore Technologies - why the stock might be worth 31% less than the current price!

Build Your Own Procore Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procore Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Procore Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procore Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報