Does Lamb Weston Still Offer Value After its 21.5% Share Price Slide?

- If you have been wondering whether Lamb Weston Holdings is a beaten down bargain or a value trap, you are not alone. This article will walk through what the numbers really say.

- The stock has slipped about 21.5% over the last year and is still down 9.6% year to date, even though the last week and month saw only modest moves of 0.3% and 4.4% respectively.

- Investors have been recalibrating expectations as the company navigates shifting consumer demand for frozen potato products and ongoing cost pressures in its supply chain. At the same time, management has continued to emphasize long term capacity expansion and brand strength, which helps explain why sentiment has not collapsed entirely despite the drawdown.

- On our framework, Lamb Weston scores a 2 out of 6 valuation score. This suggests only a couple of clear undervaluation signals so far. Next we will break that down across different valuation approaches, while keeping an even better way to think about value in mind for the end of the article.

Lamb Weston Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lamb Weston Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting the cash it can return to shareholders in the future and then discounting those cash flows back to today in $ terms.

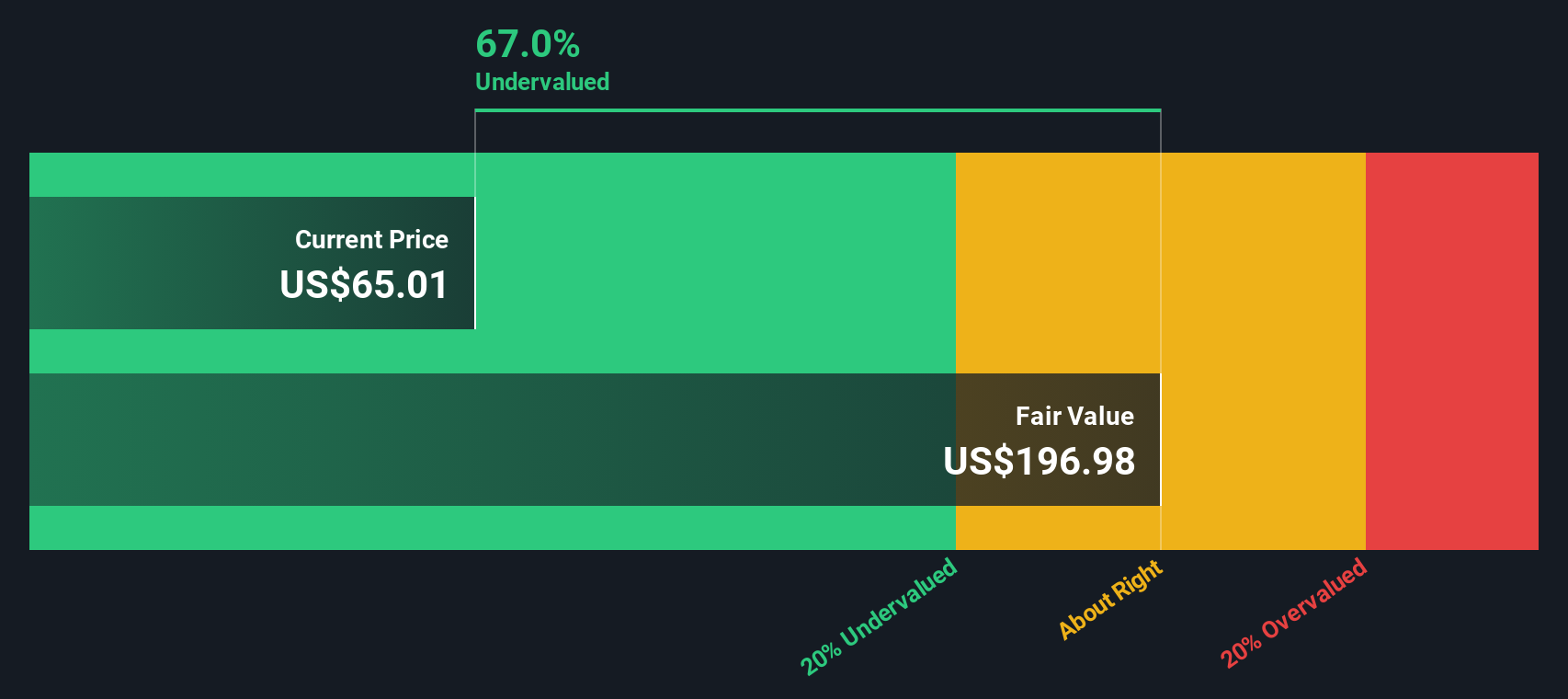

Lamb Weston generated roughly $136.7 million in free cash flow over the last twelve months. Analysts and internal forecasts expect this to rise steadily, with projected free cash flow reaching about $939 million by 2030 and continuing to grow thereafter under a 2 stage Free Cash Flow to Equity framework. These later year figures are extrapolated rather than based solely on analyst coverage, but they still point to robust cash generation potential.

When all projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $195.07 per share. Compared with the current market price, this implies the stock is trading at roughly a 69.4% discount, which indicates substantial potential upside if the projections prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lamb Weston Holdings is undervalued by 69.4%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Lamb Weston Holdings Price vs Earnings

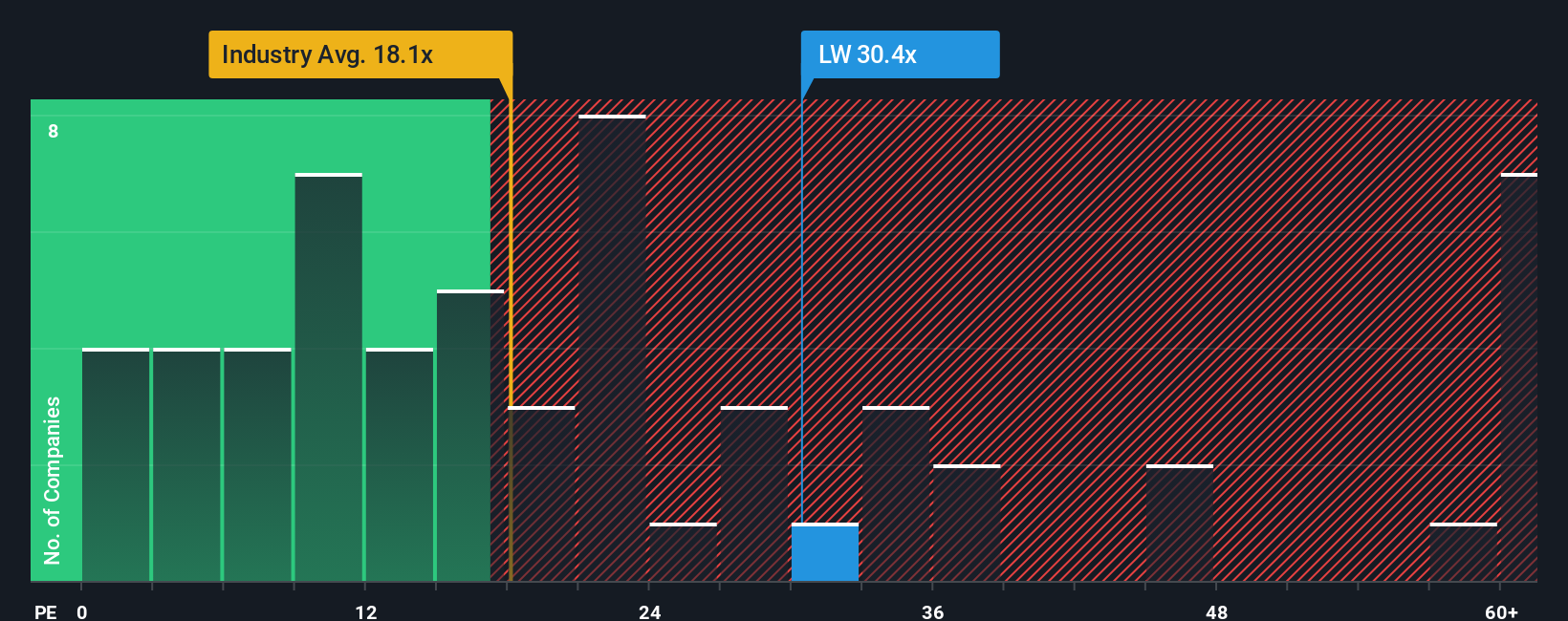

For a profitable company like Lamb Weston, the price to earnings, or PE, ratio is a useful way to see how much investors are willing to pay for each dollar of current earnings. In general, faster growing and less risky businesses tend to justify a higher, fair PE multiple, while slower growth or higher uncertainty should pull that multiple down.

Lamb Weston currently trades on a PE of about 28.29x, which sits above the broader Food industry average of roughly 20.32x and well ahead of the peer group average near 10.46x. At first glance, that premium might make the shares look expensive relative to other food stocks.

Simply Wall St also estimates a Fair Ratio for Lamb Weston of around 24.26x, which is the PE that might be expected given its earnings growth outlook, margins, industry, market value and specific risks. This can be more informative than a simple peer or industry comparison because it ties the valuation back to the company’s own fundamentals rather than assuming it should be “average.” With the current PE of 28.29x sitting above the Fair Ratio of 24.26x, the shares appear somewhat stretched on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lamb Weston Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about a company that tie your view of its future revenue, earnings and margins to a financial forecast and, ultimately, a fair value estimate.

On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors to connect the story behind a business to a set of numbers, so you can clearly see how your assumptions about growth, risks and profitability translate into what you think the shares are actually worth.

Because each Narrative calculates a Fair Value and compares it to today’s share price, it becomes a practical guide for deciding how you might view Lamb Weston as a buy, hold or sell candidate, and it automatically updates as new information comes in, like earnings releases, analyst revisions or major news on capacity, margins or demand.

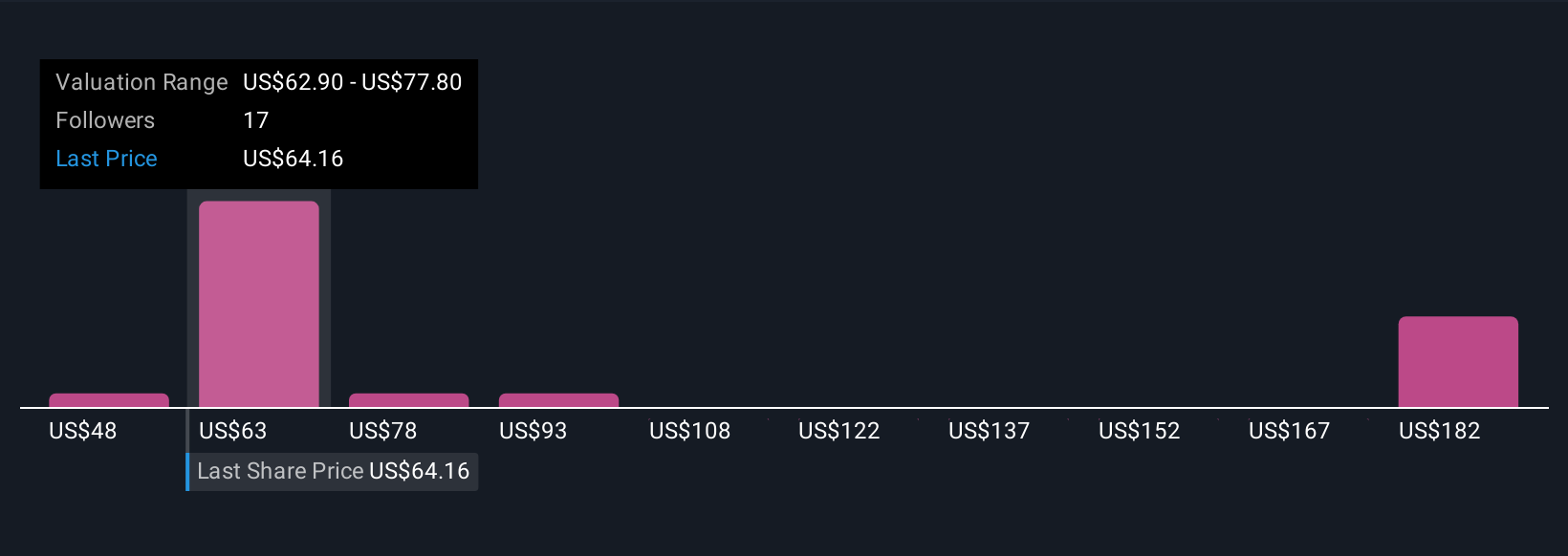

For Lamb Weston, for example, one investor’s optimistic Narrative might lean toward the higher analyst target around $80, focusing on the potential for recovering North American volumes and margin gains. A more cautious investor might anchor closer to the $57 low target, placing more weight on structural demand and cost risks. Narratives allow both views to be quantified, tracked and compared over time.

Do you think there's more to the story for Lamb Weston Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報