Does iRhythm Technologies (IRTC) Face a Governance Test That Could Reshape Its Innovation-Led Story?

- In recent months, iRhythm Technologies has faced heightened scrutiny, including an FDA warning letter, a DOJ investigation, and a new shareholder rights law firm probe into potential fiduciary breaches by officers and directors.

- These overlapping regulatory and legal pressures contrast with iRhythm's ongoing innovation in its Zio cardiac monitoring platform, creating a complex backdrop for assessing its business quality and governance.

- We’ll now explore how this added regulatory and legal pressure interacts with iRhythm’s growth-focused investment narrative and future prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

iRhythm Technologies Investment Narrative Recap

To own iRhythm, you need to believe that its Zio platform can keep expanding in cardiac monitoring while the company works through regulatory scrutiny and persistent losses. The FDA warning letter, DOJ investigation and new shareholder rights probe all sharpen the near term focus on regulatory remediation and governance, which already sit alongside fragile profitability as the key risk. At this stage, these developments look more like an added overhang than a change to the core product or demand catalyst.

Against that backdrop, iRhythm’s Q3 2025 update, with US$192.9 million in quarterly sales and a sharply narrower net loss, stands out as especially relevant. It reinforces that the business continues to grow and move closer to breakeven even as legal and regulatory costs rise, which matters for a stock that is still priced richly on sales and relies on the promise of future profitability to support its growth story.

Yet beneath the innovation story, the ongoing FDA warning letter and related compliance costs are a risk investors should be aware of, particularly if...

Read the full narrative on iRhythm Technologies (it's free!)

iRhythm Technologies’ narrative projects $1.1 billion revenue and $49.7 million earnings by 2028.

Uncover how iRhythm Technologies' forecasts yield a $219.93 fair value, a 23% upside to its current price.

Exploring Other Perspectives

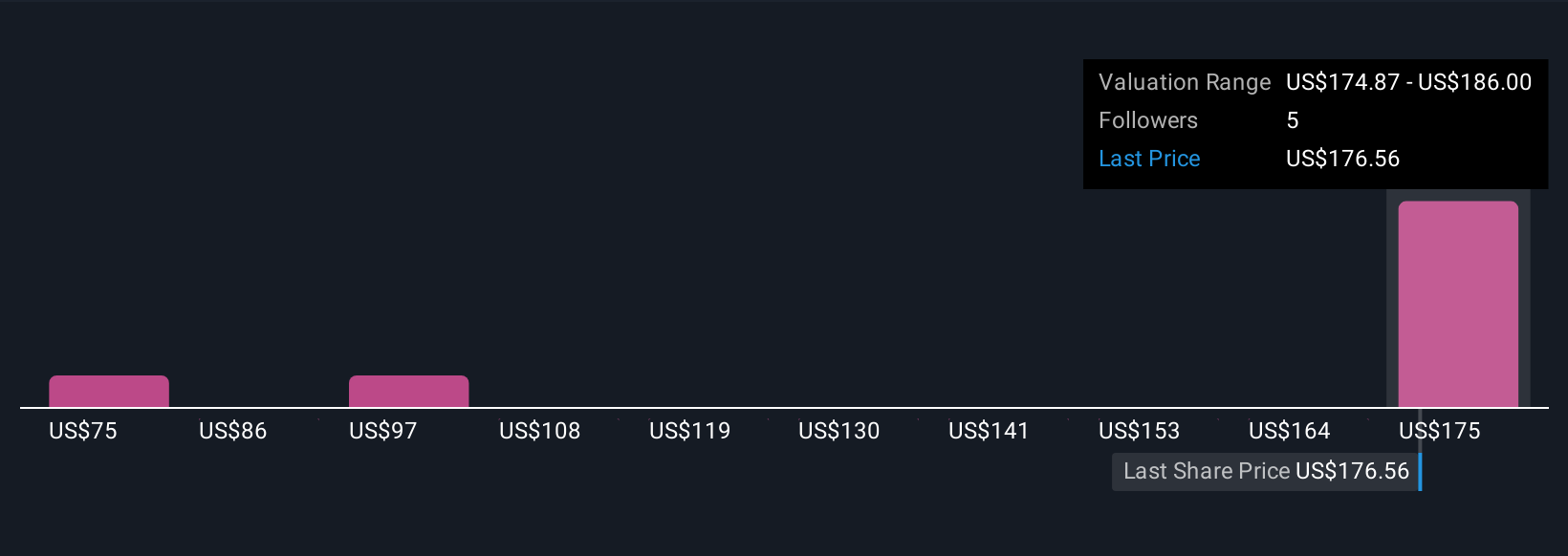

Four members of the Simply Wall St Community currently place iRhythm’s fair value anywhere between about US$69 and US$220 per share, underscoring how far apart individual views can be. As you weigh those perspectives, remember that unresolved regulatory issues and the need for third party FDA remediation audits could directly affect costs, growth plans and ultimately how the business performs over time.

Explore 4 other fair value estimates on iRhythm Technologies - why the stock might be worth less than half the current price!

Build Your Own iRhythm Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iRhythm Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free iRhythm Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iRhythm Technologies' overall financial health at a glance.

No Opportunity In iRhythm Technologies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報