Will Q3 Revenue Miss and New Fintech Partnerships Change Euronet Worldwide's (EEFT) Narrative

- Euronet Worldwide recently reported a third-quarter revenue miss and faced renewed short-seller pressure, even as management reaffirmed earnings guidance and highlighted improved October Money Transfer trends, new partnerships like Heritage Grocers, and a major Dandelion–Citibank integration.

- Beneath the headline disappointment, robust digital remittance growth and expanding partnerships suggest the company’s underlying payments network and competitive position may be strengthening.

- We’ll now examine how the third-quarter revenue shortfall, alongside strengthening digital remittances and partnerships, could reshape Euronet Worldwide’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Euronet Worldwide Investment Narrative Recap

To own Euronet Worldwide, you have to believe its shift toward digital payments and money transfers will more than offset long term pressure on legacy ATM and cash businesses. The third quarter revenue miss and short seller attention have shaken sentiment but do not appear to materially alter the near term catalyst around digital remittance expansion, nor the key risk that regulation and tech giants could chip away at the Money Transfer economics.

The Dandelion and Citibank integration looks especially relevant here, because it showcases how Euronet is trying to embed its cross border capabilities directly into large banking partners. If this rollout scales effectively, it could reinforce the digital growth story that many investors are focused on, even as they weigh headline volatility and the possibility that faster, cheaper alternatives to traditional remittances gain ground.

Yet, even with these encouraging partnerships, investors should be aware that regulatory shifts and new real time payment rails could still...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's narrative projects $5.2 billion revenue and $476.3 million earnings by 2028.

Uncover how Euronet Worldwide's forecasts yield a $117.43 fair value, a 57% upside to its current price.

Exploring Other Perspectives

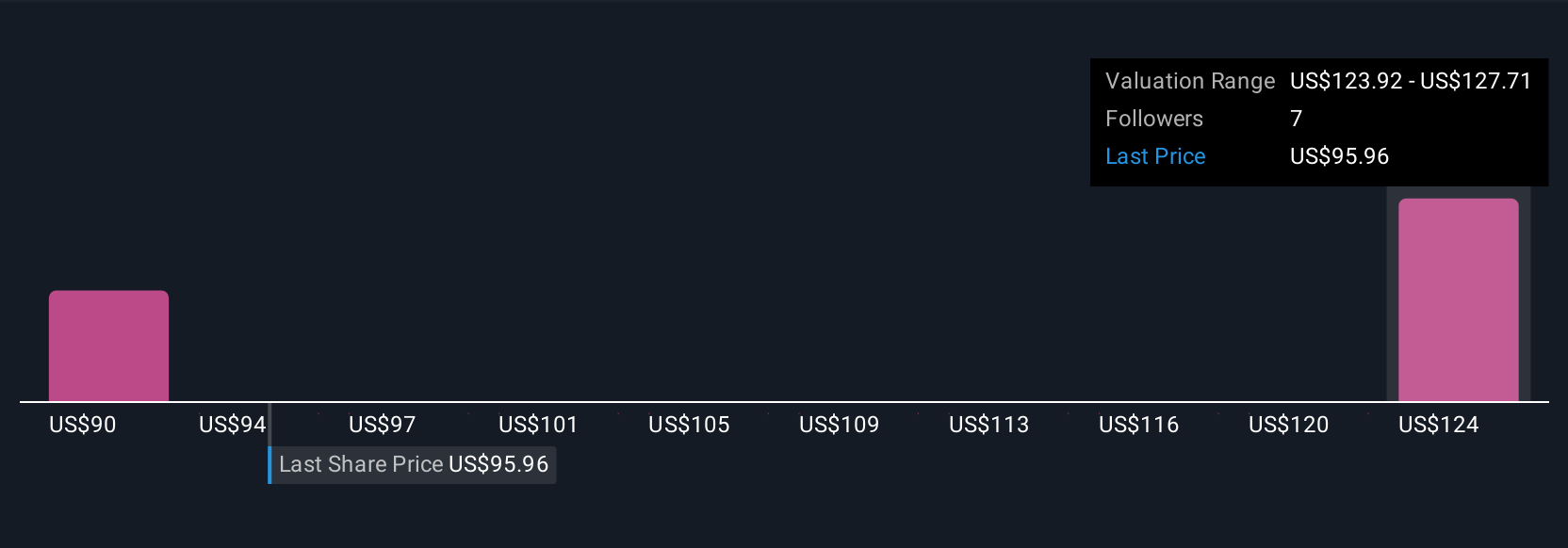

Three Simply Wall St Community fair value estimates for Euronet Worldwide cluster between US$94.36 and US$117.43 per share, hinting at wide conviction bands. You can weigh these views against the risk that regulatory changes and tech competitors pressure its core remittance margins over time, with clear implications for earnings resilience and capital return capacity.

Explore 3 other fair value estimates on Euronet Worldwide - why the stock might be worth just $94.36!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報