European Growth Companies With High Insider Ownership In December 2025

As European markets navigate mixed returns amid hopes for interest rate cuts in the U.S. and UK, growth companies with high insider ownership are gaining attention for their potential resilience and alignment of interests between management and shareholders. In this environment, stocks that exhibit strong growth prospects coupled with significant insider ownership may offer a compelling combination of strategic vision and vested interest in long-term success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €15.01 billion.

Operations: The company's revenue segments include Credit (€197.65 million), Secondaries (€124.38 million), and Private Equity (€951.11 million).

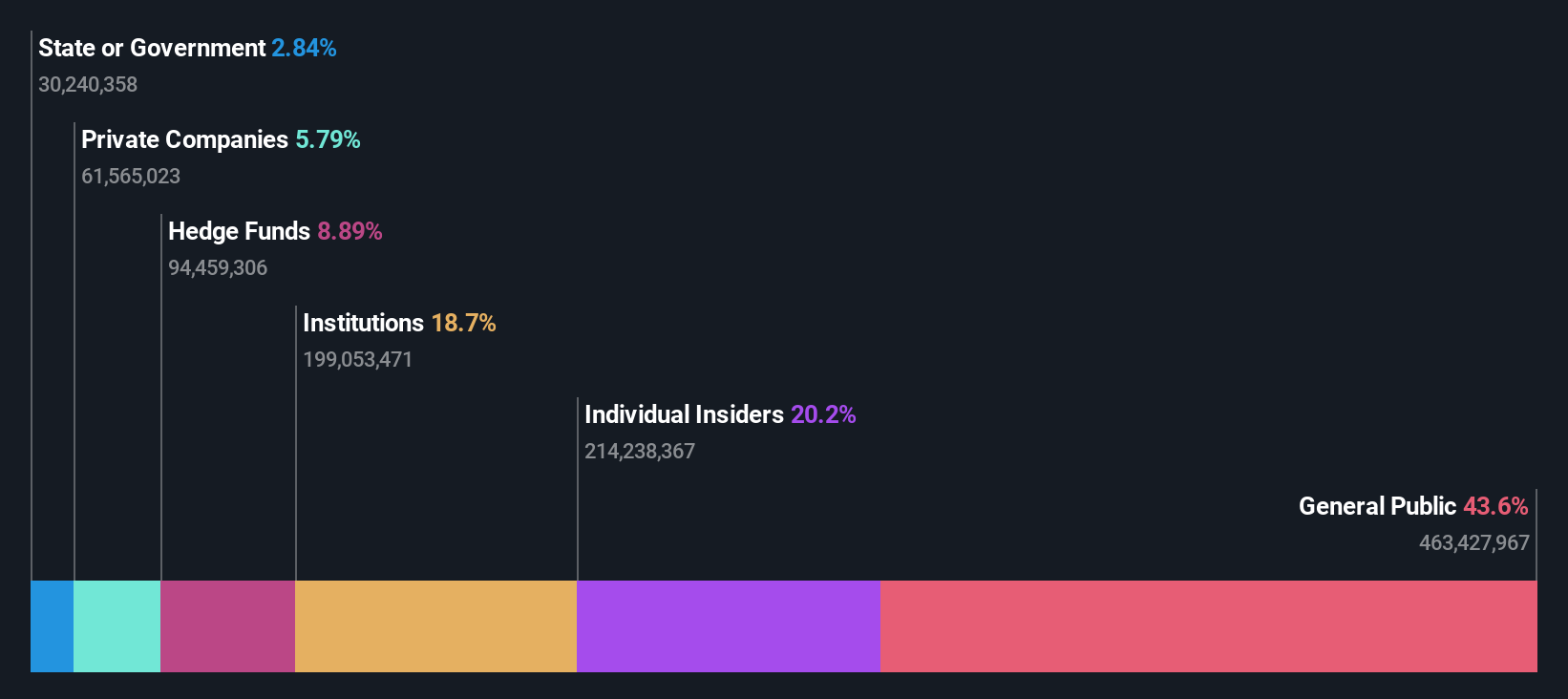

Insider Ownership: 20.2%

CVC Capital Partners, with substantial insider ownership, is poised for growth in Europe. Despite a high debt level, its earnings are forecasted to grow at 16.8% annually, outpacing the Dutch market's 12.1%. Recent M&A activities highlight its strategic focus on enterprise tech sectors, as seen in talks to acquire ValueLabs for $1 billion. Analysts expect a stock price rise of 36.6%, while CVC trades at a notable discount to its estimated fair value.

- Get an in-depth perspective on CVC Capital Partners' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that CVC Capital Partners is trading behind its estimated value.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

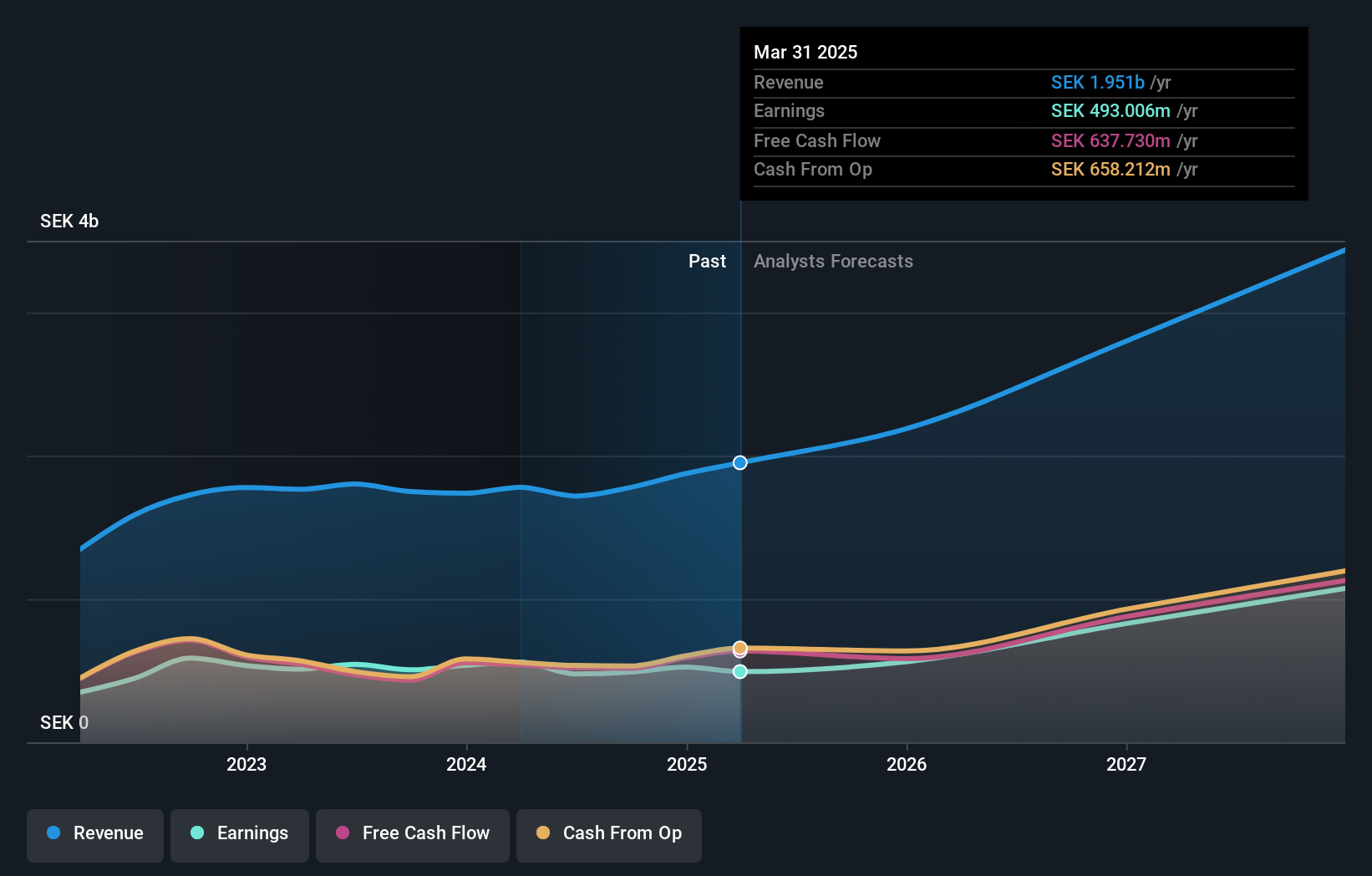

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK7.89 billion.

Operations: The company's revenue primarily comes from its communications software segment, which generated SEK2.02 billion.

Insider Ownership: 16.1%

Truecaller demonstrates significant growth potential in Europe, with high insider ownership and a strategic focus on enhancing communication solutions. Its revenue is forecast to grow at 13.2% annually, outpacing the Swedish market. Recent innovations like the Verified Business Customer Experience Platform and AI-powered adVantage engine aim to improve customer engagement and business outcomes. Despite a slight decline in recent earnings, Truecaller trades at nearly half its estimated fair value, indicating good relative value compared to peers.

- Click to explore a detailed breakdown of our findings in Truecaller's earnings growth report.

- The analysis detailed in our Truecaller valuation report hints at an deflated share price compared to its estimated value.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

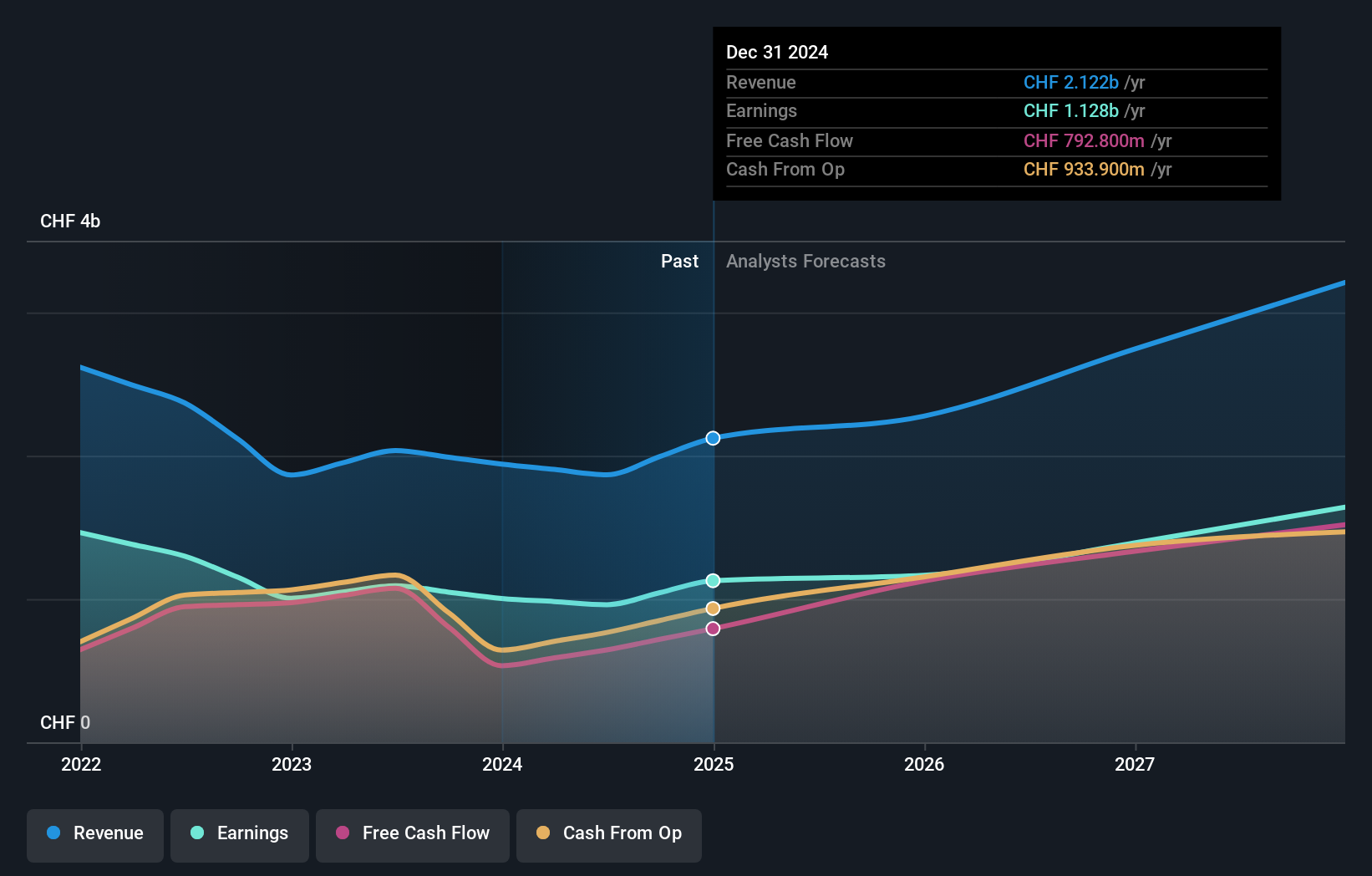

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF24.82 billion.

Operations: Partners Group Holding AG generates revenue from several segments, including CHF1.43 billion from Private Equity, CHF471.40 million from Infrastructure, CHF215.80 million from Real Estate, and CHF207.40 million from Private Credit.

Insider Ownership: 15.8%

Partners Group Holding's growth trajectory is supported by its strategic expansions and insider ownership, though earnings are forecast to grow at a moderate 10.61% annually. The company is trading below its estimated fair value, suggesting potential for price appreciation. Recent executive appointments in the Private Equity Technology Vertical aim to bolster investment capabilities. However, high debt levels pose financial risks. The firm's North American expansion and innovative fund offerings reflect its commitment to diversifying revenue streams globally.

- Unlock comprehensive insights into our analysis of Partners Group Holding stock in this growth report.

- The valuation report we've compiled suggests that Partners Group Holding's current price could be quite moderate.

Seize The Opportunity

- Navigate through the entire inventory of 206 Fast Growing European Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報