Will BMW Bank Embedded-Finance Win Reframe Fidelity National Information Services' (FIS) Platform Narrative?

- FIS announced that it helped BMW Bank GmbH in Germany accelerate deposit growth by deploying its deposits-as-a-service capability, using FIS K-CORE24 and K-e-Banking, and successfully transitioned over 300,000 deposit accounts in the second quarter of 2025.

- This rollout highlights FIS’s push into embedded finance, using cloud-based core and digital channels to boost banks’ operational efficiency and deepen customer engagement.

- We’ll now explore how this BMW Bank implementation, highlighting FIS’s embedded finance capabilities, may influence the company’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fidelity National Information Services Investment Narrative Recap

To own FIS, you need to believe its scale and technology can offset competitive and pricing pressure in payments and core banking, while execution risk on complex platforms stays contained. The BMW Bank rollout reinforces the embedded finance catalyst, but its direct impact on near term financials and on FIS’s biggest current risk around margin pressure and intense fintech competition looks limited rather than transformational.

Among recent announcements, the continued US$0.40 quarterly dividend through 2025 stands out alongside the BMW Bank win, signalling that management is balancing shareholder returns with investment in cloud and embedded solutions. For investors watching the embedded finance story, this mix of capital returns and client implementations may shape expectations for how FIS converts new capabilities into steadier growth and improved profitability over time.

Yet behind the appeal of embedded finance and steady dividends, investors should also be aware of the risk that persistent fintech competition and pricing pressure could...

Read the full narrative on Fidelity National Information Services (it's free!)

Fidelity National Information Services' narrative projects $11.7 billion revenue and $2.4 billion earnings by 2028. This requires 4.3% yearly revenue growth and about a $2.2 billion earnings increase from $158.0 million today.

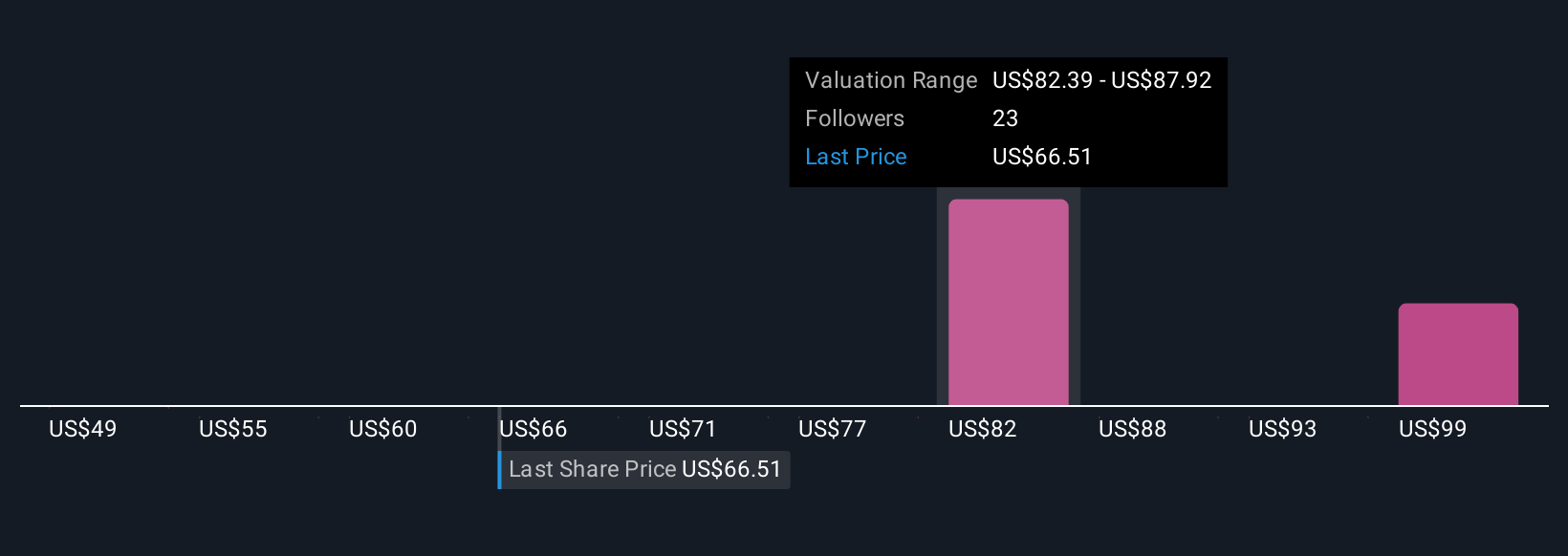

Uncover how Fidelity National Information Services' forecasts yield a $81.05 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently place FIS’s fair value between US$49.20 and US$114.68 across 3 separate views, showing how far opinions can diverge. You can weigh those against the embedded finance catalyst highlighted by the BMW Bank rollout, which some may see as an important test of how FIS defends share and pricing power over time.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth as much as 72% more than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報