AppLovin (APP) Valuation Check After Axon AI-Fueled Growth, Expansion and Buybacks Drive Bullish Sentiment

AppLovin (APP) has been on investors’ radar after its Axon AI ad platform helped drive faster revenue and profit growth, while new ecommerce and international pushes deepen the story beyond mobile gaming.

See our latest analysis for AppLovin.

Those Axon driven gains have not gone unnoticed, with the stock’s 7 day share price return of 15.4 percent and powerful year to date run suggesting momentum is still building despite an already hefty three year total shareholder return of 65.8 times.

If AppLovin’s surge has you rethinking your tech exposure, this is a good moment to explore other high growth opportunities in AI and software via high growth tech and AI stocks.

With shares doubling this year and trading near analyst targets despite a negative intrinsic discount signal, the key question now is simple: is AppLovin still mispriced to the upside, or is future hyper growth already baked in?

Most Popular Narrative Narrative: 5% Undervalued

With AppLovin closing at 691.94 dollars versus a most popular narrative fair value of 728.25 dollars, the narrative sees more upside from compound earnings power.

The analysts have a consensus price target of $499.143 for AppLovin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $250.0.

Curious how rapid revenue expansion, surging margins, and a premium future earnings multiple can still justify more upside at these levels? Unpack the assumptions powering this fair value view.

Result: Fair Value of $728.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated regulatory and platform risks, along with heavy exposure to mobile gaming demand, could quickly derail the growth and margin assumptions behind this bullish narrative.

Find out about the key risks to this AppLovin narrative.

Another Take on Valuation

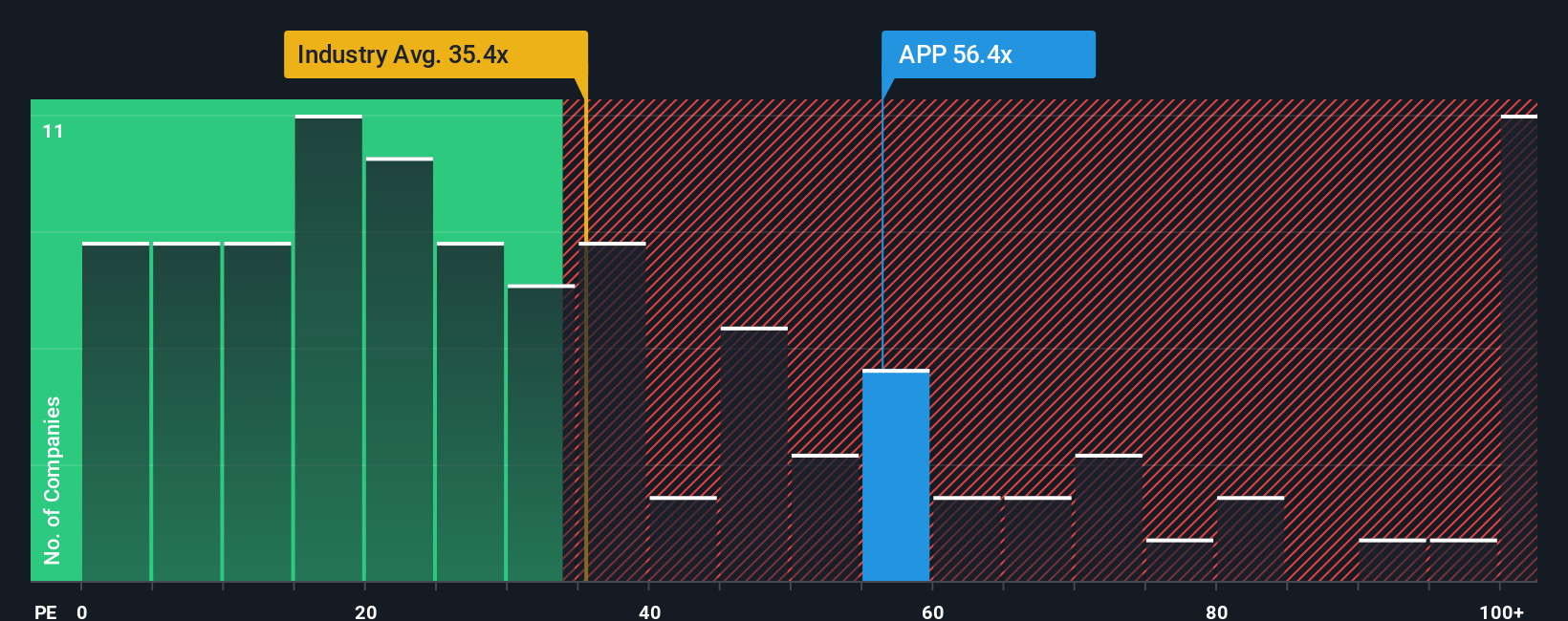

On earnings, the picture flips. AppLovin trades at about 80.2 times earnings, far richer than both US software peers at 46.7 times and the wider industry at 31.5 times, and even above a fair ratio of 57.1 times, which points to meaningful valuation risk if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winner by using the Simply Wall Street Screener to uncover focused opportunities that match your strategy.

- Capture early stage momentum by scanning these 3576 penny stocks with strong financials that already back their potential with resilient balance sheets and improving fundamentals.

- Target the next wave of innovation by filtering for these 26 AI penny stocks positioned at the heart of real world AI adoption and revenue growth.

- Strengthen your long term returns by pinpointing these 15 dividend stocks with yields > 3% that combine income potential with sustainable payout profiles and disciplined capital allocation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報