The Bull Case For Empire State Realty Trust (ESRT) Could Change Following New Buyback Plan And SoHo HQ Deal

- Empire State Realty Trust recently confirmed a fourth-quarter 2025 cash dividend of US$0.035 per share and its board authorized a new US$500 million repurchase program for Class A stock and operating partnership units, effective through December 31, 2027.

- Alongside these capital return moves, ESRT agreed to acquire Scholastic’s 555–557 Broadway headquarters in SoHo for US$386 million in cash, adding a largely pre-leased mixed office and retail asset with long-term tenants and embedded lease-up potential.

- We’ll now examine how the new US$500 million repurchase authorization could influence Empire State Realty Trust’s existing investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Empire State Realty Trust Investment Narrative Recap

To own Empire State Realty Trust, you need to believe in the long term resilience of high quality New York office, retail, and tourism assets, supported by disciplined capital allocation. The refreshed US$500 million repurchase authorization and steady US$0.035 quarterly dividend do not materially change the key nearer term swing factors, which still include leasing progress in core Manhattan assets and pressure on Observatory income from volatile tourism.

The planned US$386 million all cash acquisition of Scholastic’s 555–557 Broadway headquarters ties directly into ESRT’s push to deepen its footprint in prime Manhattan submarkets while adding mixed office and retail income. For investors focused on catalysts, this deal sits alongside the new buyback as a reminder that portfolio repositioning and capital recycling can both support the existing narrative and sharpen exposure to the same secular office and expense risks already on the table.

But investors should also be aware that persistent operating cost inflation and tourism driven Observatory volatility could...

Read the full narrative on Empire State Realty Trust (it's free!)

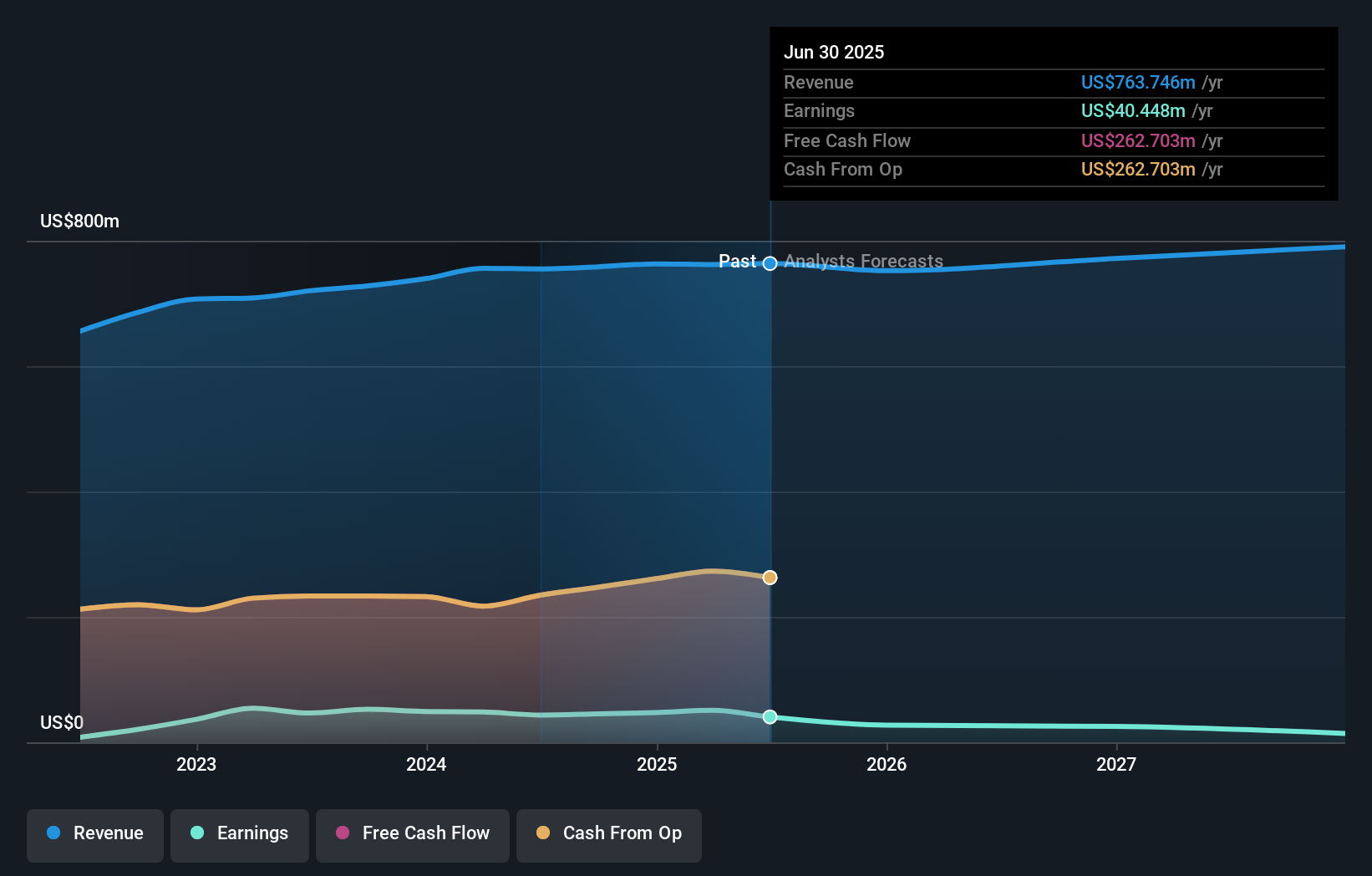

Empire State Realty Trust's narrative projects $797.6 million revenue and $13.7 million earnings by 2028. This requires 1.5% yearly revenue growth and a $26.7 million earnings decrease from $40.4 million today.

Uncover how Empire State Realty Trust's forecasts yield a $8.55 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently place ESRT’s fair value between US$8.55 and about US$13.25, underscoring how far opinions can spread. When you weigh that against ESRT’s concentrated Midtown Manhattan exposure and the long term uncertainty around office demand, it becomes even more important to compare several viewpoints before forming your own expectations.

Explore 2 other fair value estimates on Empire State Realty Trust - why the stock might be worth just $8.55!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

No Opportunity In Empire State Realty Trust?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報