Some Shareholders Feeling Restless Over ACS, Actividades de Construcción y Servicios, S.A.'s (BME:ACS) P/E Ratio

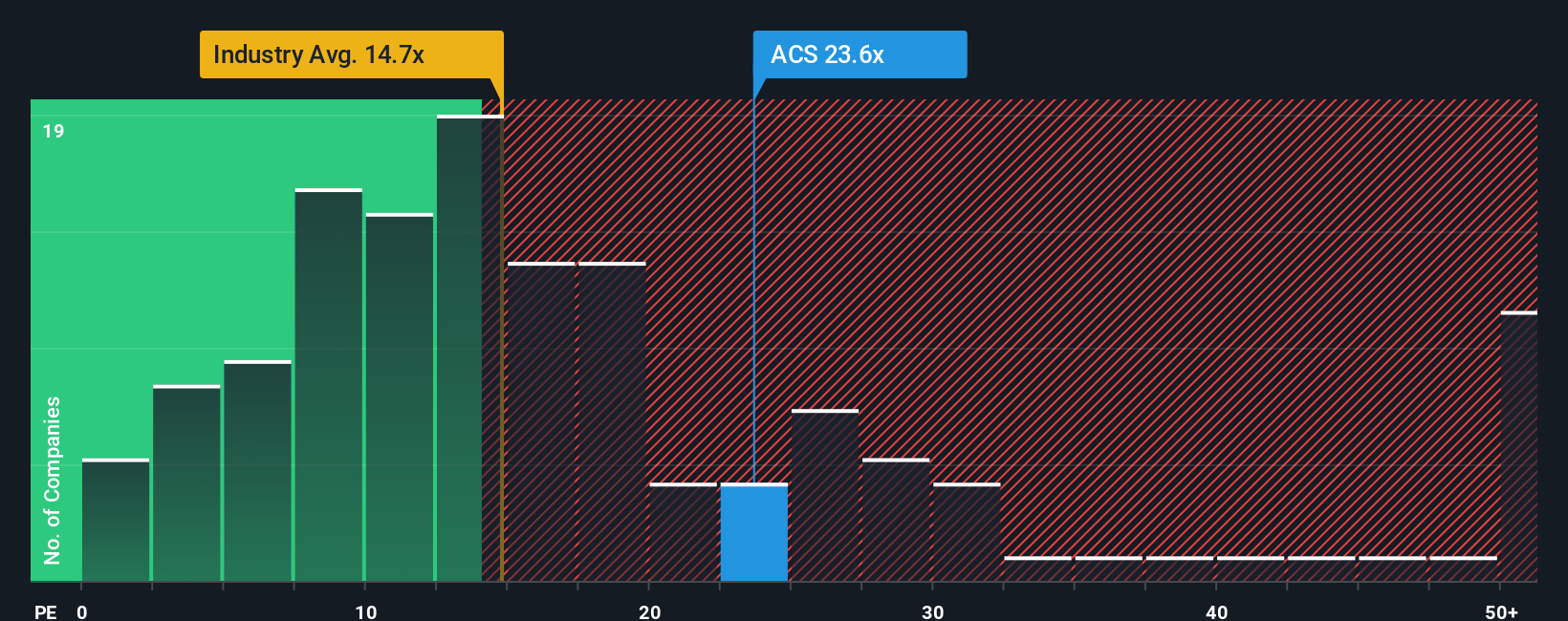

When close to half the companies in Spain have price-to-earnings ratios (or "P/E's") below 16x, you may consider ACS, Actividades de Construcción y Servicios, S.A. (BME:ACS) as a stock to potentially avoid with its 23.6x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, ACS Actividades de Construcción y Servicios has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for ACS Actividades de Construcción y Servicios

How Is ACS Actividades de Construcción y Servicios' Growth Trending?

In order to justify its P/E ratio, ACS Actividades de Construcción y Servicios would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.1% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 11% per year growth forecast for the broader market.

With this information, we find it interesting that ACS Actividades de Construcción y Servicios is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On ACS Actividades de Construcción y Servicios' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of ACS Actividades de Construcción y Servicios' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 3 warning signs for ACS Actividades de Construcción y Servicios (1 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on ACS Actividades de Construcción y Servicios, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報