“Sister Mu Tou” investment company ARK makes a big forecast: SpaceX's market capitalization will reach 2.5 trillion US dollars by 2030

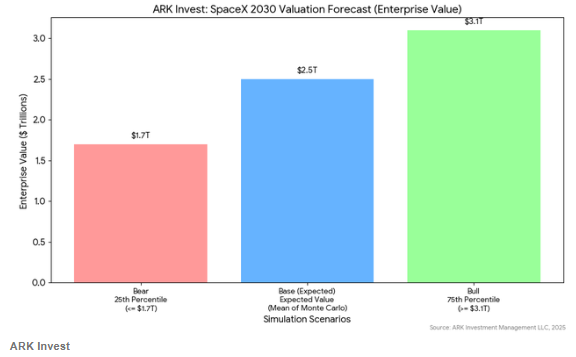

The Zhitong Finance App learned that Ark Invest, an investment company owned by “Sister Wood” Kathy Wood, predicts that the corporate value of Elon Musk's space company SpaceX will reach about 2.5 trillion US dollars by 2030. Based on ARK's open source model, this valuation is based on a Monte Carlo simulation that takes into account 17 key variables that reflect SpaceX's potential for development over the next twenty years.

The model provides three possible valuation scenarios: $2.5 trillion for the base scenario, $1.7 trillion for the pessimistic scenario, and $3.1 trillion for the optimistic scenario. These predictions show differences due to strategic initiatives, such as satellite development and deployment, and the ultimate emphasis on colonizing Mars.

The core of SpaceX's ambitious future plans is the full deployment of the “Starlink” satellite constellation, which is expected to be achieved by 2035. Once in use, Starlink is expected to generate up to $300 billion in annual revenue, accounting for about 15% of global communications spending. This expansion highlights the transformative impact brought about by the spread of affordable, high-speed satellite internet around the world.

Second, the reusability of Starships is another key factor in Ark Invest's assessment — SpaceX aims to make significant progress in the Earth and Mars projects by reducing the turnaround time of the Starship fleet and reducing launch costs. The implementation of the Starship complies with the “Rite Law”, which indicates that increased efficiency will accelerate return on investment by increasing launch frequency.

Ark Invest also pointed out potential risks. These risks include disruptions from competitive innovation and the challenges SpaceX faces in executing operations in the demanding field of space exploration.

Musk said on Saturday that reports about SpaceX's recent financing at a valuation of $800 billion are inaccurate; SpaceX has maintained positive cash flow for many years and regularly performs stock repurchases twice a year to provide liquidity to employees and investors; the increase in valuation depends on the progress of the “Starship” and “Starlink” projects, as well as access to the global direct-connected satellite communication band — this band will significantly expand our target market size.

In addition to internal share transactions in the secondary market, SpaceX is also speeding up preparations for listing. The media quoted people familiar with the matter as saying that the company has indicated to institutional investors that it aims to launch a company-wide initial public offering (IPO) in the second half of next year. This is clearly accelerated compared to the previous statement by CFO Johnson in 2024 that “it will still take a few years for the Starlink business to go public.”

SpaceX management has discussed many times over the years the possibility of splitting and listing the satellite internet business Starlink. However, in the past, Musk has always been cautious, and the timing of the launch was uncertain. According to this news, the company seems inclined to have the entire group IPO, not just Starlink.

Its Starlink low-rail internet network has deployed more than 9,000 satellites, far ahead of other competitors including Amazon (AMZN.US) Amazon Leo. As the development of the more powerful Starship super-heavy rocket accelerates, SpaceX plans to use this to further expand the scale of the Starlink satellite and undertake future lunar landing and manned deep space missions.

Nasdaq

Nasdaq 華爾街日報

華爾街日報