Is Oki’s Projection-Guided DX Push in Southeast Asia Altering The Investment Case For Oki Electric Industry (TSE:6703)?

- Oki Electric Industry Co., Ltd. recently launched its Projection Assembly System in Thailand and Indonesia, combining projector-based task guidance and image sensing to support assembly and quality inspection while advancing digital transformation at manufacturing sites.

- This rollout marks the start of OKI’s global manufacturing DX expansion, externalizing in-house factory know-how to address labor turnover, workforce diversity, and quality consistency through multilingual support and local partner collaboration.

- We’ll now examine how this international push for projector-guided, multilingual assembly support reshapes Oki Electric Industry’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Oki Electric Industry's Investment Narrative?

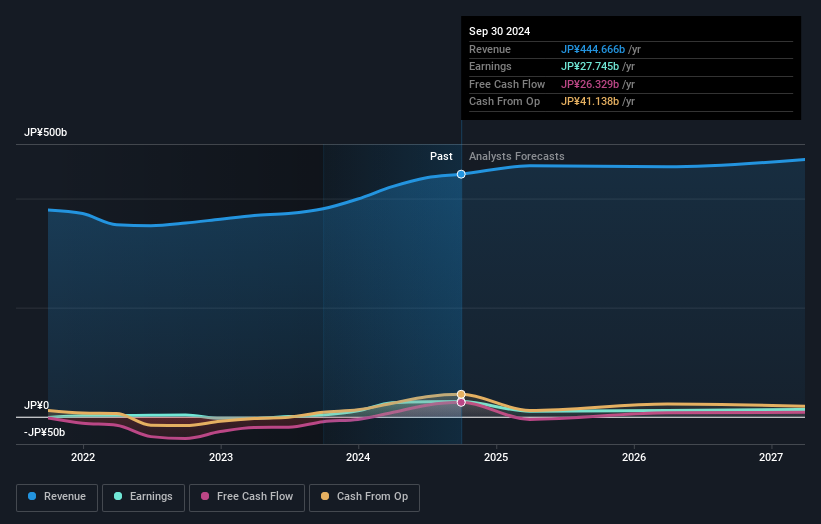

To own Oki Electric Industry, you need to believe it can turn modest top-line growth and relatively low margins into more durable, higher-quality earnings, while justifying a valuation that already prices it above many electronics peers. Recent guidance confirmed steady profit expectations and a higher dividend, which keeps near-term focus on execution rather than a sudden earnings reset. The Thailand and Indonesia rollout of the Projection Assembly System fits neatly into this: it reinforces the story that OKI can commercialize in-house factory know-how globally and add a new, higher-value software-and-services layer. That said, given the early stage and limited disclosed scale, this DX push looks more like a medium-term catalyst than a material short-term earnings driver, while balance sheet leverage and margin pressure remain front-of-mind risks.

But that potential comes with debt-related and profitability risks investors should not overlook. Oki Electric Industry's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Oki Electric Industry - why the stock might be worth as much as ¥263!

Build Your Own Oki Electric Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oki Electric Industry research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oki Electric Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oki Electric Industry's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報