Will ICE’s Extended UK Carbon Auction Role and Derivatives Growth Shift Intercontinental Exchange's (ICE) Narrative

- Intercontinental Exchange recently confirmed that the UK’s Department for Energy Security & Net Zero has re-appointed it to host UK Emissions Trading Scheme allowance auctions through 2028, alongside reporting November 2025 trading metrics showing higher average daily volumes and open interest across several markets.

- This combination of a renewed long-term UK carbon auction mandate and broad-based derivatives activity growth underscores how ICE’s exchange and data infrastructure remain deeply embedded in key global markets.

- We’ll now examine how ICE’s extended role in UK carbon auctions through 2028 may influence its broader investment narrative and growth drivers.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Intercontinental Exchange Investment Narrative Recap

To own ICE, you have to believe in the durability of its exchanges, clearinghouses and data platforms as essential financial plumbing, with volumes and subscriptions supporting compounding earnings over time. The renewed UK ETS auction mandate and stronger November volumes reinforce this infrastructure role, but do not materially change the near term focus on integration risk from large M&A like Black Knight or on potential fee and volume pressure in core markets.

The InnovestX adoption of ICE’s Portfolio Analytics platform sits closest to this carbon auction news, because both highlight how deeply ICE’s technology and data are embedded in clients’ trading and risk workflows. Together they point to how growth in high margin data and analytics can complement transaction activity in environmental and energy contracts, potentially broadening the company’s growth drivers beyond pure volume sensitivity in cyclical commodities markets.

Yet, even with these strengths, investors should be aware of how rising low cost trading competition and fee compression could...

Read the full narrative on Intercontinental Exchange (it's free!)

Intercontinental Exchange's narrative projects $11.4 billion revenue and $4.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and about a $1.1 billion earnings increase from $3.0 billion today.

Uncover how Intercontinental Exchange's forecasts yield a $190.29 fair value, a 21% upside to its current price.

Exploring Other Perspectives

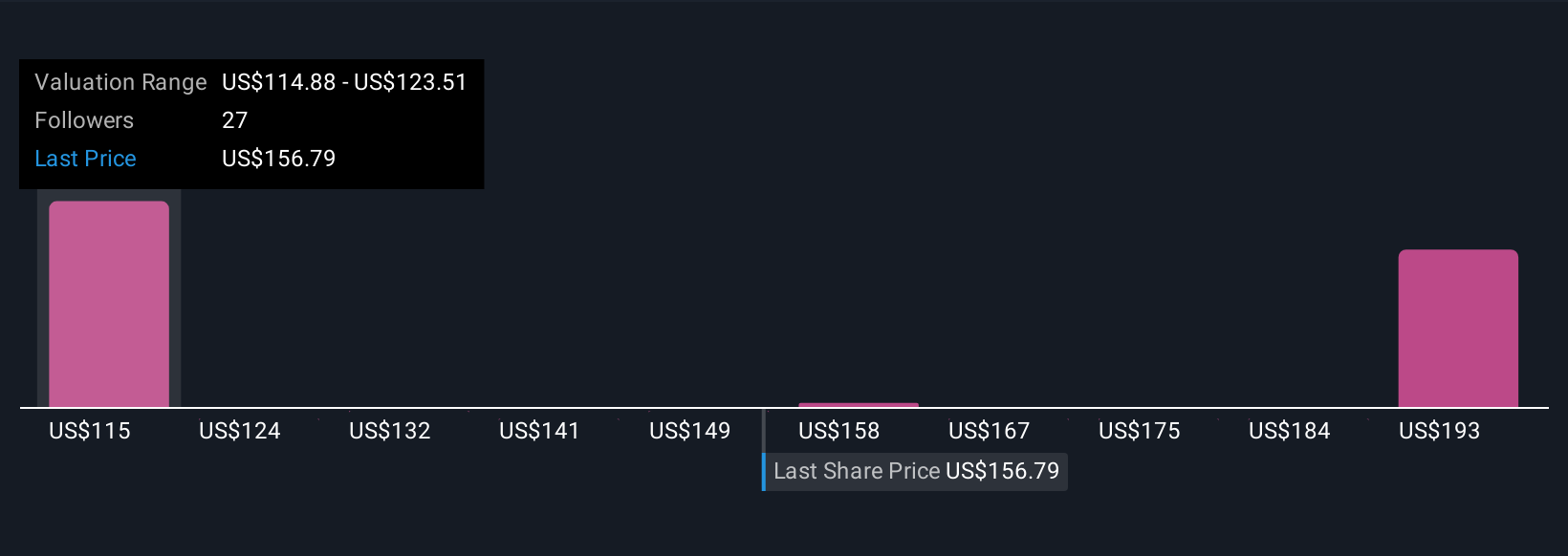

Seven fair value estimates from the Simply Wall St Community span roughly US$103 to US$190 per share, showing how far apart individual views can sit. As you weigh those opinions, remember that ICE’s reliance on energy and environmental contract volumes still ties part of its performance to regulatory and market shifts that could hit trading activity, so it can be worth comparing several different scenarios before committing capital.

Explore 7 other fair value estimates on Intercontinental Exchange - why the stock might be worth 35% less than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intercontinental Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercontinental Exchange's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報