Pegasystems (PEGA): Valuation Check After Analyst Optimism and New Moody’s AI Compliance Partnership

Pegasystems (PEGA) just linked up with Moody’s in a strategic collaboration that plugs Moody’s entity verification data directly into Pega’s AI driven client lifecycle management and KYC tools for financial institutions.

See our latest analysis for Pegasystems.

The collaboration headlines come as momentum in Pegasystems’ stock has been firm, with a year to date share price return near 30% and a three year total shareholder return above 200%, suggesting investors are leaning into its AI workflow story.

If you like the mix of software, AI and financial-grade workflows, it could also be worth exploring other high growth tech names using our curated screener for high growth tech and AI stocks.

With analyst targets still sitting almost 25% above the current share price and growth expectations rising, is Pegasystems quietly trading at a discount, or is the market already baking in years of AI-driven expansion?

Most Popular Narrative Narrative: 17.8% Undervalued

With Pegasystems last closing at $60.11 against a narrative fair value of $73.09, the most followed view sees meaningful upside still on the table.

The analysts have a consensus price target of $62.682 for Pegasystems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $78.0, and the most bearish reporting a price target of just $40.19.

Want to see why modest revenue growth and rising margins still back a premium earnings multiple, usually reserved for category leaders? The full narrative unpacks the earnings ramp, margin lift, and valuation bridge that justify this fair value call.

Result: Fair Value of $73.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency swings and a slower European enterprise spending backdrop could still derail cloud growth assumptions and challenge those upbeat long term earnings targets.

Find out about the key risks to this Pegasystems narrative.

Another Lens on Valuation

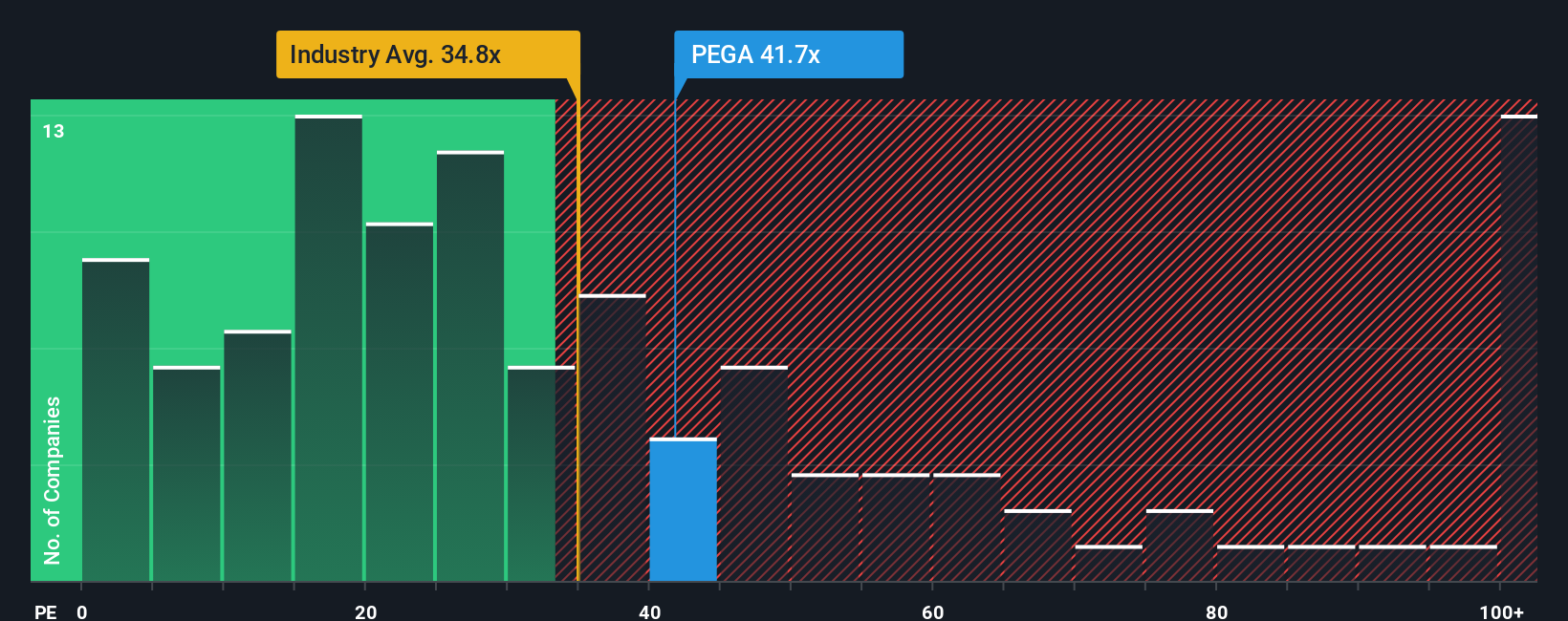

While the narrative fair value suggests Pegasystems is 17.8 percent undervalued, a simple earnings based lens tells a tougher story. At a 36.7 times price to earnings ratio, versus a 31.5 times industry average and a 28.9 times fair ratio, much of the optimism may already be in the price, leaving less room for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized Pegasystems narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pegasystems.

Ready for Your Next Investing Move?

Before the market prices in the next wave of opportunities, use the Simply Wall St Screener to uncover focused ideas that fit your strategy and risk appetite.

- Capture early stage growth potential by scanning these 3575 penny stocks with strong financials that pair smaller market caps with improving fundamentals.

- Target the intersection of innovation and productivity by zeroing in on these 26 AI penny stocks shaping the future of intelligent software and automation.

- Identify value focused opportunities by filtering for these 908 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報