Is AMC (AMC) Quietly Rewriting Its Risk Profile With The Hycroft Exit And Cinema Refocus?

- Recently, AMC Entertainment completed the transfer of most of its Hycroft Mining equity stake to Sprott Mining for US$24.1 million in net consideration, while retaining some equity and warrants tied to Hycroft’s future outcomes.

- This move marks a clear reallocation of capital back toward AMC’s core theatrical business, while preserving optional exposure to any upside in its former mining investment.

- Next, we’ll examine how redirecting capital from Hycroft to core cinema operations could influence AMC’s investment narrative and risk profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AMC Entertainment Holdings Investment Narrative Recap

To own AMC today, you need to believe that traditional moviegoing can remain relevant enough, and premium in-theater experiences compelling enough, to support a path toward better cash generation despite ongoing losses and high leverage. The Hycroft Mining exit modestly simplifies the story but does not meaningfully change the near term catalyst, which still centers on driving higher attendance and concession spend, or the key risk that box office recovery stalls and leaves the current cost and debt load exposed.

Among AMC’s recent moves, the new AMC Popcorn Pass stands out as most directly tied to this refocused cinema narrative, reinforcing efforts to deepen loyalty and lift per-visit spending among Stubs members. If it boosts recurring concession traffic, it could support the catalyst of higher food and beverage margins, though it does not address balance sheet pressure or the structural risk that theatrical attendance remains well below pre pandemic levels.

Yet while concessions initiatives may help near term revenue, investors also need to be aware that AMC’s high debt load and ongoing equity dilution risk could...

Read the full narrative on AMC Entertainment Holdings (it's free!)

AMC Entertainment Holdings' narrative projects $5.7 billion revenue and $541.4 million earnings by 2028.

Uncover how AMC Entertainment Holdings' forecasts yield a $3.34 fair value, a 47% upside to its current price.

Exploring Other Perspectives

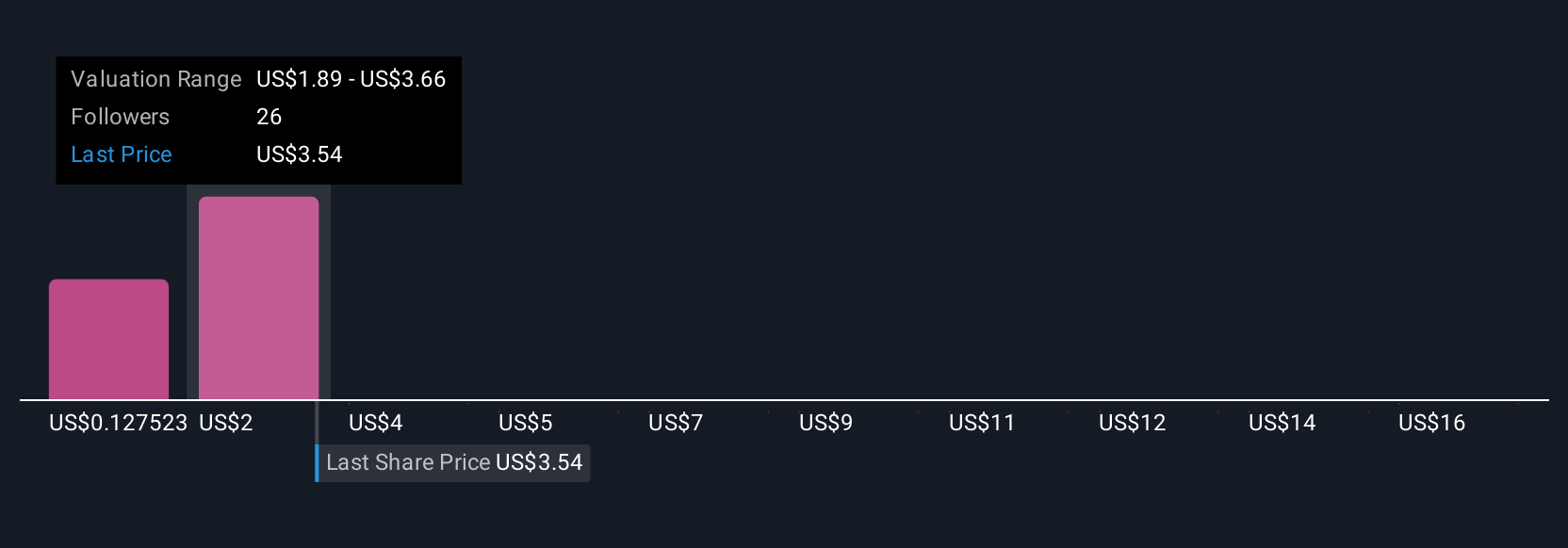

Seven fair value estimates from the Simply Wall St Community span roughly US$3 to US$33 per share, showing how far apart individual views can be. Against that backdrop, AMC’s dependence on a still incomplete box office recovery and expensive premium upgrades gives you several different risk and reward paths to weigh before forming your own view.

Explore 7 other fair value estimates on AMC Entertainment Holdings - why the stock might be worth just $3.21!

Build Your Own AMC Entertainment Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMC Entertainment Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free AMC Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMC Entertainment Holdings' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報