Assessing Almonty Industries (TSX:AII) Valuation After Appointing Brigadier General Steven L. Allen as COO

Almonty Industries (TSX:AII) just shook up its executive ranks, naming retired U.S. Army Brigadier General Steven L. Allen as Chief Operating Officer, a move that squarely targets operations and execution across its global tungsten projects.

See our latest analysis for Almonty Industries.

That kind of operational firepower is landing at a time when momentum is clearly building, with the share price delivering a roughly 56 percent 90 day share price return and an eye catching one year total shareholder return north of 650 percent.

If this kind of rerating has you wondering what else might be setting up for a strong run, it could be worth scouting fast growing stocks with high insider ownership as a source of fresh ideas.

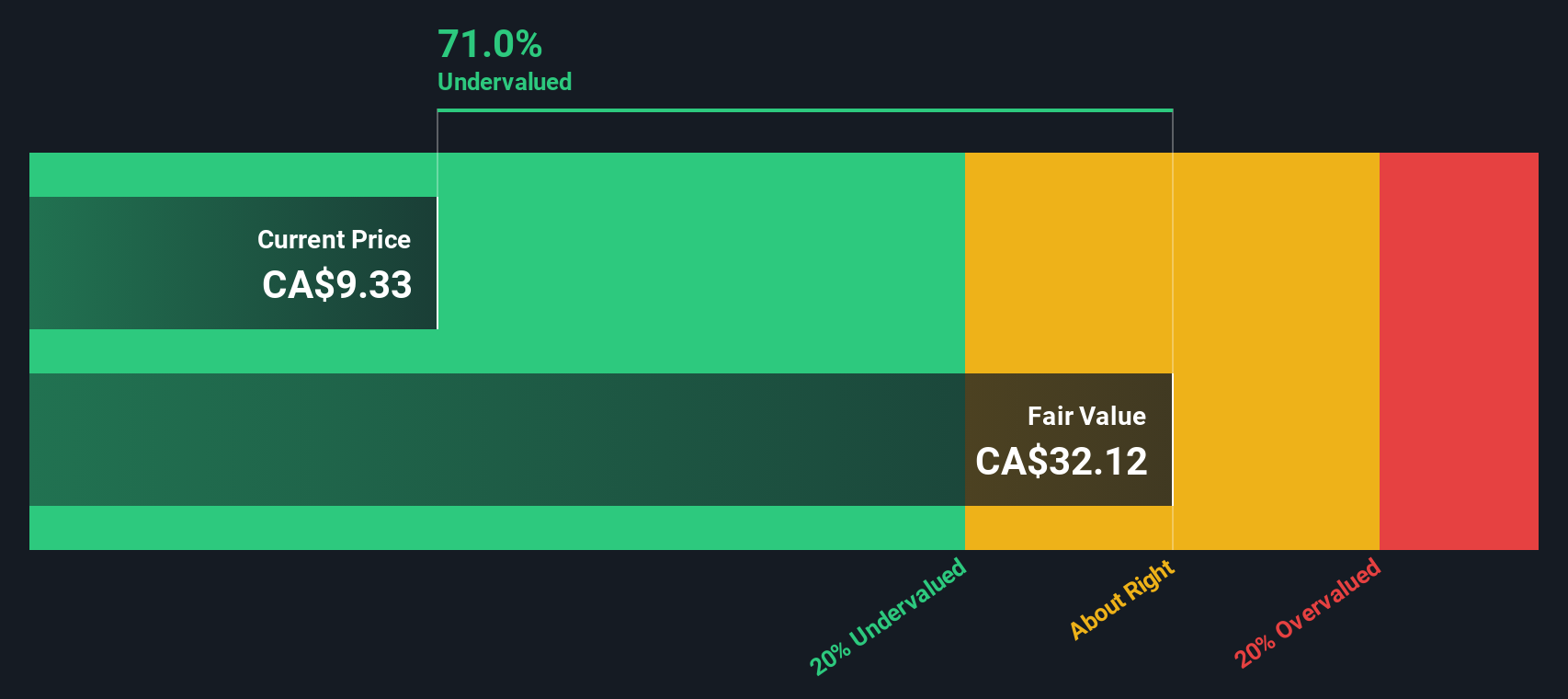

With the stock already up multiples over the past year, yet still trading below some estimates of intrinsic value, the real question now is whether Almonty remains a mispriced growth story or if the market is already discounting its next leg higher.

Price-to-Book of 13.7x: Is it justified?

On a simple lens, Almonty trades on a punchy 13.7 times price to book at CA$9.99, a clear premium to both direct peers and the broader Canadian metals and mining space.

The price to book ratio compares a company’s market value to the net assets on its balance sheet, a yardstick investors often lean on in asset heavy mining businesses.

In Almonty’s case, the 13.7 times multiple versus a 9.3 times peer average and a far lower 2.7 times industry average suggests the market is baking in a substantial lift in future returns on its tungsten asset base, despite the company still being loss making today.

That gap is hard to ignore. It signals investors are willing to pay a premium multiple on today’s book value against the wider sector, on the view that forecast revenue and earnings growth will ultimately justify the higher starting point.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 13.7x (OVERVALUED).

However, the stretched valuation leaves little room for error, and ongoing losses mean any setback in ramping key tungsten projects could quickly sour sentiment.

Find out about the key risks to this Almonty Industries narrative.

Another View on Value

Looked at through our DCF model, the picture flips. Almonty’s shares at CA$9.99 sit around 73 percent below our CA$37.22 fair value estimate, which implies deep undervaluation if its growth and profitability targets are met. Is the market underestimating the tungsten ramp, or wisely demanding proof first?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Almonty Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Almonty Industries Narrative

If this framing does not quite align with your own view, or you would rather dig into the numbers yourself, you can build a custom thesis in just a few minutes, Do it your way.

A great starting point for your Almonty Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high potential opportunities?

Do not stop with one success story. Use the Simply Wall St Screener now to uncover fresh, data backed opportunities before the crowd wakes up.

- Capture potential multi baggers early by scanning these 3575 penny stocks with strong financials that pair tiny market caps with solid underlying financial strength.

- Ride powerful secular trends by targeting these 26 AI penny stocks positioned at the core of machine learning, automation, and next generation software.

- Explore value focused ideas with these 908 undervalued stocks based on cash flows that flag companies trading at meaningful discounts to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報