Does Descartes Systems Group’s (TSX:DSG) New Buyback Reveal a Deeper Shift in Capital Priorities?

- Descartes Systems Group recently reported higher third-quarter and nine-month results to October 31, 2025, with sales and net income rising year-on-year, and then announced a new 12‑month share repurchase program subject to Toronto Stock Exchange approval.

- This combination of improving profitability and a planned buyback suggests management is prioritizing earnings quality and capital returns alongside continued growth investments.

- We’ll now explore how Descartes’ stronger earnings and planned share repurchase program could influence the company’s longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Descartes Systems Group Investment Narrative Recap

To own Descartes Systems Group, you need to believe in the long term value of its logistics software, recurring revenue and ability to keep integrating acquisitions. The latest earnings uptick and planned 12 month buyback do not materially change the main short term catalyst, which remains execution on organic and acquisition driven growth, or the key risk from potential revenue volatility if global trade and transportation volumes stay subdued.

The recent third quarter and nine month results to 31 October 2025 are most relevant here, with sales rising to US$187.68 million in the quarter and net income to US$43.9 million. This profitability improvement supports the planned repurchase program, but it does not remove the bigger risk that prolonged weak transportation and logistics volumes could still pressure Descartes’ transactional revenue and cash flows if sector conditions remain soft.

Yet that stronger earnings picture can distract from one issue investors really should be aware of if transportation activity stays weaker for longer...

Read the full narrative on Descartes Systems Group (it's free!)

Descartes Systems Group's narrative projects $899.6 million revenue and $240.4 million earnings by 2028. This requires 10.4% yearly revenue growth and about a $95.6 million earnings increase from $144.8 million today.

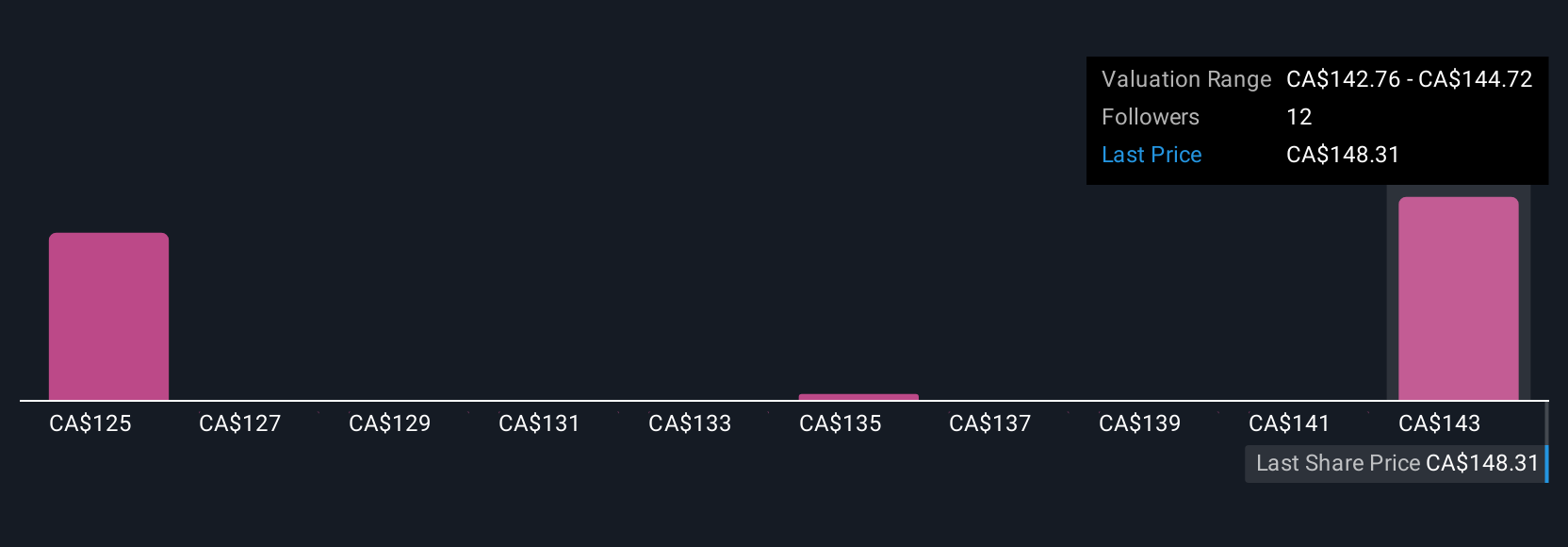

Uncover how Descartes Systems Group's forecasts yield a CA$131.93 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Descartes cluster in a tight CA$131.93 to CA$135.01 range, underscoring how differently individual investors can view the same stock. You may want to weigh those views against the risk that prolonged weakness in transportation and logistics volumes could still constrain Descartes’ revenue growth and earnings power over time.

Explore 3 other fair value estimates on Descartes Systems Group - why the stock might be worth just CA$131.93!

Build Your Own Descartes Systems Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Descartes Systems Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Descartes Systems Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Descartes Systems Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報