Asana (ASAN) Is Up 10.1% After Strong Q3 AI-Driven Revenue And Executive Changes - Has The Bull Case Changed?

- Asana reported past third-quarter results showing revenue of US$201.03 million, rising from US$183.88 million a year earlier, while also announcing the upcoming departure of its Chief Operating Officer and General Counsel, who will both move into short-term advisory roles.

- Alongside higher sales and raised revenue guidance for fiscal 2026, Asana highlighted growing traction from its AI Studio offerings as a contributor to customer renewals and new revenue streams.

- We’ll now examine how Asana’s stronger-than-expected AI-fueled revenue performance could influence its existing investment narrative and risk–reward balance.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Asana Investment Narrative Recap

To own Asana, you need to believe its AI driven workflow tools can deepen customer relationships enough to offset competitive pressure and ongoing losses. The latest quarter’s AI fueled revenue beat supports that thesis, while the short term catalyst remains whether AI Studio and AI Teammates can sustain mid single digit to high single digit growth. The announced COO and General Counsel departures appear manageable given orderly transitions, but they add to leadership change as a near term execution risk.

The most relevant update here is Asana’s fiscal 2026 revenue guidance of US$789.0 million to US$791.0 million, implying 9% year over year growth. That outlook anchors the AI adoption story in concrete numbers and gives investors a yardstick to judge whether new products like AI Studio and Asana Gov are offsetting SMB headwinds and rising competition in project management and collaboration software.

Yet for investors, rising competitive pressure from large bundled platforms is something you should be aware of, because...

Read the full narrative on Asana (it's free!)

Asana’s narrative projects $966.9 million revenue and $126.6 million earnings by 2028.

Uncover how Asana's forecasts yield a $15.76 fair value, a 11% upside to its current price.

Exploring Other Perspectives

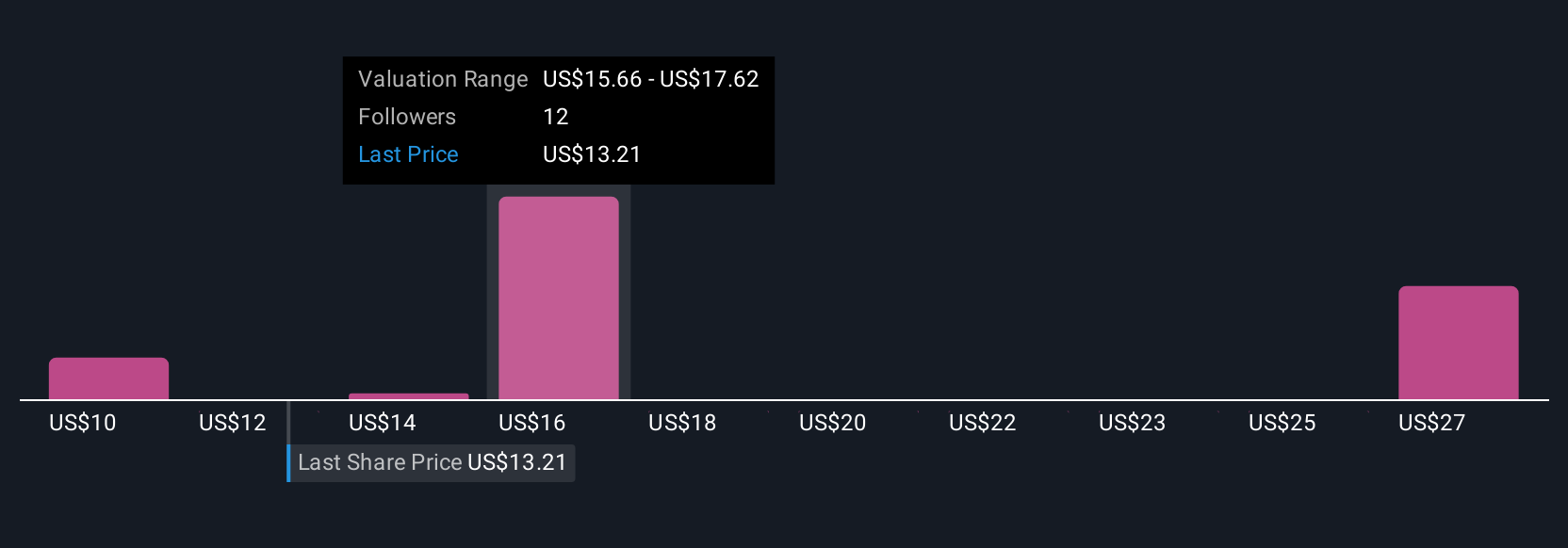

Seven fair value estimates from the Simply Wall St Community span roughly US$9.80 to US$22.00 per share, showing how far apart individual views can be. You can weigh those against the current reliance on AI driven products to counter intense competition and assess what that might mean for Asana’s ability to sustain its growth profile.

Explore 7 other fair value estimates on Asana - why the stock might be worth as much as 55% more than the current price!

Build Your Own Asana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asana's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報