Is Strong Q3 Earnings and ESG Recognition Altering The Investment Case For MKS (MKSI)?

- MKS Inc. recently reported third-quarter 2025 results that surpassed consensus expectations for both adjusted earnings and revenue, with management issuing upbeat fourth-quarter guidance and analysts revising estimates higher.

- At the same time, MKS earned a place on Newsweek and Statista’s 2026 list of America’s Most Responsible Companies for the third consecutive year, reinforcing its corporate responsibility credentials alongside its operational performance.

- We’ll now examine how MKS’s stronger-than-expected earnings and optimistic guidance might influence the existing investment narrative for the business.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MKS Investment Narrative Recap

MKS appeals to investors who believe in long term demand for semiconductor and specialty industrial process technologies, while accepting cyclical swings and a still‑elevated debt load. The third quarter earnings beat and constructive fourth quarter guidance support the near term earnings recovery story, but do not materially change the key risk that high leverage reduces flexibility if conditions soften or tariffs intensify.

The most relevant recent announcement here is the third quarter 2025 result, where MKS delivered year over year growth in revenue and earnings and guided fourth quarter revenue to about US$990 million. For investors focused on earnings momentum as a short term catalyst, this stronger run rate and clearer outlook may help balance concerns about competitive pressure and customer concentration in core semiconductor markets.

Yet behind the improving earnings picture, investors should also be aware that MKS still carries a sizeable debt load and...

Read the full narrative on MKS (it's free!)

MKS’ narrative projects $4.4 billion revenue and $475.8 million earnings by 2028.

Uncover how MKS' forecasts yield a $174.85 fair value, a 7% upside to its current price.

Exploring Other Perspectives

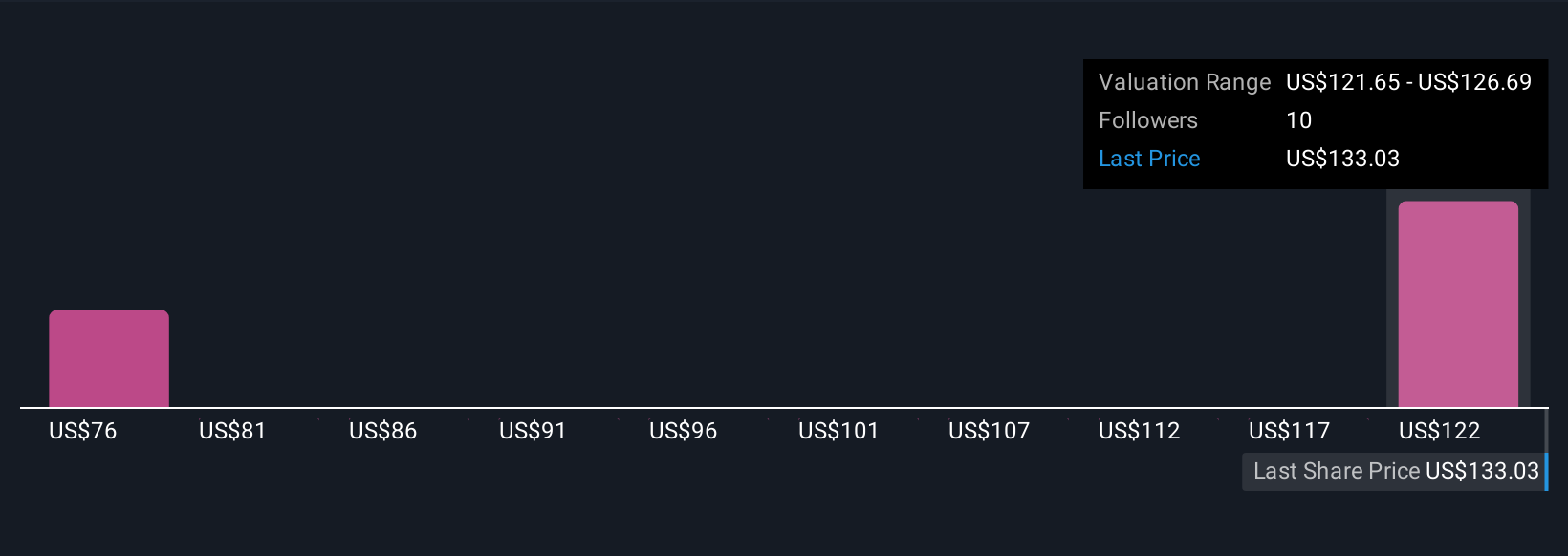

Three members of the Simply Wall St Community value MKS between US$88 and US$175 per share, highlighting a wide spread in expectations. You can weigh those views against the company’s reliance on a lumpy NAND upgrade cycle and consider how that might affect future performance.

Explore 3 other fair value estimates on MKS - why the stock might be worth 46% less than the current price!

Build Your Own MKS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MKS research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MKS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MKS' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報