Is Akamai (AKAM) Quietly Repositioning Its Edge Network Into a Federal-Grade Security Platform?

- Akamai Technologies recently achieved FedRAMP High Ready status for Akamai Cloud, confirming via third-party assessment that its platform meets stringent federal security baselines for sensitive workloads and Zero Trust capabilities.

- This milestone could broaden Akamai’s access to high-security government cloud projects, reinforcing its push beyond traditional content delivery into higher-value security and compute services.

- We’ll now examine how FedRAMP High Ready status for Akamai Cloud may influence Akamai’s investment narrative around security and edge infrastructure.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Akamai Technologies Investment Narrative Recap

To own Akamai today, you need to believe its pivot from legacy CDN into higher value security, cloud and edge compute can offset delivery headwinds and rising CapEx. FedRAMP High Ready status validates Akamai Cloud’s security credentials for sensitive federal workloads, but the impact on near term results and on its biggest current risk customer concentration in compute and cloud infrastructure services contracts appears limited until full authorization and concrete wins emerge.

The AccuWeather partnership with Zuplo best illustrates how Akamai’s edge platform can support higher value, API driven workloads that benefit from low latency and integrated security. While it does not change the core risk around dependence on a handful of large compute contracts, it aligns with the same catalyst investors are watching growing demand for secure, performance sensitive services atop Akamai’s distributed infrastructure.

Yet investors should be aware that even as these higher value services expand, reliance on a few large compute customers...

Read the full narrative on Akamai Technologies (it's free!)

Akamai Technologies’ narrative projects $4.9 billion revenue and $765.1 million earnings by 2028.

Uncover how Akamai Technologies' forecasts yield a $95.20 fair value, a 14% upside to its current price.

Exploring Other Perspectives

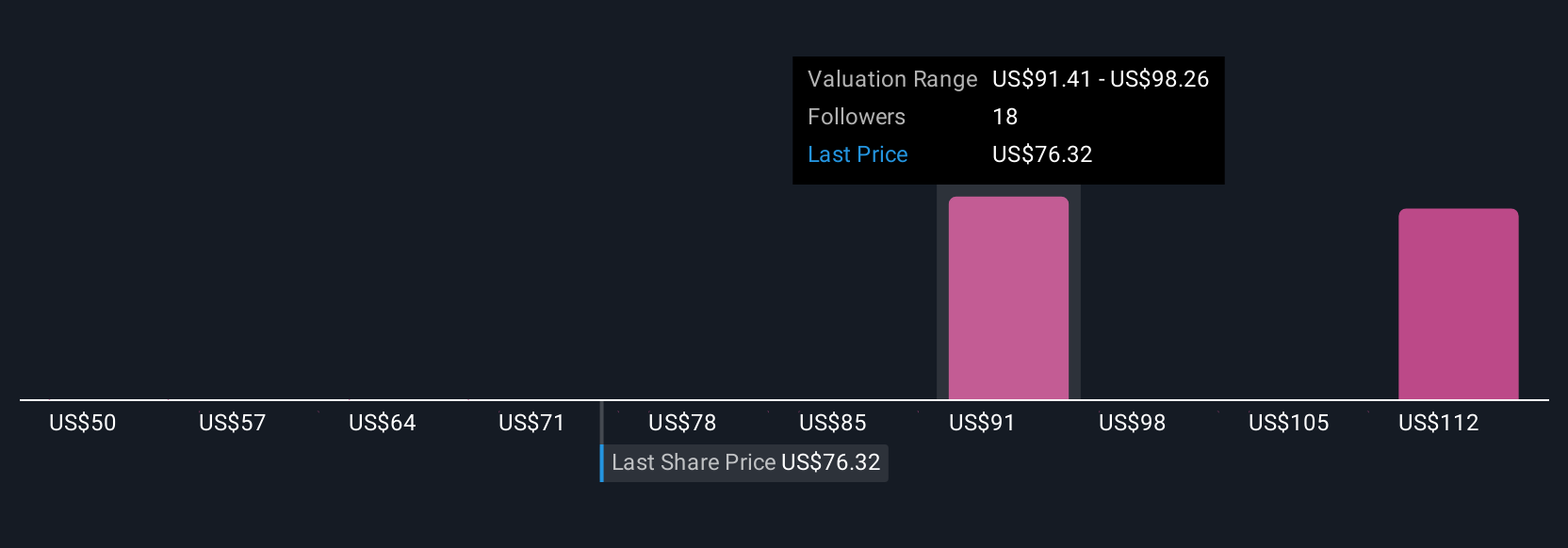

Six fair value estimates from the Simply Wall St Community range from US$66 to about US$131.6 per share, showing very different views on Akamai’s potential. Against this, the key catalyst remains whether newer security and edge offerings can offset pressure in the legacy delivery segment and support the company’s long term earnings power.

Explore 6 other fair value estimates on Akamai Technologies - why the stock might be worth 21% less than the current price!

Build Your Own Akamai Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akamai Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Akamai Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akamai Technologies' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報