News Corp (NWSA): Revisiting Valuation After a Renewed $1 Billion Share Buyback Authorization

News (NWSA) has extended its authorization to repurchase up to $1 billion of its Class A and Class B shares, which indicates that management sees long term value in the current stock price.

See our latest analysis for News.

That confidence is coming after a choppy stretch, with the share price at $26.04 and a weak 90 day share price return contrasting with a strong three year total shareholder return that still points to solid long term momentum.

If this buyback has you revisiting the media space, it could also be a good moment to see what else is gaining traction through fast growing stocks with high insider ownership

With earnings still growing, a sizable discount to analyst targets, and a fresh buyback in place, is News quietly trading below its intrinsic value, or is the market already factoring in the next leg of growth?

Most Popular Narrative: 29% Undervalued

With News last closing at $26.04 against a narrative fair value near $36.69, the implied upside leans heavily on premium earnings power and stickier digital revenues.

Content licensing and anticipated AI/data partnership deals are creating new diversified revenue streams, leveraging News Corp's high-value intellectual property in an environment where digital and AI content consumption is rapidly expanding, supporting incremental revenue and long-term earnings growth.

Curious why a media name gets a valuation multiple usually reserved for market darlings, even with only mid single digit growth and modest margin expansion baked in? The narrative leans on powerful subscription engines, richer data products, and an earnings trajectory that assumes investors will still pay up years from now. Want to see exactly how those moving parts stack together to justify that future profit profile? Read on to unpack the full playbook behind this fair value view.

Result: Fair Value of $36.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural pressure on legacy media and softer digital engagement trends, particularly at Realtor.com, could quickly challenge these upbeat long term assumptions.

Find out about the key risks to this News narrative.

Another Lens on Value

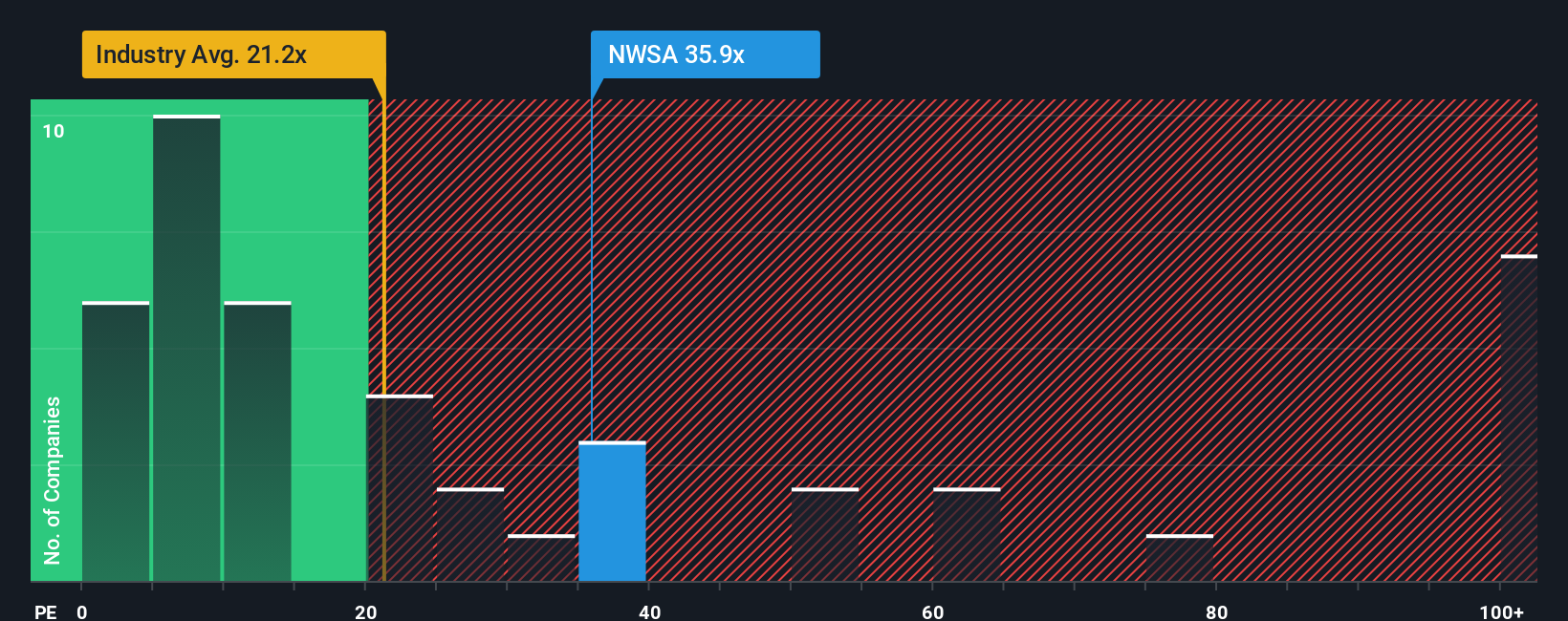

On earnings, the picture looks less forgiving. News trades on a 30.7x price to earnings ratio, far richer than the US Media industry at 15.4x, peers at 16.7x, and even its 20.2x fair ratio. This suggests valuation risk rather than a hidden bargain. Which story do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own News Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, build a personalised view in minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding News.

Ready for Your Next Move?

Put your conviction to work by scanning fresh opportunities on Simply Wall Street's screener, before others spot the momentum shifts and long term potential you care about.

- Capture mispriced potential by targeting companies that look cheap on cash flow with these 906 undervalued stocks based on cash flows, and position yourself before sentiment catches up.

- Ride structural growth trends by zeroing in on innovators using AI in healthcare through these 30 healthcare AI stocks, where data advantages can compound for years.

- Tap into high income opportunities by filtering for reliable payouts above 3 percent using these 15 dividend stocks with yields > 3%, so your capital works harder while you wait.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報