Why NetApp (NTAP) Is Up 5.1% After Deepening AWS AI Integration With ONTAP Data Access

- In late 2025, NetApp introduced Amazon S3 Access Points for Amazon FSx for NetApp ONTAP, allowing AWS AI and analytics services to access NetApp-managed data in the cloud and on-premises without moving it, while preserving full file protocol access and ONTAP’s cyber‑resilience features.

- This deeper integration with AWS positions NetApp’s storage platform more firmly at the center of AI and analytics workflows, potentially increasing the relevance of its hybrid cloud and subscription offerings to enterprises scaling data‑intensive workloads.

- Next, we’ll examine how this tighter AWS AI integration could influence NetApp’s investment narrative and expectations for its cloud-driven growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NetApp Investment Narrative Recap

To own NetApp, I think you need to believe its hybrid cloud and AI centric storage strategy can offset pressure on legacy on premises gear and hyperscaler driven margin risk. The new Amazon S3 Access Points for FSx for ONTAP strengthens the key AI and analytics catalyst, but does not remove concerns about competition from cloud native storage and the impact of subscription mix on near term cash flows.

Among recent developments, the reaffirmed fiscal 2026 guidance looks most relevant beside this AWS AI integration. Management is guiding to US$6.625 billion to US$6.875 billion in revenue and operating margins of 23.5% to 24.5%, which frames how much cloud and AI related demand needs to contribute while NetApp manages geographic softness and the shift toward Storage as a Service.

Yet while AI integration with AWS looks promising, investors should still be aware of how reliance on hyperscaler partnerships could affect...

Read the full narrative on NetApp (it's free!)

NetApp's narrative projects $7.5 billion revenue and $1.4 billion earnings by 2028. This requires 4.3% yearly revenue growth and about a $0.2 billion earnings increase from $1.2 billion today.

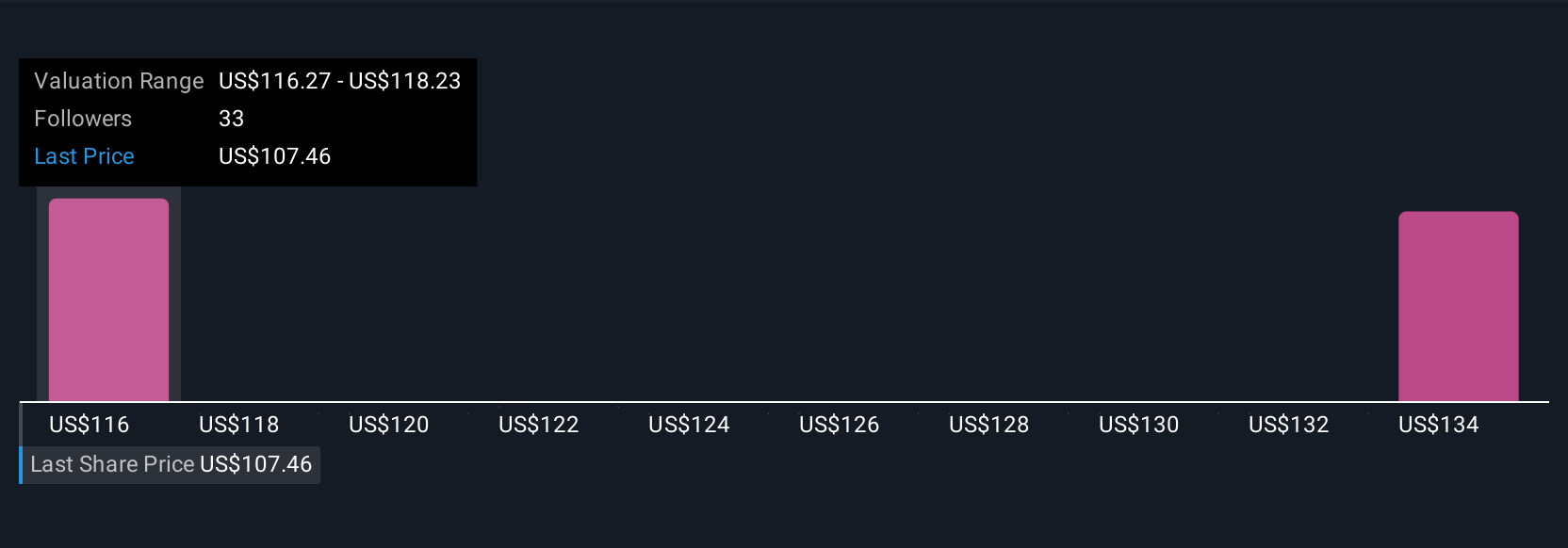

Uncover how NetApp's forecasts yield a $125.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place NetApp’s fair value between US$125 and about US$186 per share, highlighting very different expectations. Set against this, the growing importance of AI and analytics workloads for NetApp’s hybrid cloud platform could materially shape how those views on future performance evolve, so it is worth weighing several of these perspectives before deciding what the stock is really worth.

Explore 4 other fair value estimates on NetApp - why the stock might be worth as much as 58% more than the current price!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報