BorgWarner (BWA): Evaluating Valuation After a Strong Year-to-Date Rally and Recent Pullback

BorgWarner (BWA) has quietly outpaced many auto suppliers this year, with the stock up about 38% year to date even after a recent month pullback. This invites a closer look at what the market is pricing in.

See our latest analysis for BorgWarner.

The recent pullback leaves BorgWarner trading around $43.30, yet its strong year to date share price return and solid multi year total shareholder returns suggest momentum has cooled slightly rather than reversed, as investors reassess growth and execution risks.

If you are weighing BorgWarner against other auto names, this could be a useful moment to scan auto manufacturers for similar opportunities and potential outperformers.

With shares still below analyst targets and trading at a sizeable intrinsic discount despite healthy long term returns and earnings growth, is BorgWarner a mispriced value in the EV transition, or is the market already baking in its future gains?

Most Popular Narrative: 12.4% Undervalued

With BorgWarner’s fair value estimate sitting around $49.43 versus a $43.30 last close, the most followed narrative implies some upside still on the table.

Ongoing operational restructuring and cost controls, alongside battery business consolidation measures, are yielding improvements in adjusted operating margins and free cash flow, indicating enhanced profitability and the potential for structurally higher net margins as the company pivots to electrified products.

Want to see what kind of revenue runway, margin lift, and earnings power this story is actually built on? The narrative leans on ambitious growth, richer profitability, and a future earnings multiple that assumes BorgWarner fully earns its EV transition stripes. Curious how those moving parts add up to that fair value call?

Result: Fair Value of $49.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering dependence on combustion products and ongoing volatility in the Battery and Charging Systems segment could quickly challenge that upbeat EV transition thesis.

Find out about the key risks to this BorgWarner narrative.

Another View: Earnings Multiple Sends a Different Signal

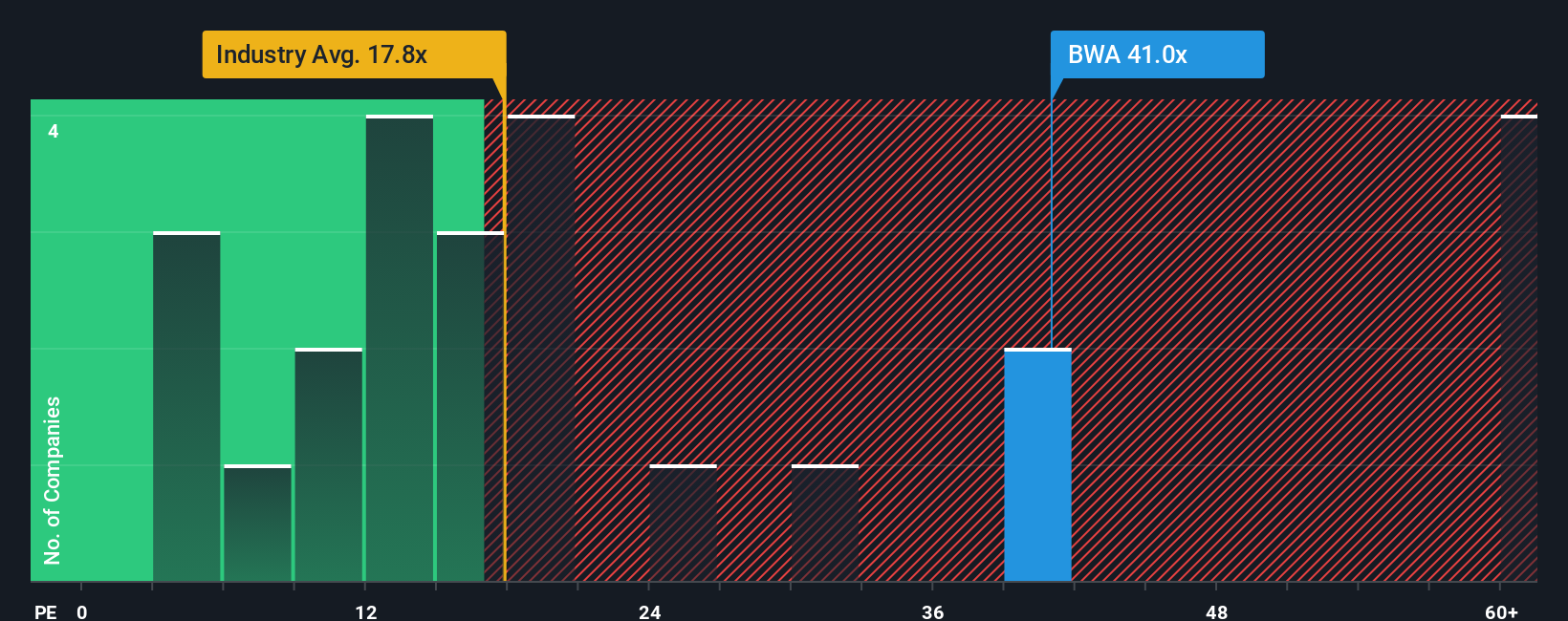

While narratives and fair value estimates point to upside, BorgWarner’s current price to earnings ratio near 68 times looks stretched against both the industry average of about 19 times and a fair ratio closer to 18 times, as well as peers around 32 times. That gap suggests meaningful valuation downside if earnings normalize faster than the story plays out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BorgWarner Narrative

If you see the setup differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop scanning the market, so use the Simply Wall St Screener now to uncover fresh opportunities before the crowd catches on.

- Capitalize on mispriced opportunities by targeting these 906 undervalued stocks based on cash flows that strong cash flows suggest the market has overlooked.

- Ride the next wave of technological disruption by focusing on these 26 AI penny stocks positioned at the core of rapid AI adoption.

- Lock in reliable income potential by zeroing in on these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報