How Investors May Respond To People's Insurance Company of China (SEHK:1339) Probing Executive-Rumor Turmoil

- In early December 2025, PICC Property and Casualty said it was verifying market rumors about certain senior executives after unusual trading in its Hong Kong-listed shares, while emphasizing that operations remained normal and that it was unaware of any undisclosed inside information.

- The company’s decision to publicly acknowledge and review these management-related rumors highlights how concerns over leadership stability can become material for investors even when business conditions are reported as steady.

- We’ll now examine how PICC’s review of senior executive rumors fits into and potentially reshapes its existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

People's Insurance Company (Group) of China Investment Narrative Recap

To own PICC, you generally need to believe in the resilience of its core insurance franchises and its ability to turn underwriting strength and investment income into sustainable earnings. The current review of rumors around senior executives appears more about clarifying governance than altering near term business drivers, so it does not clearly change the main short term catalyst of earnings delivery or the key risk from underwriting and catastrophe exposure.

The most relevant recent announcement is the 9M 2025 results, which showed net income of RMB 46,822 million and higher earnings per share versus the prior year. Against the backdrop of strong recent profitability, the market’s reaction to leadership related rumors may influence how much weight investors place on governance and management stability when assessing whether earnings quality and current valuation can support their own investment case.

Yet for all the focus on short term share price swings, investors should also be aware of the risk that...

Read the full narrative on People's Insurance Company (Group) of China (it's free!)

People's Insurance Company (Group) of China's narrative projects CN¥698.0 billion revenue and CN¥39.5 billion earnings by 2028. This requires 8.3% yearly revenue growth and a CN¥3.4 billion earnings decrease from CN¥42.9 billion today.

Uncover how People's Insurance Company (Group) of China's forecasts yield a HK$7.76 fair value, a 11% upside to its current price.

Exploring Other Perspectives

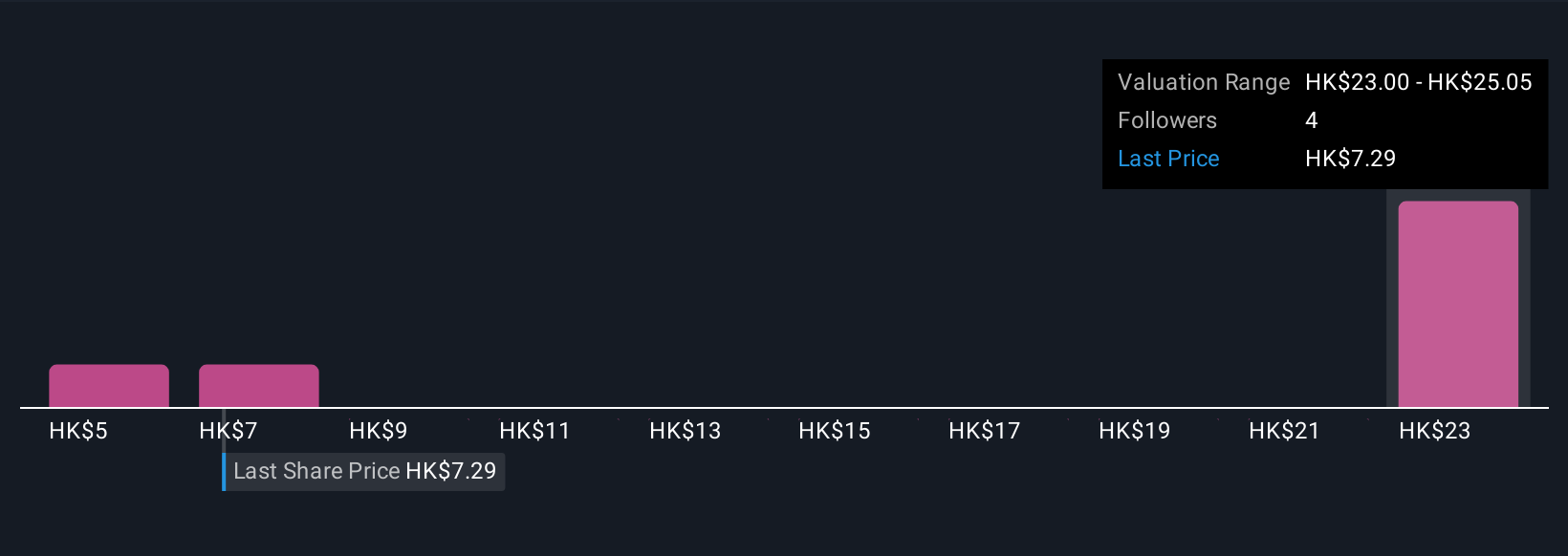

Three members of the Simply Wall St Community value PICC between HK$4.56 and HK$26.46, highlighting very different expectations about its potential. When you set those views against the ongoing concern about underwriting margins and catastrophe exposure, it underlines why examining several viewpoints on PICC’s future performance can be useful.

Explore 3 other fair value estimates on People's Insurance Company (Group) of China - why the stock might be worth over 3x more than the current price!

Build Your Own People's Insurance Company (Group) of China Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your People's Insurance Company (Group) of China research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free People's Insurance Company (Group) of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate People's Insurance Company (Group) of China's overall financial health at a glance.

No Opportunity In People's Insurance Company (Group) of China?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報