American Eagle Outfitters (AEO) Is Up 13.2% After Raising Guidance And Completing Big Buyback - Has The Bull Case Changed?

- American Eagle Outfitters recently reported third-quarter 2025 results showing sales of US$1,362.7 million and net income of US$91.34 million, and raised fourth-quarter and full-year operating income guidance on the back of stronger-than-expected demand, particularly in its Aerie and Offline brands.

- On top of the earnings upgrade, the company reaffirmed shareholder returns by declaring a US$0.125 quarterly dividend and confirming completion of a US$421.49 million share repurchase program that retired almost 15.9% of its stock since early 2024.

- With guidance now calling for higher fourth-quarter operating income driven by robust Aerie and Offline momentum, we'll assess how this reshapes American Eagle's investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

American Eagle Outfitters Investment Narrative Recap

To own American Eagle Outfitters, you need to believe that Aerie and Offline can keep pulling the overall business forward while cost pressures, tariffs and a softer consumer stay manageable. The latest guidance hike makes stronger holiday demand the key short term catalyst, while persistent margin pressure from tariffs and markdowns remains the biggest risk; this quarter’s news does not remove that tension, it just buys the company more breathing room.

The most relevant update here is the sizable increase to fourth quarter and full year 2025 operating income guidance, now US$155–160 million for Q4 and US$303–308 million for the year, driven by 8–9% expected comparable sales growth. That upgrade directly strengthens the case behind Aerie and Offline as growth engines, but it also raises the bar for execution at a time when higher markdowns and tariff costs could still chip away at profitability if sales momentum slows.

But investors should also be aware that tariff and markdown pressures could still weigh on earnings if...

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters' narrative projects $5.6 billion revenue and $340.2 million earnings by 2028. This requires 2.2% yearly revenue growth and about a $143 million earnings increase from $197.1 million today.

Uncover how American Eagle Outfitters' forecasts yield a $16.44 fair value, a 29% downside to its current price.

Exploring Other Perspectives

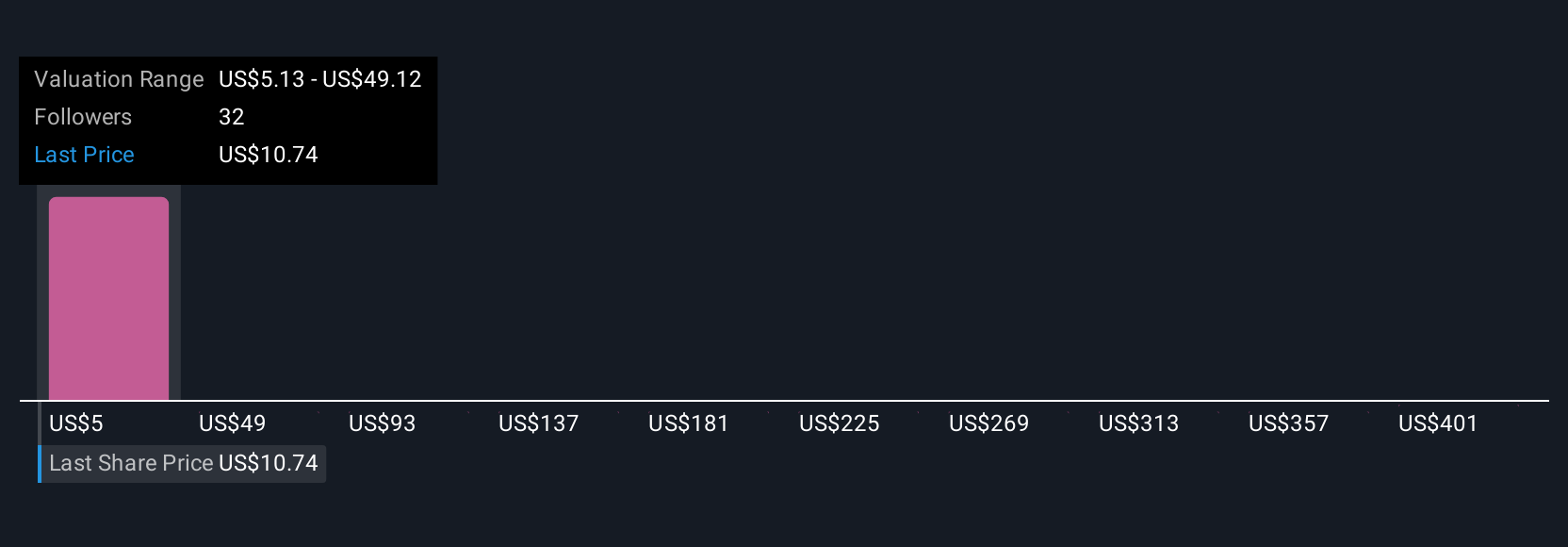

Ten members of the Simply Wall St Community value American Eagle Outfitters between US$9.13 and US$445.03, with most estimates clustered below US$52.72. Against this wide spread of opinions, the recent lift in operating income guidance highlights how much the story now depends on Aerie and Offline sustaining their sales momentum under ongoing cost and tariff pressures, so it is worth weighing several different views before deciding where you stand.

Explore 10 other fair value estimates on American Eagle Outfitters - why the stock might be a potential multi-bagger!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報