Kinross Gold (TSX:K) Valuation After $500 Million Debt Repayment and Strengthened Balance Sheet

Kinross Gold (TSX:K) just wiped out its remaining 4.5% Senior Notes, redeeming $500 million of debt ahead of schedule and capping $1.5 billion in repayments over 2024 and 2025 that reshape its balance sheet.

See our latest analysis for Kinross Gold.

The early redemption lands after a year of strong execution, with Kinross streamlining its balance sheet while the share price climbs to $37.73 and posts a 164.77% year to date share price return and a 175.10% one year total shareholder return. This suggests momentum is still firmly on the upside even after recent pullbacks.

If this kind of turnaround story has your attention, it could be a good time to explore other materials and miners with strong insider conviction using fast growing stocks with high insider ownership.

With debt tumbling, profits rising, and the share price already near analyst targets, are investors still getting Kinross at a discount, or is the market now fully pricing in its next leg of growth?

Most Popular Narrative: 20% Undervalued

With Kinross last closing at CA$37.73 against a narrative fair value near CA$37.79, the story now hinges on margins, buybacks, and future cash flows.

Kinross's strengthened balance sheet, robust free cash flow, and commitment to shareholder capital returns (buybacks and dividends) position the company to maintain financial flexibility, enabling further investment in low-cost production and providing potential for earnings and return-on-capital growth.

Want to see why modest revenue growth, sticky high margins, and a richer future earnings multiple still point to upside from here? The full narrative joins those assumptions into one tight valuation case that could change how you view Kinross at this price.

Result: Fair Value of $37.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and long permitting timelines could quickly erode margins and delay growth projects, challenging the optimistic valuation narrative.

Find out about the key risks to this Kinross Gold narrative.

Another View: Cash Flows Flash a Warning

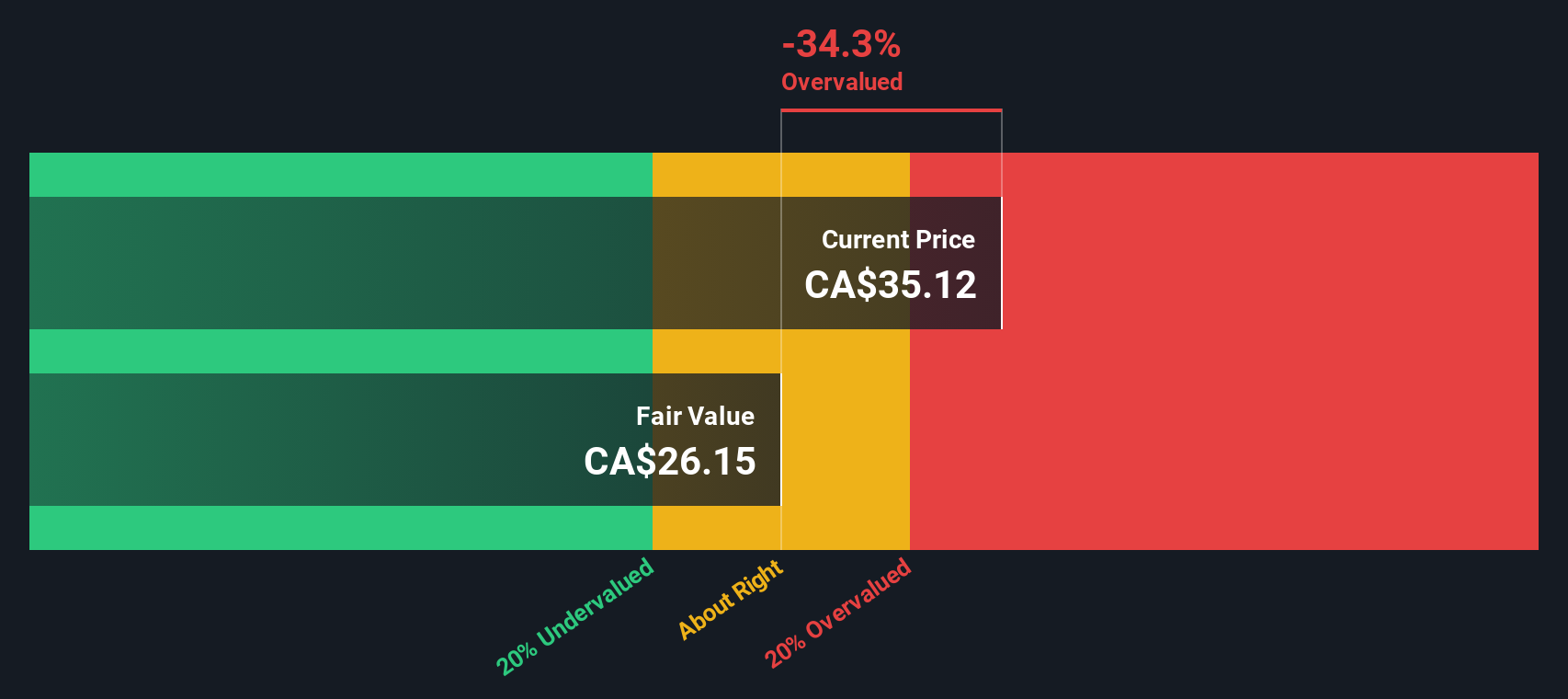

While the narrative model sees Kinross as modestly undervalued, our DCF model points the other way. It suggests the stock is trading at a steep premium to its cash flow based fair value. If cash flows disappoint, could today’s multiple quickly feel stretched?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kinross Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kinross Gold Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in minutes by using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kinross Gold.

Ready for your next investing move?

Kinross might be compelling, but you will kick yourself if you ignore other standout opportunities our screener surfaces across different themes and risk profiles.

- Capitalize on potential mispricings by targeting companies trading below intrinsic value using these 906 undervalued stocks based on cash flows and sharpen your hunt for bargains.

- Ride powerful secular trends by focusing on innovators reshaping the future with these 26 AI penny stocks before the crowd fully catches on.

- Strengthen your income strategy by filtering for reliable payers through these 15 dividend stocks with yields > 3% and avoid settling for mediocre yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報