XJ International Holdings' (HKG:1765) Problems Go Beyond Poor Profit

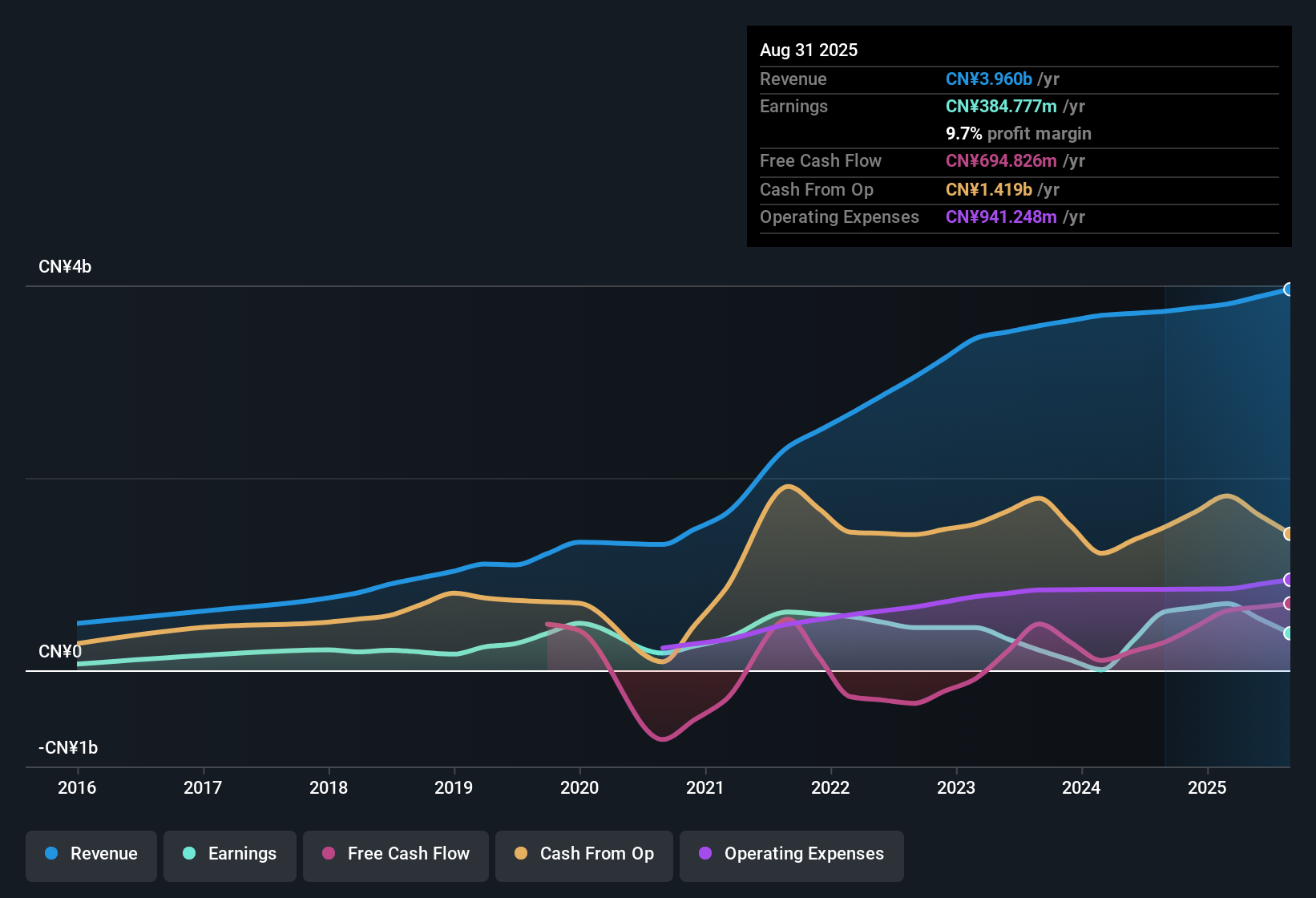

XJ International Holdings Co., Ltd. (HKG:1765) recently posted soft earnings but shareholders didn't react strongly. Our analysis suggests that they may be missing some concerning details underlying the profit numbers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. XJ International Holdings expanded the number of shares on issue by 5.5% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of XJ International Holdings' EPS by clicking here.

A Look At The Impact Of XJ International Holdings' Dilution On Its Earnings Per Share (EPS)

XJ International Holdings' net profit dropped by 13% per year over the last three years. Even looking at the last year, profit was still down 37%. Sadly, earnings per share fell further, down a full 37% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if XJ International Holdings' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of XJ International Holdings.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted XJ International Holdings' net profit by CN¥708m over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. XJ International Holdings had a rather significant contribution from unusual items relative to its profit to August 2025. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On XJ International Holdings' Profit Performance

In its last report XJ International Holdings benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at XJ International Holdings' statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. You'd be interested to know, that we found 2 warning signs for XJ International Holdings and you'll want to know about these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報