Earnings Upgrade And Analyst Optimism Might Change The Case For Investing In Willdan Group (WLDN)

- Recently, Zacks assigned Willdan Group a Rank #1 (Strong Buy) after its full-year earnings consensus estimate climbed 12.5% over the past three months, signaling a stronger earnings outlook.

- This earnings upgrade, coupled with the company’s very large year-to-date return versus weaker industry performance, highlights how sharply analyst sentiment has shifted in Willdan’s favor.

- Next, we’ll examine how this upgraded earnings outlook and analyst enthusiasm could reshape Willdan Group’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Willdan Group Investment Narrative Recap

To own Willdan Group, you need to believe that long term demand for energy efficiency, electrification and infrastructure upgrades will keep supporting its consulting and implementation work with utilities and governments. The recent Zacks Rank upgrade reflects stronger earnings expectations and reinforces the near term catalyst of improving profitability, but it does not remove key risks such as potential policy shifts or higher taxes that could pressure margins.

Among recent announcements, the raised 2025 net revenue guidance to US$360 million to US$365 million stands out as most aligned with stronger earnings sentiment. It anchors the optimistic analyst view in concrete expectations for continued top line growth, while also raising the stakes if tax changes, cost inflation or policy developments were to slow that momentum.

Yet behind the upbeat earnings outlook, investors should be aware of how a higher effective tax rate could...

Read the full narrative on Willdan Group (it's free!)

Willdan Group's narrative projects $867.2 million revenue and $76.9 million earnings by 2028. This requires 11.3% yearly revenue growth and an earnings increase of about $41.7 million from $35.2 million today.

Uncover how Willdan Group's forecasts yield a $132.50 fair value, a 26% upside to its current price.

Exploring Other Perspectives

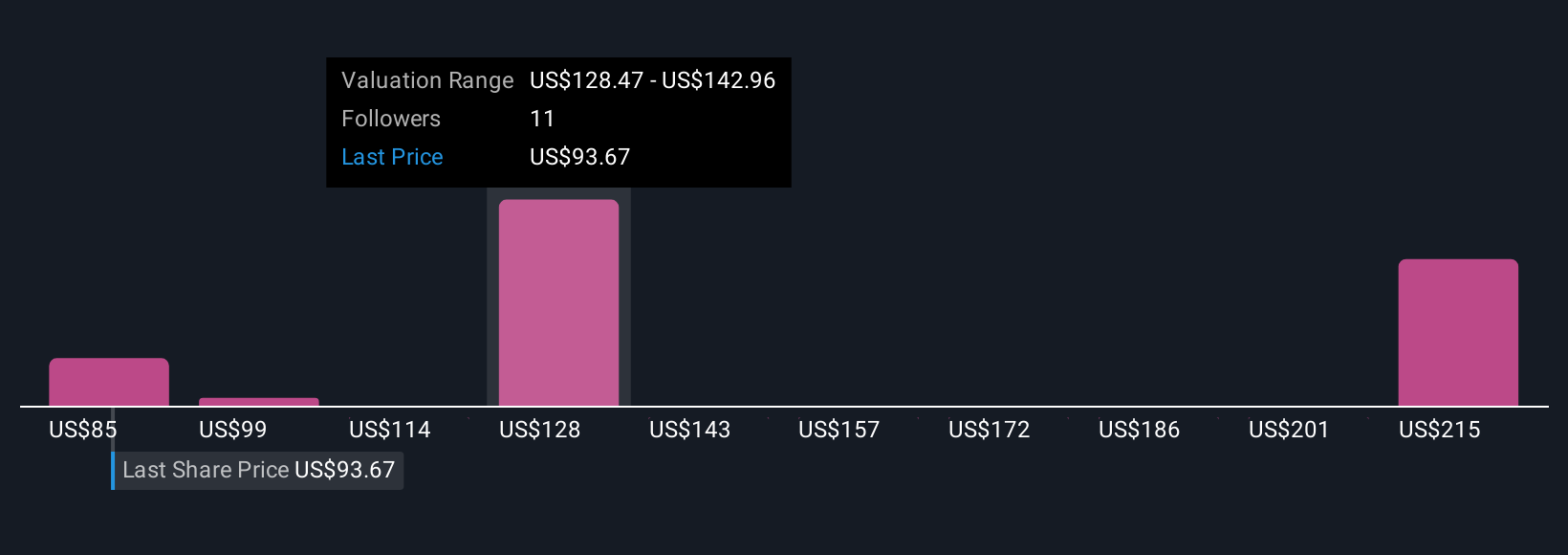

Four Simply Wall St Community fair value estimates for Willdan span roughly US$85 to US$192.75, underlining how far apart individual views can be. When you set that against the earnings driven catalyst that analysts are focused on, it becomes even more important to compare different assumptions and explore several alternative viewpoints.

Explore 4 other fair value estimates on Willdan Group - why the stock might be worth as much as 83% more than the current price!

Build Your Own Willdan Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Willdan Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willdan Group's overall financial health at a glance.

No Opportunity In Willdan Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報