Does Recent Technical Momentum Redefine Silver Mines’ (ASX:SVL) Long‑Term Investment Narrative?

- Recently, expert technical analysis on the ASX singled out Silver Mines as one of the most interesting uptrends within the materials sector, highlighting strong price momentum and positive chart signals.

- This attention has placed Silver Mines alongside other closely watched silver and mining stocks, potentially broadening its visibility among investors who follow technical indicators.

- We’ll now examine how this recent technical-analysis spotlight on Silver Mines’ price momentum may influence the company’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Silver Mines' Investment Narrative?

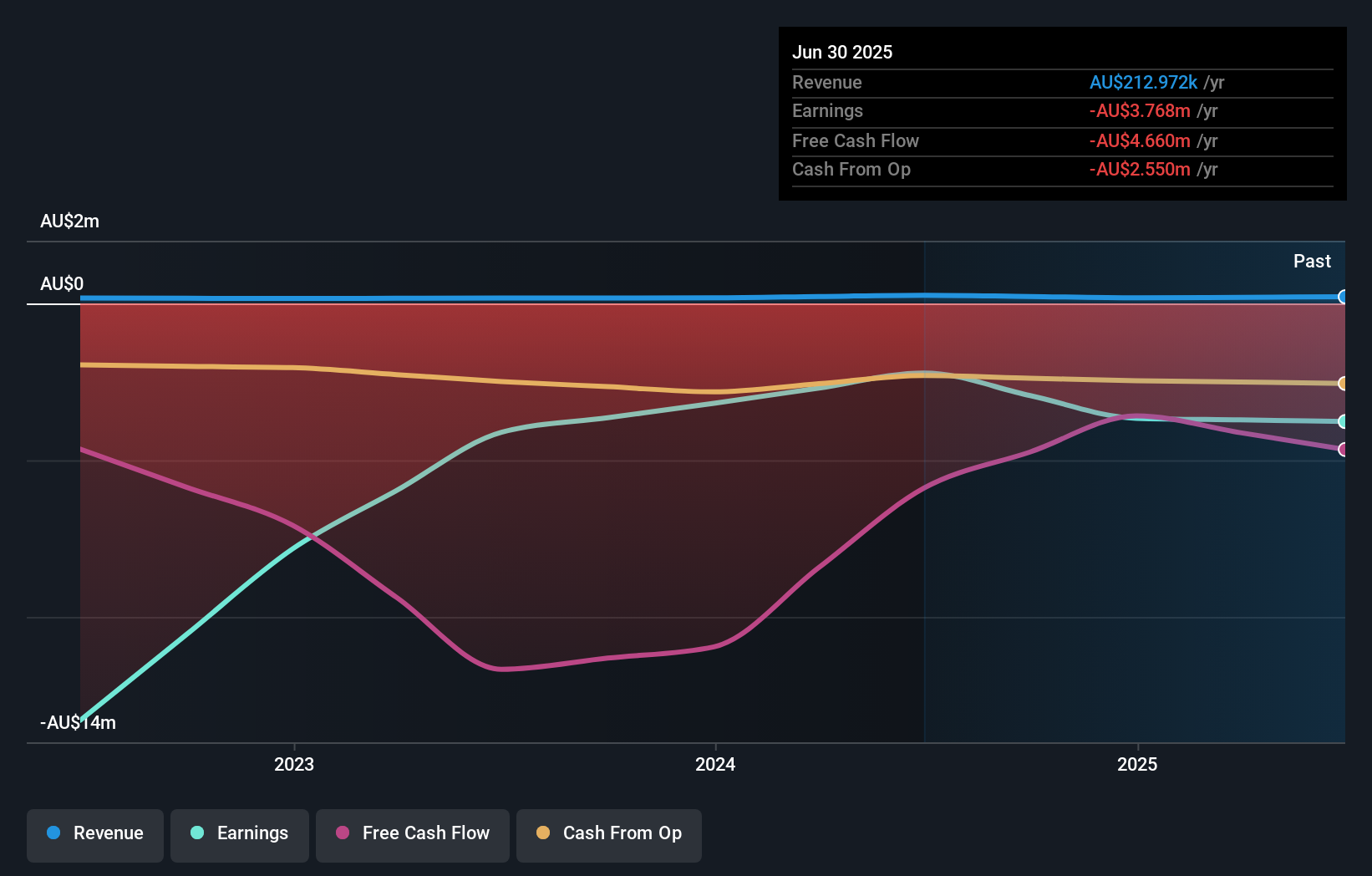

To own Silver Mines, you really have to believe that its Bowdens project and newer exploration options like Kramer Hills can one day justify a business that currently generates only A$213,000 in revenue and continues to report multi‑million‑dollar losses. The recent surge in price and the technical-analysis spotlight speak to growing speculative interest, but they do not materially change the core near term catalysts, which remain permitting progress, funding clarity and exploration results. If anything, the strong share price and recent equity raisings shift the balance of risks a little: dilution and execution discipline now sit even closer to the front of the queue. The technical uptrend may help management raise capital on better terms, but it also raises the stakes if project milestones slip.

However, the current valuation already embeds a lot of project ambition that investors should understand. Our expertly prepared valuation report on Silver Mines implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on Silver Mines - why the stock might be worth as much as 25% more than the current price!

Build Your Own Silver Mines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silver Mines research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Silver Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silver Mines' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報