Lithia’s Toronto Dealership Buys and Buybacks Could Be A Game Changer For Lithia Motors (LAD)

- Lithia Motors recently expanded its North American footprint by acquiring three Hyundai dealerships and Fines Ford in the Greater Toronto Area, moves that are expected to add about US$540 million in annualized revenue while the company also repurchased roughly 3.3% of its outstanding shares year-to-date through an ongoing buyback program.

- These acquisitions and buybacks highlight Lithia’s effort to grow its revenue base while reducing share count, potentially amplifying per-share results and reinforcing its omnichannel retail ambitions across the United States, Canada, and the United Kingdom.

- With these new dealerships set to lift annualized revenue, we’ll now examine how this expansion influences Lithia Motors’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lithia Motors Investment Narrative Recap

To own Lithia Motors, you need to believe the company can keep growing earnings by consolidating dealerships and scaling its omnichannel platform while improving margins. The latest Hyundai and Fines Ford acquisitions support the growth side of that thesis, but do not directly resolve concerns about SG&A running above management’s long term target, which remains a key near term swing factor for profitability and sentiment.

The most directly relevant update here is Lithia’s ongoing share repurchase activity, with roughly 3.3% of outstanding shares bought back this quarter. That shrinking share count can magnify the impact of any revenue lift from the new Canadian and Hyundai stores on per share results, which matters if investors are focused on earnings growth amid questions about organic performance and cost control.

But investors should also be aware that if SG&A stays elevated and margins fail to improve, then …

Read the full narrative on Lithia Motors (it's free!)

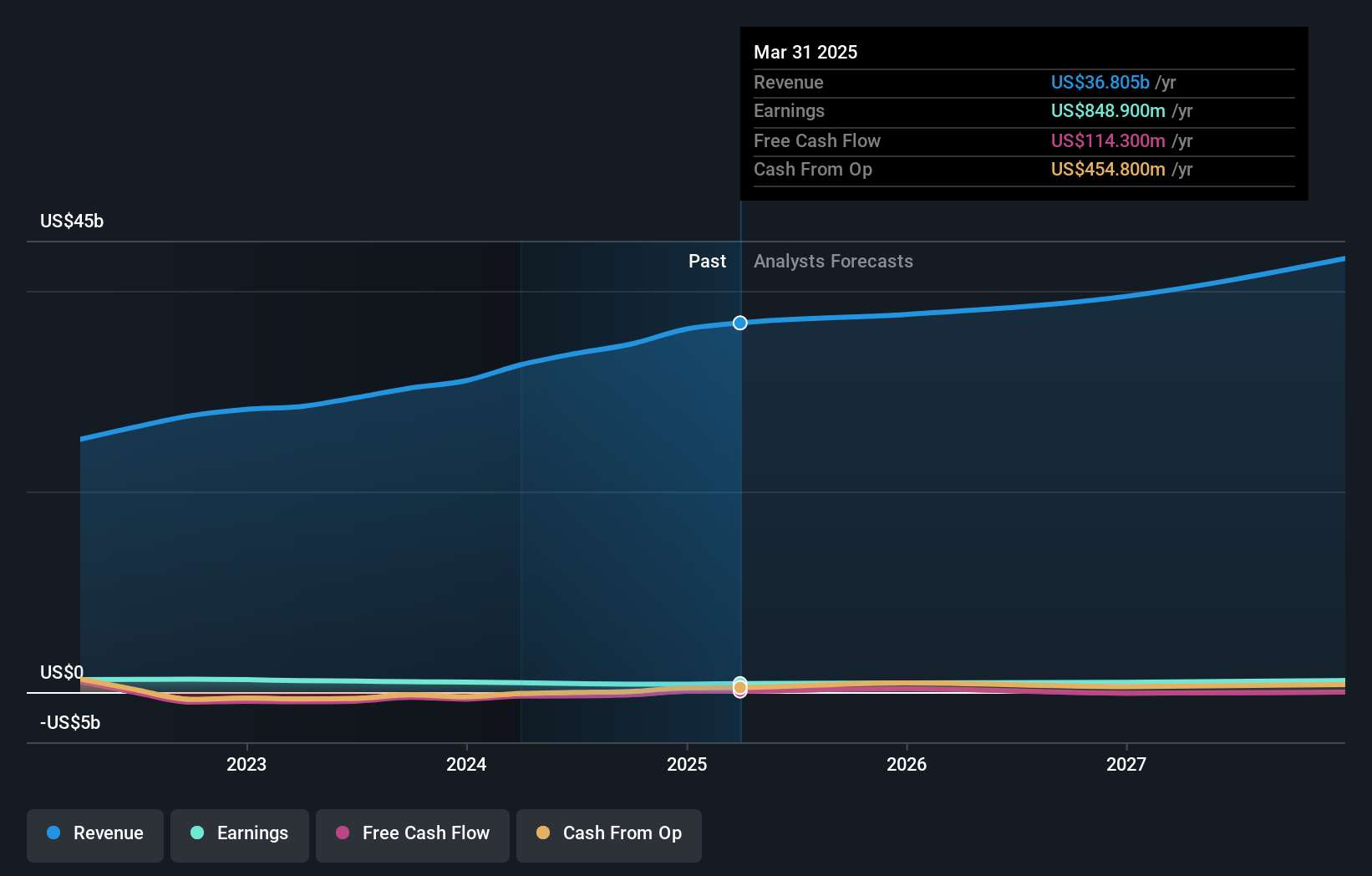

Lithia Motors' narrative projects $43.4 billion revenue and $1.1 billion earnings by 2028. This requires 5.3% yearly revenue growth and an earnings increase of about $209.1 million from $890.9 million today.

Uncover how Lithia Motors' forecasts yield a $390.13 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$390 to US$631 per share, underscoring how far apart individual views can be. Set that against Lithia’s acquisition driven growth story and omnichannel ambitions, and it becomes even more important to weigh several perspectives on how sustainable its earnings power really is.

Explore 2 other fair value estimates on Lithia Motors - why the stock might be worth just $390.13!

Build Your Own Lithia Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithia Motors research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithia Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithia Motors' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報