Undiscovered Gems in the US Market for December 2025

As the U.S. stock market experiences a mixed performance with major indices hovering near record highs, investors are closely watching key economic indicators and upcoming inflation data that could influence Federal Reserve decisions. In this environment, small-cap stocks often present unique opportunities for growth due to their potential to capitalize on niche markets and innovative solutions, making them intriguing options for those seeking undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Preformed Line Products (PLPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Preformed Line Products Company specializes in designing and manufacturing products and systems for the construction and maintenance of various networks across the energy, telecommunication, cable, and data communication industries, with a market cap of $1.05 billion.

Operations: Wire & Cable Products contributes $663.35 million to the revenue. The company's market cap is $1.05 billion, indicating its significant presence in its industry sector.

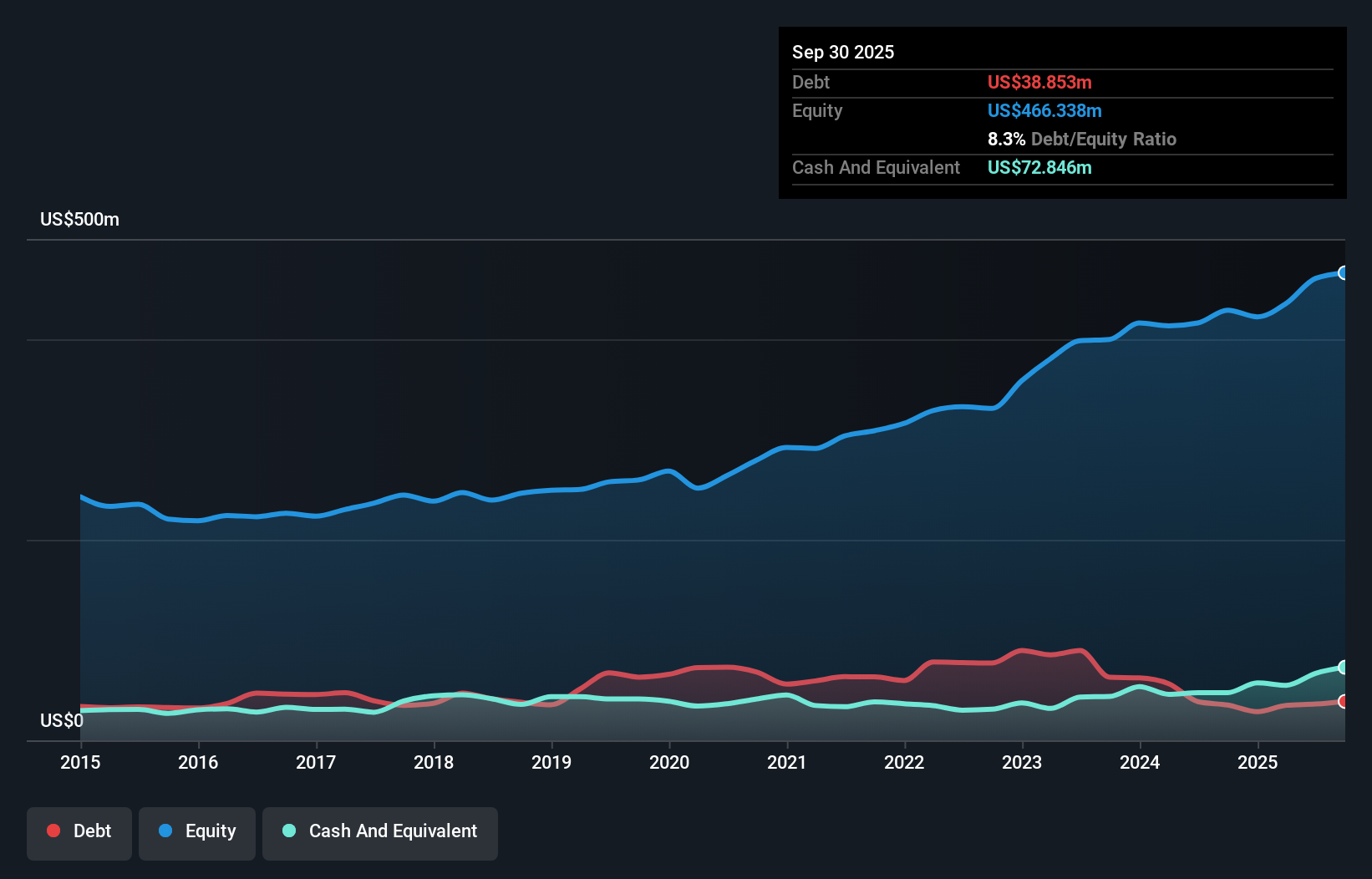

Preformed Line Products, with a market presence in the electrical industry, has demonstrated financial resilience. Over the past five years, its earnings have grown at an average of 5.3% annually. The company has successfully reduced its debt to equity ratio from 24.3% to 8.3%, indicating prudent financial management. Despite a recent dip in quarterly net income to US$2.63 million from US$7.68 million last year, PLPC maintains robust interest coverage and free cash flow positivity, with a price-to-earnings ratio of 28.5x that is competitive within its industry peer group average of 31.2x.

- Unlock comprehensive insights into our analysis of Preformed Line Products stock in this health report.

Assess Preformed Line Products' past performance with our detailed historical performance reports.

TETRA Technologies (TTI)

Simply Wall St Value Rating: ★★★★★★

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market capitalization of $1.16 billion.

Operations: TETRA Technologies generates revenue primarily through its Water & Flowback Services and Completion Fluids & Products segments, with the latter contributing $361.60 million. The company's market capitalization stands at approximately $1.16 billion.

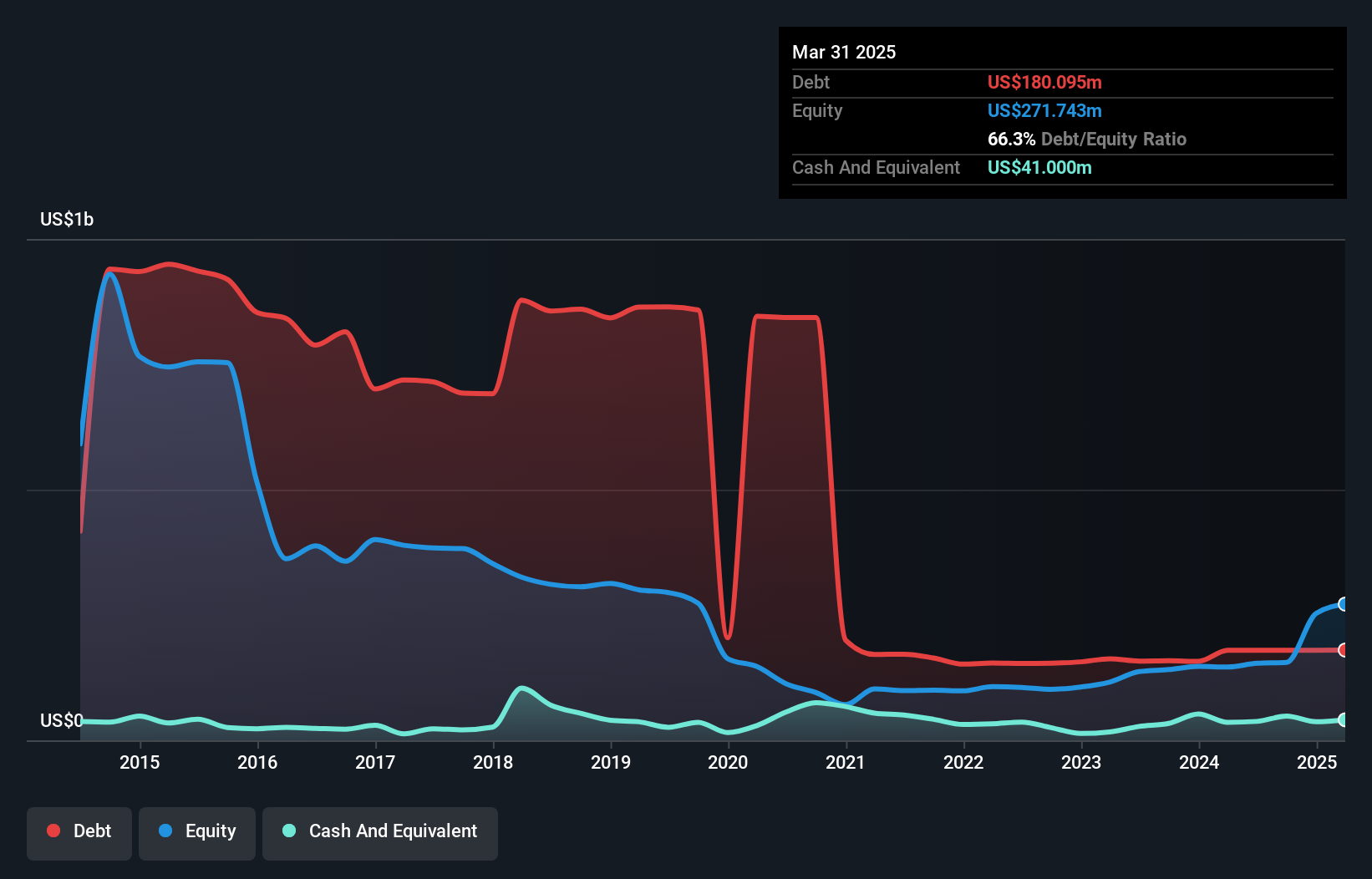

TETRA Technologies, a notable player in the energy services sector, is diversifying into energy storage and water solutions to meet rising demands for grid resilience. The company has seen its earnings soar by 1601.9% over the past year, outpacing industry trends, while trading at 60.5% below estimated fair value suggests potential upside. With a satisfactory net debt to equity ratio of 38.5%, TETRA's interest payments are well covered by EBIT at 3.3 times coverage. However, anticipated profit margin shrinkage from 19.8% to just 0.3% poses challenges amid heavy capital expenditures and reliance on deepwater projects for growth stability.

Weis Markets (WMK)

Simply Wall St Value Rating: ★★★★★★

Overview: Weis Markets, Inc. operates a chain of supermarkets focused on the retail sale of food primarily in Pennsylvania, with a market capitalization of approximately $1.64 billion.

Operations: The primary revenue stream for Weis Markets comes from its retail grocery store operations, generating approximately $4.89 billion. The company's net profit margin is a key financial indicator to consider when analyzing its profitability.

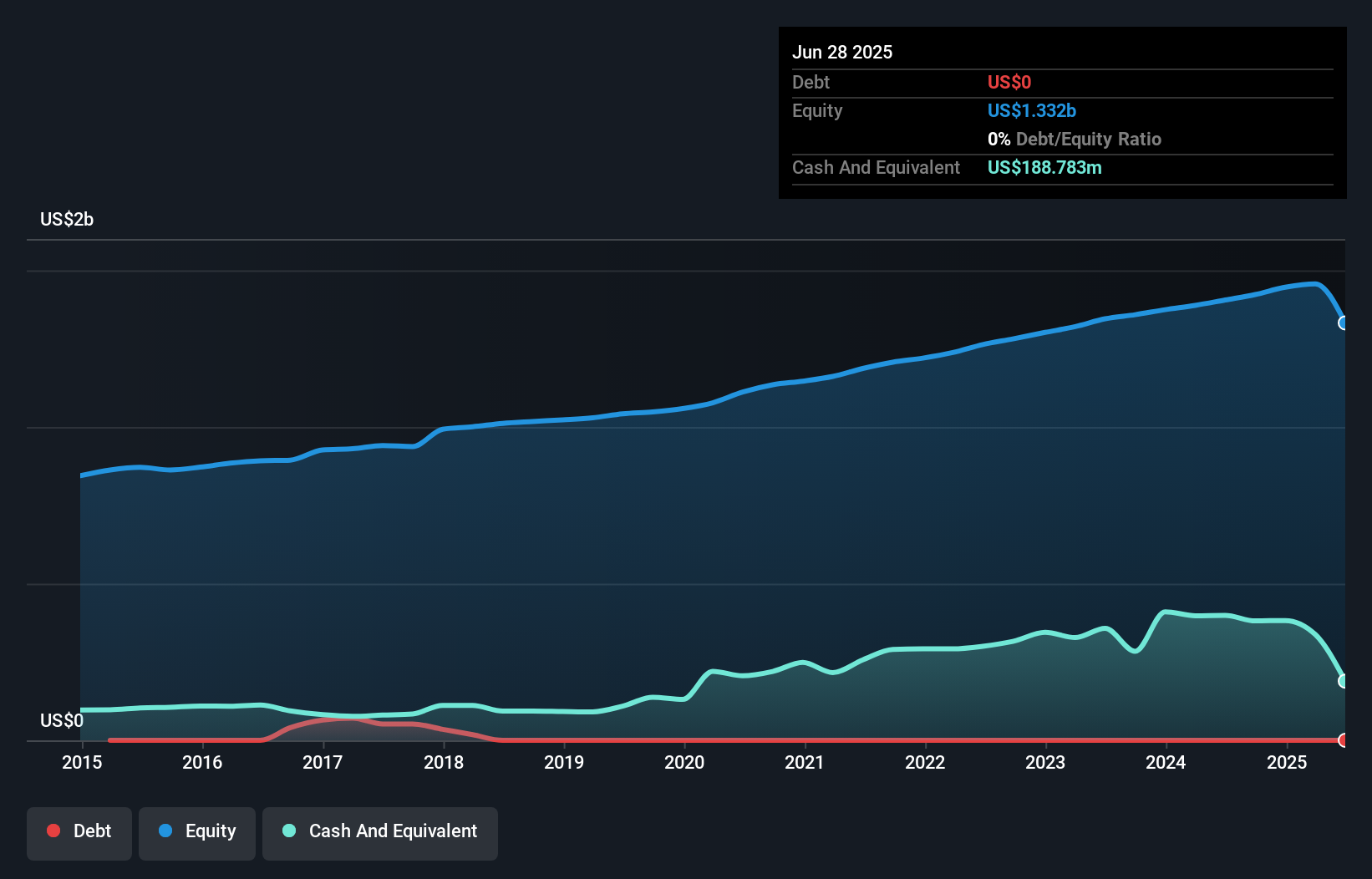

Weis Markets, a player in the grocery sector, shows a mixed bag of performance. Despite earnings growth of 4.3% over the past year, net income for Q3 2025 dropped to US$18.23 million from US$25.84 million the previous year, indicating challenges in maintaining profitability. With no debt on its books and high-quality earnings, Weis stands out financially stable compared to peers with its price-to-earnings ratio at 16.5x below the market average of 18.7x. However, free cash flow remains negative which could impact future investments or expansions despite recent sales growth to US$1,238 million from US$1,186 million last year.

- Click here and access our complete health analysis report to understand the dynamics of Weis Markets.

Evaluate Weis Markets' historical performance by accessing our past performance report.

Next Steps

- Discover the full array of 297 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報