Should Rising Analyst Optimism Around Banking License Plans Require Action From Nu Holdings (NU) Investors?

- In recent weeks, Nu Holdings has seen positive earnings estimate revisions, an analyst upgrade to Outperform from Grupo Santander, and confirmation that its planned 2026 Brazilian banking license should not alter day‑to‑day operations or capital requirements.

- Together, these developments point to growing confidence in Nu’s core Latin American franchise and its ability to integrate tighter regulation without disrupting customers.

- We’ll now examine how this renewed analyst optimism around Nu’s Latin American growth momentum could influence the company’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Nu Holdings Investment Narrative Recap

To own Nu Holdings, you need to believe its digital model can keep converting underbanked Latin American users into profitable, long term customers without credit losses or regulation eating into returns. The latest analyst upgrades and earnings estimate revisions support the near term growth catalyst, while the planned 2026 Brazilian banking license currently looks neutral for operations and capital, so it does not materially change the biggest risk around credit quality in fast growing loan books.

Among the recent updates, Grupo Santander’s upgrade to Outperform with a US$22 price target stands out, because it directly reflects growing confidence in Nu’s core Brazil and Mexico momentum. That upgrade connects closely to the key catalyst of ongoing customer and revenue expansion across Latin America, while also putting more attention on whether Nu can manage higher mass market lending exposures without a spike in bad loans or pressure on margins.

Yet behind the rapid growth story, Nu’s rising exposure to mass market credit and already high bad loan ratio is something investors should be aware of...

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' narrative projects $33.0 billion revenue and $6.1 billion earnings by 2028. This requires 78.1% yearly revenue growth and about a $3.8 billion earnings increase from $2.3 billion today.

Uncover how Nu Holdings' forecasts yield a $18.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

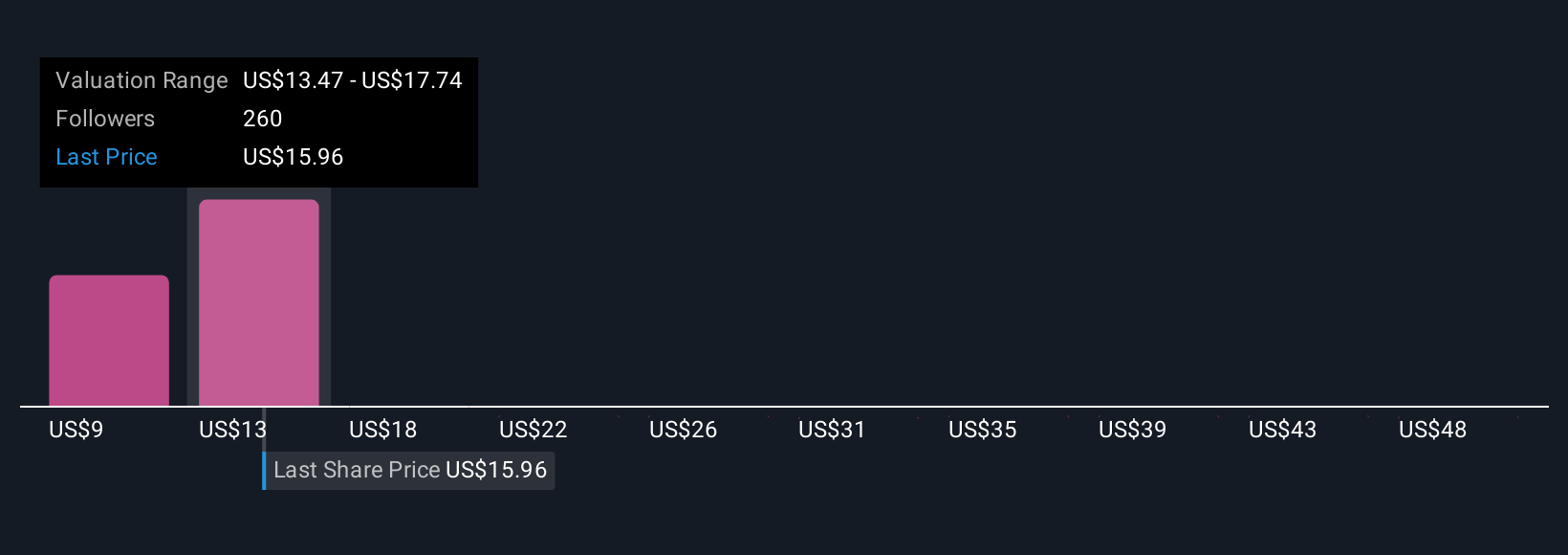

Simply Wall St Community members’ fair value estimates for Nu span US$10.34 to US$22.84 across 28 views, showing how far apart individual assessments can be. You can weigh those against the core growth catalyst of Latin American digital banking adoption and consider how long Nu can grow quickly without credit risk and regulation constraining performance.

Explore 28 other fair value estimates on Nu Holdings - why the stock might be worth as much as 29% more than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報