How Plexus’ (PLXS) Earnings Beat and Strong Cash Flow Will Impact Investors

- Plexus recently reported past-quarter revenues of US$1.06 billion, essentially flat year on year but modestly above analyst expectations, while also beating earnings estimates and issuing revenue guidance for the next quarter that topped forecasts.

- An important detail for investors is that free cash flow outpaced projections, underscoring the company’s ability to convert earnings into cash despite stable headline sales.

- We’ll now explore how Plexus’s better‑than‑expected guidance and strong free cash flow shape the company’s broader investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Plexus Investment Narrative Recap

To own Plexus, you need to believe it can keep winning complex manufacturing programs in sectors like healthcare and defense while managing cyclicality in areas such as semicap and aerospace. The latest quarter’s modest revenue beat, stronger earnings and above-consensus guidance support that thesis in the near term, although they do not materially change the key risk that large customer ramp delays or cutbacks could quickly unsettle revenue and margins.

The recent update on Plexus’s US$100 million share repurchase program is particularly relevant here, because strong free cash flow in the latest quarter gives the company more room to keep buying back stock while still funding growth. That cash generation, combined with capacity investments such as the Malaysia facility, ties directly into the main short term catalyst: Plexus’s ability to turn its program wins and sector mix into steadier earnings despite end market uncertainty.

Yet despite the solid quarter, the risk that a few major customers could pull back orders faster than Plexus can replace them is something investors should be aware of...

Read the full narrative on Plexus (it's free!)

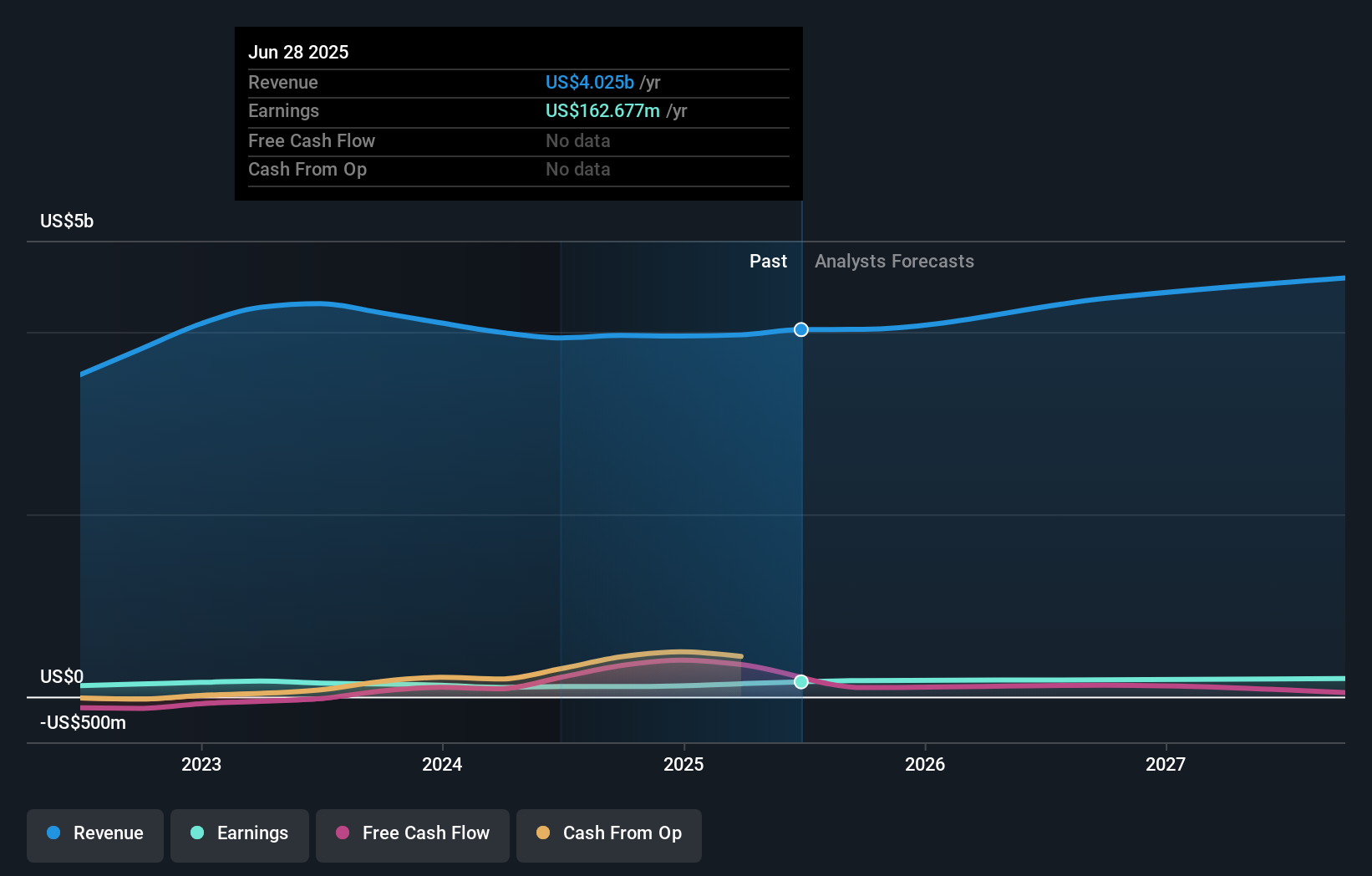

Plexus' narrative projects $4.8 billion revenue and $202.1 million earnings by 2028. This requires 6.1% yearly revenue growth and about a $39.4 million earnings increase from $162.7 million today.

Uncover how Plexus' forecasts yield a $159.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community sits at US$114.18, underlining how individual views can differ from analyst targets. Set this against Plexus’s reliance on large customer ramp ups, and you can see why it pays to compare several independent perspectives before forming an opinion.

Explore another fair value estimate on Plexus - why the stock might be worth 23% less than the current price!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報